The Financial Health of People With Disabilities

Key Obstacles and Opportunities

Originally published on The Financial Health Network

By Andrew Warren, Wanjira Chege, Meghan Greene, Lisa Berdie

Overview

A Nearly Universal Experience, With Profound Financial Implications

Disability is part of the human condition. Almost everyone will experience a disability at some point in their lives, and more than 40 million Americans are living with a disability today.1 But despite their ubiquity, people with disabilities are frequently marginalized, resulting in profound impacts to their physical, social, mental, and economic well-being.2

In a new report published in partnership with the National Disability Institute and The Harkin Institute, we find that people with disabilities are far less likely to be Financially Healthy than those without disabilities. Our research uncovers multiple obstacles – including employment barriers, financial exclusion, and public safety net constraints – that may be undermining their financial health. This report explores the complex challenges faced by people with disabilities in their daily financial lives, while identifying several opportunities to foster equity and financial well-being across the disability community.

Key Findings

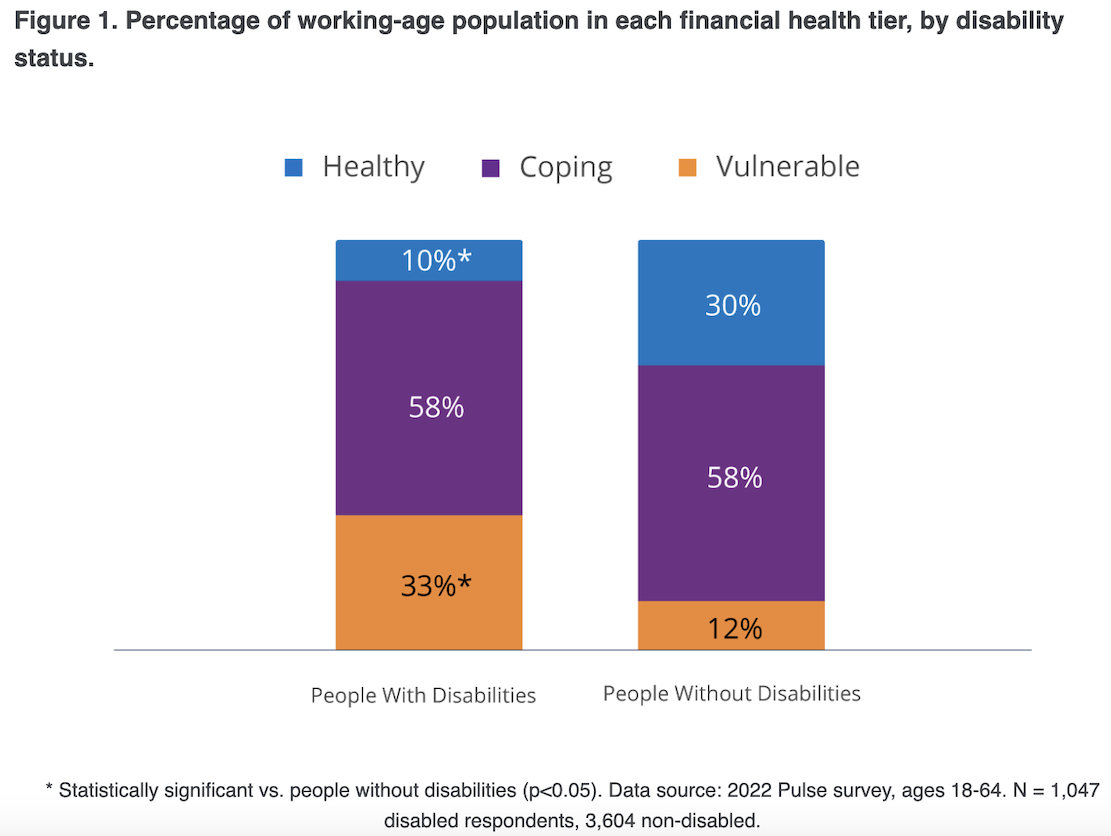

- Just 10% of working-age people with disabilities are Financially Healthy, compared with 30% of working-age people without disabilities.

