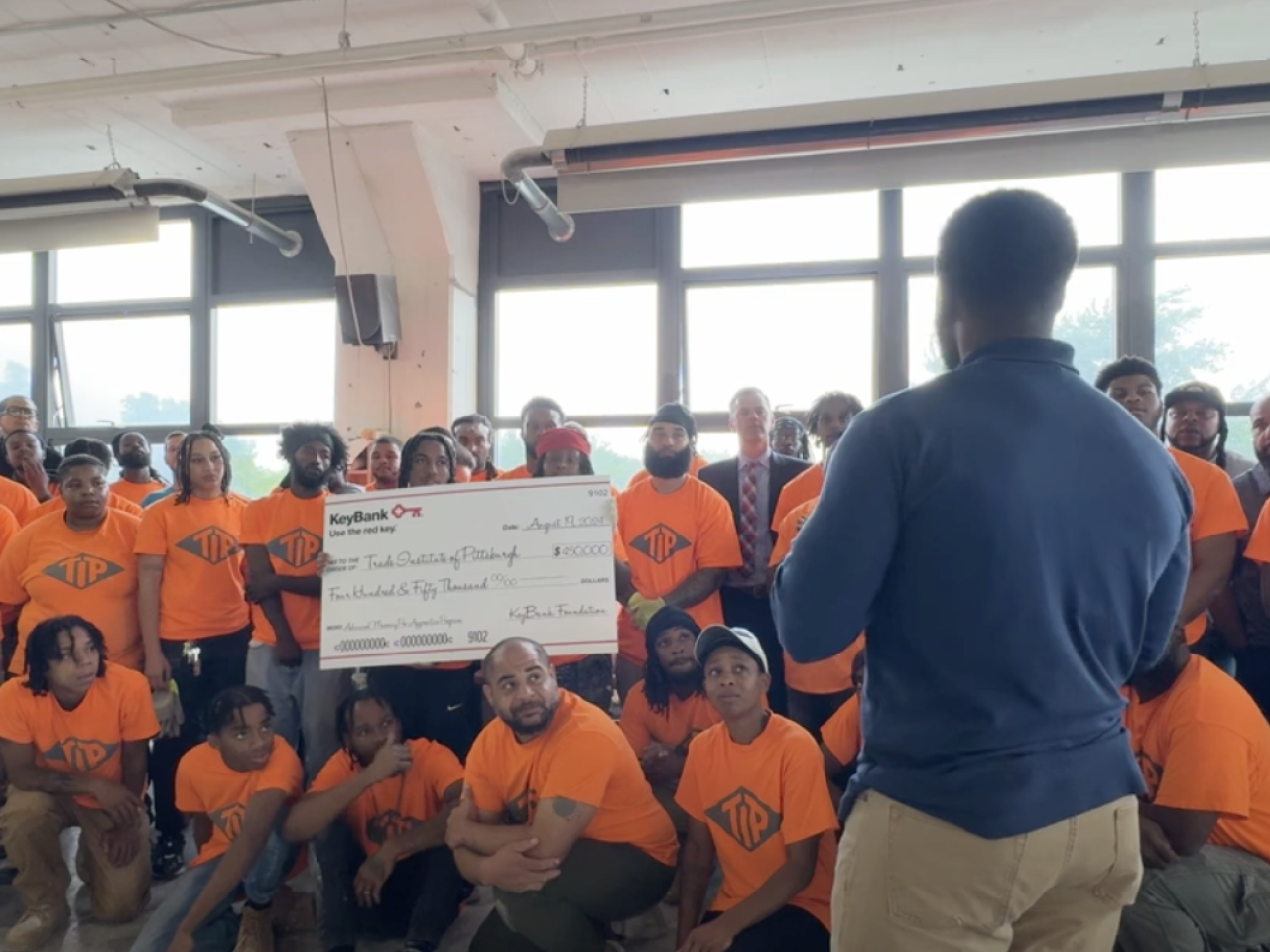

KeyBank's Community Investment

In states where Key has a presence, there are approximately 1.7 million low- to moderate-income (LMI) households. Many LMI individuals don’t have bank accounts or access to credit, and Key recognizes this important segment of the population as the “underserved.” Unfortunately, many underserved individuals turn to payday lenders or check cashing stores as a source of banking and receive no help establishing a credit history, breaking the cycle of debt, or establishing savings.

Since launching KeyBank Plus in 2004, Key has been a leader in responsible innovation for the underserved. KeyBank Plus is a unique combination of solutions which goes beyond “traditional” banking, creates economic stability and wealth-building, and offers reasonably priced products with features that ensure responsible use. For its approach to the underserved, Key has been recognized as an industry leader by the Center for Financial Services Innovation (CFSI), the National Community Reinvestment Coalition (NCRC), the Federal Reserve, the U.S. House Finance Committee, and the Federal Deposit Insurance Corporation (FDIC).