Disparity Or Despair?

As previously seen on the CSRHub blog

As previously seen on Skytop Strategies and published with permission.

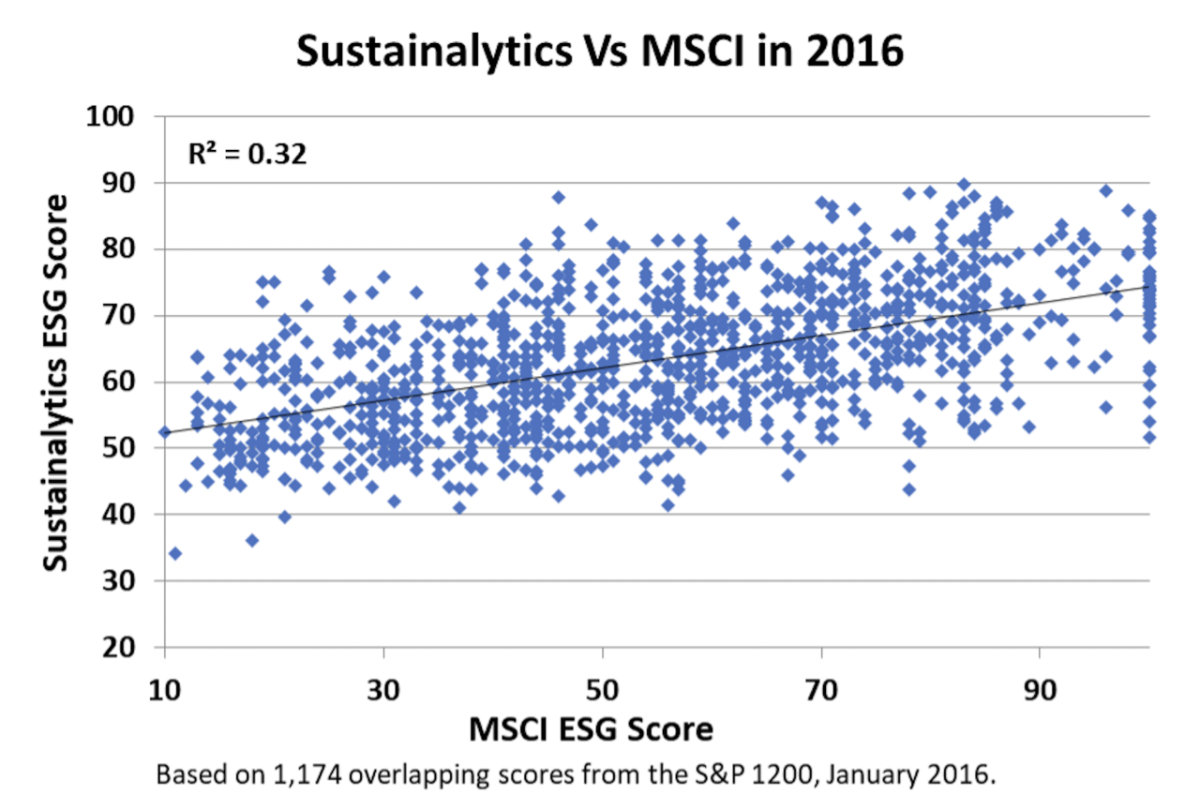

Back in 2016, we published an article in Reuters that highlighted the low correlation between MSCI and Sustainalytics ratings. For the S&P 1200 (a well-studied group of companies), there was only a 32% correlation between the ESG ratings from these two major data sources.

Sustainalytics VS MSCI in 2016

While much had been said or written before this article about ratings disparity, this was one of the first solid numerical proofs that there was an issue. With help from other sources (CSRHub has ingested ratings from more than 800 expert ESG ratings sources), we found similar differences between ESG sources that relied on company self-reported data on from sources that used “natural language processing” approaches.