- 40% of people with disabilities who weren‘t working reported that they would like to be working for pay.

- 93% of people with disabilities are unfamiliar with ABLE accounts, the primary tax-advantaged asset-building tool for people with disabilities.

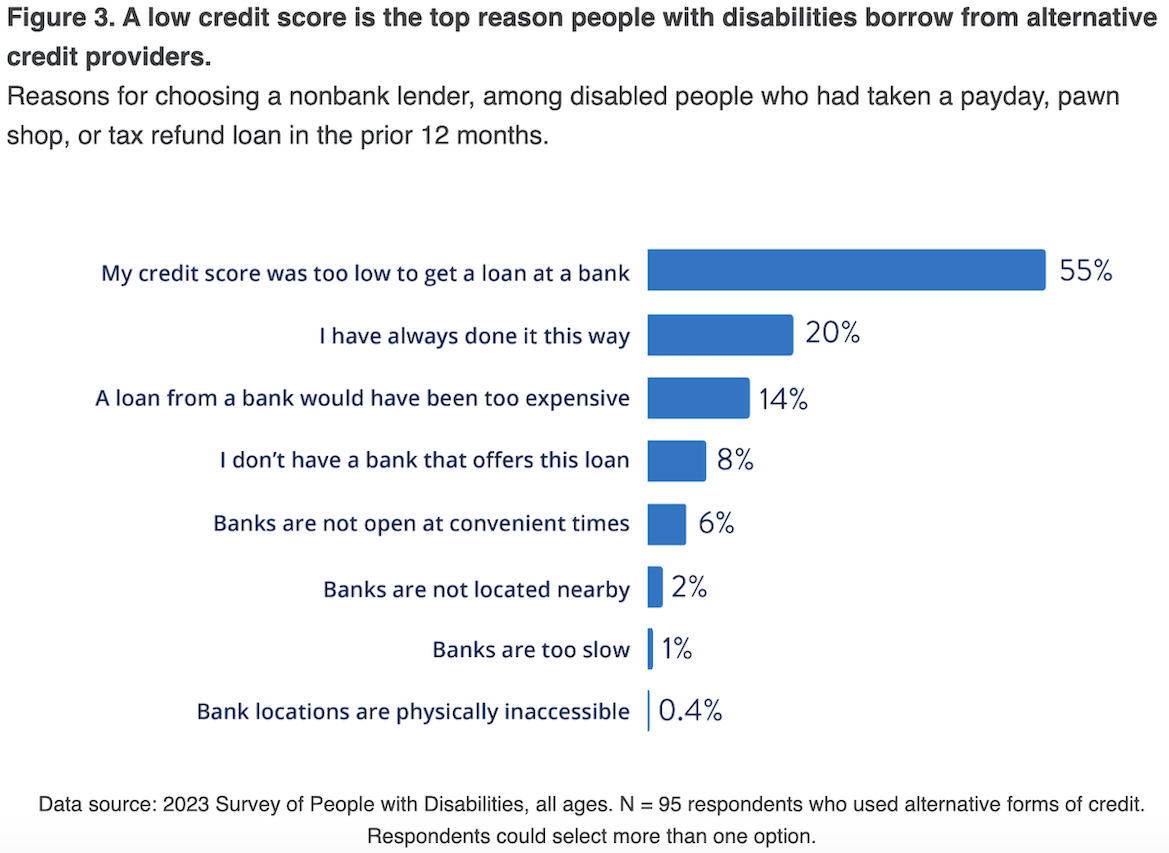

- 55% of respondents to our survey of people with disabilities who used an alternative credit service said they did so because their “credit score was too low to get a loan at a bank.”

