Access Home Loan Helps Mother of Four Become Homeowner

Milwaukee resident Melody Jones recently purchased the home she has rented for 15 years

Originally published on U.S. Bank company blog

Earlier this year, Milwaukee nonprofit Safe & Sound distributed fliers in the city’s Metcalfe Park neighborhood informing residents about a special program that allowed them to purchase the homes they were currently renting.

Melody Jones saw the flier when she got home from work and called the number listed. Months later, Jones became the new owner of the four-bedroom, two-bath home she has rented for 15 years and shared with her four children, now ages 14 to 27.

“I always knew I wanted to own a home,” Jones said. “When my mother got sick, it worried me that, as a renter, I could be told who could and couldn’t live in my home. I didn’t want to have to worry about that type of thing ever again.”

Her journey to homeownership began with working with local nonprofits, including Safe & Sound, the Greater Milwaukee Urban League and Acts Housing. U.S. Bank has partnered with these organizations to increase homeownership within its U.S. Bank Access Home initiative, part of U.S. Bank Access Commitment®, the bank’s long-term framework to help close the wealth gap for underserved communities.

Through U.S. Bank Access Home initiatives, Jones received financial education from Acts Housing, which provides one-on-one and online U.S. Dept. of Housing and Urban Development-approved homebuyer and financial coaching for individuals and families to help them become ready to buy.

Jones came into the program with a great credit score, but earned less than 50% of the Area Median Income in Milwaukee, an amount that has historically locked families like hers out of homeownership because their debt-to-income ratio is too high to qualify for a traditional mortgage.

As part of her homebuyer coaching and education experience with Acts Housing, Jones reviewed her mortgage options and down payment assistance grant opportunities.

During that process, Jones learned she qualified for the U.S. Bank Access Home Loan mortgage, a special purpose credit program that offers up to $17,500 in combined down payment and lender credit assistance to eligible homebuyers. In addition, because of a unique tax credit program associated with the housing community where Jones was renting, she was able to purchase her home at a price below market value, gain instant equity and save more than $700 a month between her prior rent and new monthly mortgage.

“There is a misconception that homeownership is not for certain communities, that it’s not available,” said Kelly Andrews, vice president of strategic partnerships at Acts Housing. “We are helping overcome that mindset and get more people pre-approved.”

Together, Acts Housing and U.S. Bank have been providing financial education programs to help hopeful homebuyers move closer to their goal of moving into their first home.

Earlier this year, Jones was one of about 140 potential homebuyers participating in the Acts Housing Power Pack, a cohort program focused on learning about credit, goal setting and money management. Jones became buyer-ready in three months and continues to attend financial education classes through the program.

She also became the first borrower to use the recently announced Access Home Loan mortgage. The down payment assistance program was launched in 11 pilot markets this summer, including Milwaukee, with a focus on removing barriers to homeownership in underserved communities where the minority population is more than 50%.

“Our Access Home initiative has created a strong foundation for individuals just like Melody to not only realize the opportunity of homeownership, but to get on the right track to work towards it,” said Lenny McNeill, head of Strategic Markets and Affordable Lending at U.S. Bank. “Now, with the Access Home Loan mortgage, we are making it easier for even more people to become homeowners.”

When reflecting on her journey to owning her home, Jones said knowing “that it would be mine” kept her going, as well as all the support and resources she had access to.

“People think you have to know about all of this stuff yourself, but there are a lot of people that can help you,” Jones said. “Now that I own my home, it means we don’t have to get put out of our home. My kids can always come back, they’ll have a home to come home to."

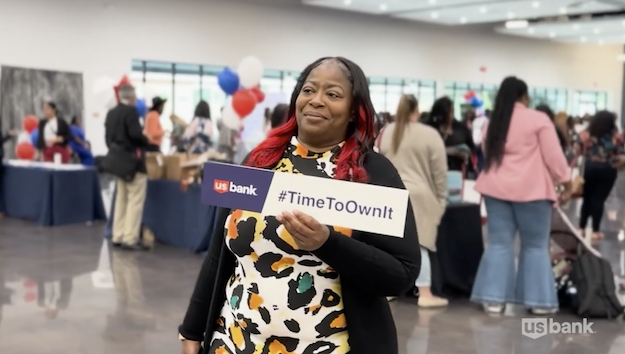

A video highlighting Jones and her homeownership journey is above.