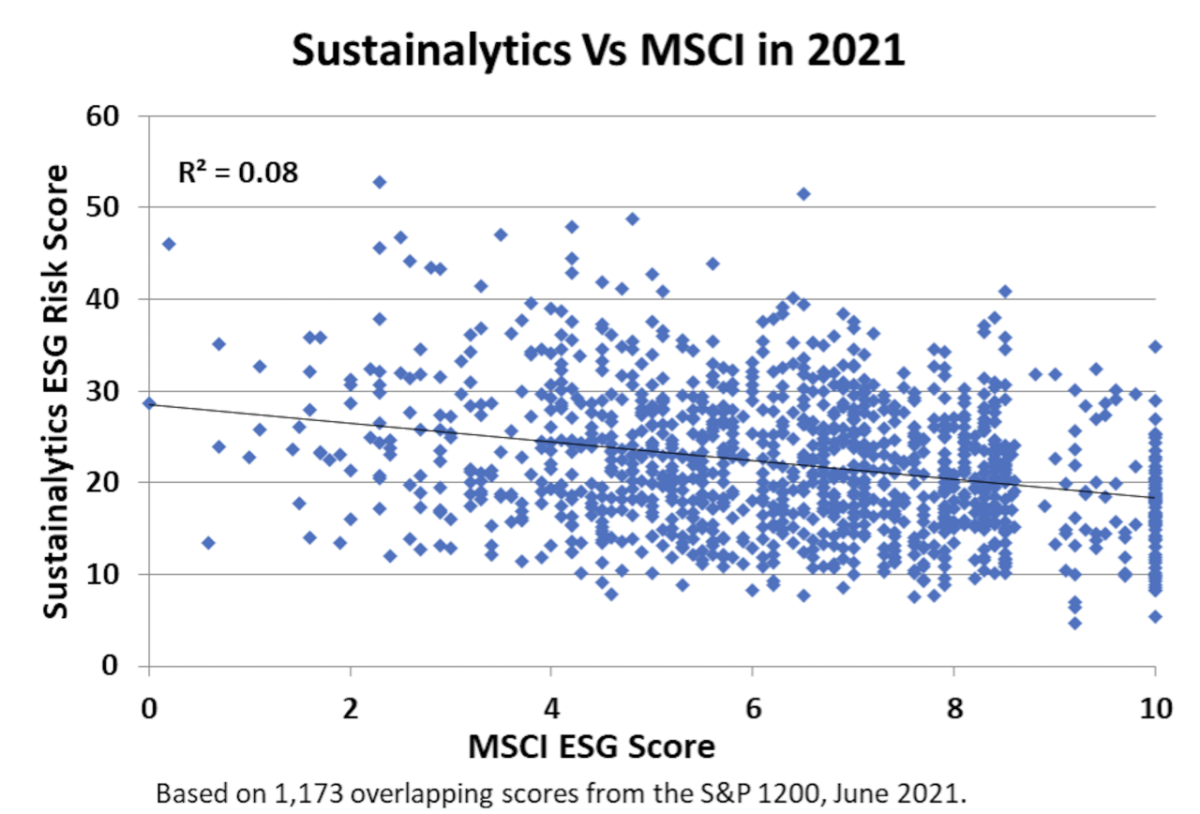

We decided recently to take a fresh look at this situation. We pulled the top level scores from the same two sources, and found that the disparity between them has grown.

Sustainalytics VS MSCI in 2021

One good reason for disparity is that ESG rating sources have different views of how companies should behave. In effect, each source has its own ratings schema—separate from “industry standard” approaches such as the ISSB (successor to SASB’s system), GRI’s GSSB, and assurance approaches such as AA1000. ESG sources sometimes change their schemas. In the charts above, one can see the Sustainalytics flipped its scoring system when it shifted from a focus on ESG performance (high score is good) to ESG-related risk (high score is bad).