Defining Disability

In this report, we follow the current definition of disability set by federal surveys and classify a person as disabled if they indicate that they have serious difficulty with any one of the following:

- Hearing

- Seeing (even with glasses)

- Concentrating, remembering, or making decisions

- Walking or climbing stairs

- Dressing or bathing

- Doing errands alone

Throughout the report, we use both person-first and identity-first language, acknowledging that preferences differ and are evolving within the disability community. For a detailed explanation of how we define disability and the questions used in our surveys, please see the full report.

Key Finding 1

The Disability Gap in Financial Health

People with disabilities are far less Financially Healthy than people without disabilities.

There is a large and concerning gap in the financial health of people with and without disabilities; working-age people with disabilities are only a third as likely to be Financially Healthy as working-age people without disabilities.

People with disabilities struggle with all aspects of financial health.

- Just half (51%) of working-age people with disabilities said they were able to pay all of their bills on time, while close to half (46%) said they have unmanageable levels of debt.

- Only one in five (22%) said they were confident they were on track to meet their long-term goals.

The diversity of the disability community leads to a diversity in financial health experiences.

- 37% of respondents with only hearing difficulties were Financially Healthy, much higher than all other disability types.

- Only 14% of people with vision difficulties, 10% of those with mobility difficulties, and a miniscule 6% of those with cognitive difficulties or multiple difficulties were Financially Healthy.

Many individuals with disabilities face intersectional challenges related to other elements of their identity.

- Working-age women with disabilities were only half as frequently Financially Healthy as working-age men with disabilities (7% vs. 14%).

- Black people with disabilities were far less frequently Financially Healthy (7%) than Asian (24%), Latinx (17%), and White (22%) people with disabilities (all ages).

- LGBTQIA+ people with disabilities were less frequently Financially Healthy compared with non-LGBTQIA+ people with disabilities (14% vs. 20%, all ages).

“[Do] I feel like my blindness has impacted my ability to make ends meet? Absolutely! I was unable to work, so I went… on disability at 39. So that’s a fixed income, and we know how prices have changed over the years.”

– Jonathan

Key Finding 2

Low Incomes, Elevated Expenses

People with disabilities face several obstacles to making ends meet, from earning enough to get by to higher expenses associated with their conditions.

Employment Barriers

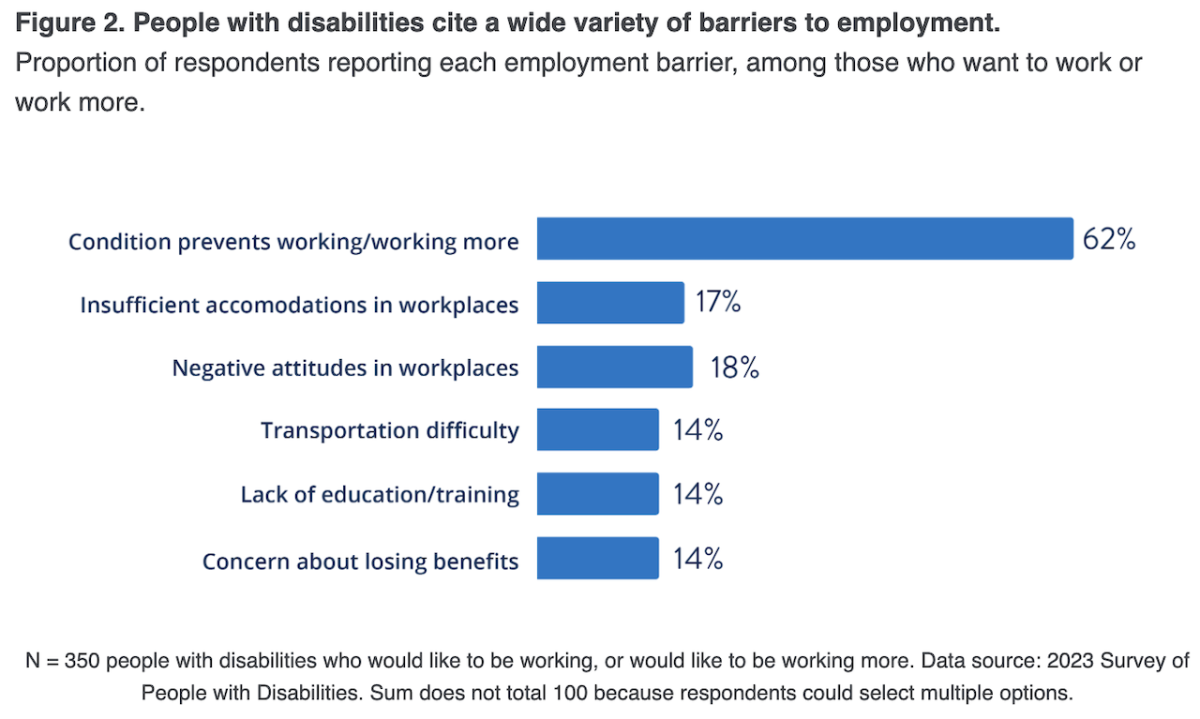

- People with disabilities cite a wide variety of barriers to employment.

- Negative attitudes in workplaces, insufficient workplace accommodations, transportation difficulties, a lack of education and training, and concern about losing benefits were all commonly cited by respondents (Figure 2).

- Even among those who said their disability was a barrier (62%), more than half also cited another reason, suggesting they do not attribute their difficulties to their condition alone.

Income Disparities

- Nearly half (45%) of working-age people with disabilities had annual household incomes under $30,000, compared with just 21% of non-disabled people.

- Only 40% of working-age people with disabilities were employed, but many want to work or work more.

- 40% of those who weren‘t working reported that they would like to be working for pay.

- 23% of those who were working reported that they would like to be working more.

Public Benefits Barriers

- Safety net programs designed to support people with disabilities don’t appear to fill the gap left by employment barriers.3, 4

- Only about a third of working-age people with disabilities were receiving Supplemental Security Income (SSI) or Social Security Disability Insurance (SSDI), the two federal disability-related cash benefits.

- Even among people with disabilities who have low incomes and face barriers to work, many don’t receive benefits. Only 63% of those who had annual household incomes below $30,000, were not employed, and who reported that their condition was preventing them from working were receiving SSDI or SSI.

- Interviewees described difficult application and enrollment processes for public benefits.

- Means testing and asset limit requirements demand that recipients maintain limited savings cushions and assets – leaving recipients vulnerable to financial shocks and without long-term security.5, 6

The Cost of a Disability

- In addition to income challenges, managing a disability can lead to a higher cost of living. Prior research has estimated that households with an adult with a work-limiting disability require 28% more income on average to reach an equivalent standard of living as those without a disability.7

“I have to switch out my [hearing aid] batteries like every 3 days, and those packets are $20 just for 8. I probably have spent thousands of dollars [in the past few years] just on hearing aid batteries. You just can’t win with all these extra costs, and even if you have the highest [health insurance], they don’t cover ear-related things.”

– Simone

Key Finding 3

Financial Services Barriers for the Disability Community

People with disabilities also report several unique challenges in accessing and using financial services that help them save, borrow, and prepare for the future.

Banking Access

- Prior research has demonstrated that people with disabilities are unbanked – lacking a checking or savings account – at higher rates than the non-disabled population.8, 9, 10

- We find that the gap in unbanked status between people with and without disabilities appears to be related to income differences: while people with disabilities are unbanked at far higher rates than those without disabilities, gaps close after controlling for income.

- However, people with disabilities are “underbanked” (banked, but also using alternative financial services) at higher rates than people without disabilities even after accounting for income differences.

- Credit health may be a key reason that disabled people are using alternative credit services like payday loans, pawn, title loans, and refund anticipation loans. More than half (55%) of disabled survey respondents who used an alternative credit service said they did so because their “credit score was too low to get a loan at a bank” (Figure 3).

- People with disabilities reported worse credit scores than those without disabilities at all income levels, suggesting they face distinct barriers to affordable credit.