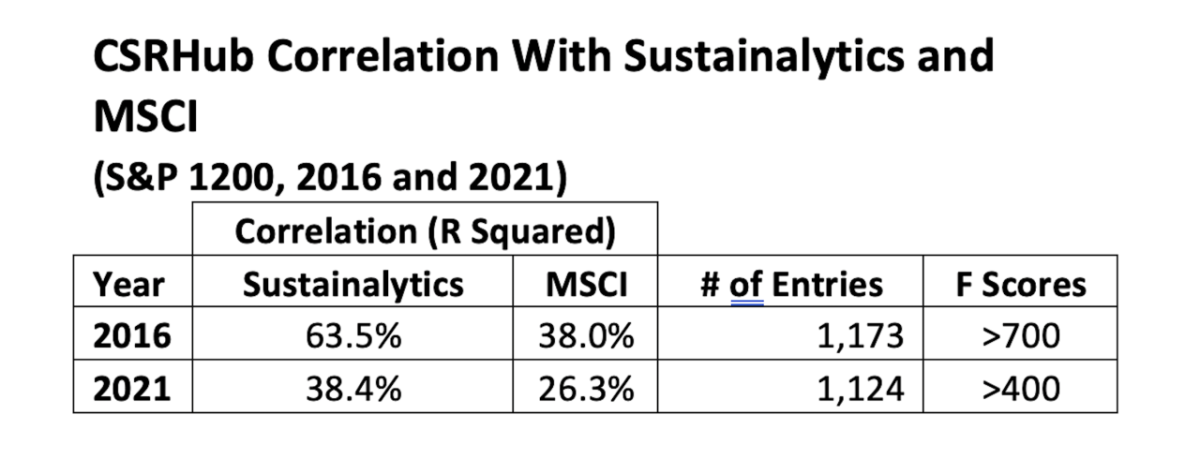

One driver for disparity may be a desire from ratings groups to generate alpha. To be “right” relative to the market, a ratings group needs to offer a unique, non-consensus opinion. CSRHub tracks and generates an ESG consensus opinion. We compared our scores to those for the two sources in the diagrams above. As you can see, both sources have moved further from consensus over the past five years.

CSRHub Correlation With Sustainalytics and MSCI

Differences in ratings between major ESG ratings groups drive everyone crazy. Corporate managers (especially those in Investor Relations), cannot explain them. Investors aren’t sure who to listen to. Consumers (who are increasingly affected by the views expressed by ESG ratings firms) can’t decide what products to buy. It would be easy to despair about this, but we believe instead those who use ESG ratings should instead say “vive le difference!” The richness and diversity of opinion in ESG is driving companies to disclose more data, using better systems, in more standard ways. This influx of new data won’t damp differences (it certainly hasn’t over the last five years!). But, it will give those who are using ESG ratings a better base of reference information to build upon. These users will be able to back test, analyze, and decipher the methods and messages that are hidden in ESG. This will give them opportunities to press for change in company behavior and track the impact of those changes.

We plan to keep tracking our sources against consensus and watching the evolution of disparity. We don’t expect convergence but we do expect more and more value to be derived from ESG data, as we move forward.

Bahar Gidwani is CTO and Co-founder of CSRHub. He has built and run large technology-based businesses for many years. Bahar holds a CFA, worked on Wall Street with Kidder, Peabody, and with McKinsey & Co. Bahar has consulted to a number of major companies and currently serves on the board of several software and Web companies. He has an MBA from Harvard Business School and an undergraduate degree in physics and astronomy. He plays bridge, races sailboats, and is based in New York City.

About CSRHub

CSRHub offers one of the world’s broadest and most consistent set of Environment, Social, and Governance (ESG) ratings, covering 50,000 companies. Its Big Data algorithm combines millions of data points on ESG performance from hundreds of sources, including leading ESG analyst raters, to produce consensus scores on all aspects of corporate social responsibility and sustainability. CSRHub ratings can be used to drive corporate, investor and consumer decisions. For more information, visit www.CSRHub.com. CSRHub is a B Corporation.