Accessibility of Services

- Very few people with disabilities report discrimination or lack of accessibility at financial institutions.

- However, levels of satisfaction with financial service providers vary from service to service. In our interviews, several participants noted opportunities for better customer service at financial institutions.

Limited Opportunities for Long-Term Savings

- One promising solution to burdensome asset limits – the ABLE account – remains rarely used and poorly understood.

- SSI and Medicaid impose asset limits on their beneficiaries, but ABLE accounts allow eligible disabled individuals to save and invest assets without losing these benefits. In our survey of individuals with disabilities, less than 1% had an ABLE account, and all of them had less than $10,000 in their accounts.

- In addition to low account ownership, we find a near-universal lack of awareness or knowledge about ABLE accounts among the disability community: 93% of survey respondents said they were unfamiliar with ABLE accounts.

“There are times when people just completely overlooked me as a consumer… And it’s not only about dignity, it’s equality. I really wanna be treated just like you. And if I see a slight difference, like you’re not paying attention or… not as engaged with me as a client, it really bothers me.”

– Melanie

Conclusion

Creating More Supportive, Inclusive Environments

The challenges faced by people with disabilities are complex, and no single policy change or intervention will ameliorate them all. However, our research points to several opportunities for stakeholders to better meet the financial health needs of people with disabilities and create more supportive, inclusive environments. With disability inherent to the human condition, this is not just an altruistic notion – supporting the financial health of people with disabilities is in everyone’s interest. Read the full report to explore our recommendations, including increased willingness from employers to provide accommodations, greater promotion of ABLE accounts, and reforms to social safety net systems.

The Financial Health of People With Disabilities

Explore the trends. Discover new insights. Build stronger strategies.

Methodology

The findings in this report are drawn from data collected from two surveys and 10 individual in-depth interviews by the Financial Health Network in 2022 and 2023. Our Financial Health Pulse survey, fielded using the Understanding America Study (UAS) online panel, is representative of the population of the United States and asks a wide variety of financial health-related questions. These data allow us to compare financial health outcomes between people with and without disabilities. For the in-depth interviews, we partnered with NDI to recruit the 10 interviewees. For additional methodological details and notes on terminology and data limitations, please download the full report.

Acknowledgments

This report was developed with support from Principal Foundation and in partnership with the National Disability Institute and The Harkin Institute.

Endnotes

- Estimates of the number of people with disabilities (adults and children) in the U.S. vary. Census estimates put the number at around 41 million, and other surveys suggest it may be higher. See Appendix A in the full report for more information.

- “Disability Inclusion,” World Bank, April 2023.

- Rebecca Vallas, Kimberly Knackstedt, Hayley Brown, Julie Cai, Shawn Fremstad, & Andrew Stettner, “Disability Justice is Economic Justice,” The Century Foundation, April 2022.

- Michael Karpman, “Medicaid Work Requirements Would Do Little or Nothing to Increase Employment, but Would Harm People’s Health,” Urban Institute, May 2023.

- Benjamin Landy, “How Asset Tests Punish the Poor,” The Century Foundation, November 2013.

- Rebecca Vallas & Joe Valenti, “Asset Limits Are a Barrier to Economic Security and Mobility,” Center for American Progress, September 2014.

- Nanette Goodman, Michael Morris, Zachary Morris, & Stephen McGarity, “The Extra Costs Associated with Living With a Disability in the United States,” National Disability Institute, October 2020.

- “2021 FDIC National Survey of Unbanked and Underbanked Households,” FDIC, November 2022.

- Nanette Goodman & Michael Morris, “Banking Status and Financial Behaviors of Adults with Disabilities: Findings from the 2017 FDIC National Survey of Unbanked and Underbanked Households and Focus Group Research,” National Disability Institute, 2019.

- Stephen V. McGarity & Mary A. Caplan, “Living outside the Financial Mainstream: Alternative Financial Service Use among People with Disabilities,” Journal of Poverty, December 2018.