KeyBank Survey Finds Signs of Confidence With Small Business Owners Coupled With Concerns About Inflation, Fraud and Political Noise

Confidence among small business owners could be one of the first indicators of economic resiliency in the U.S.

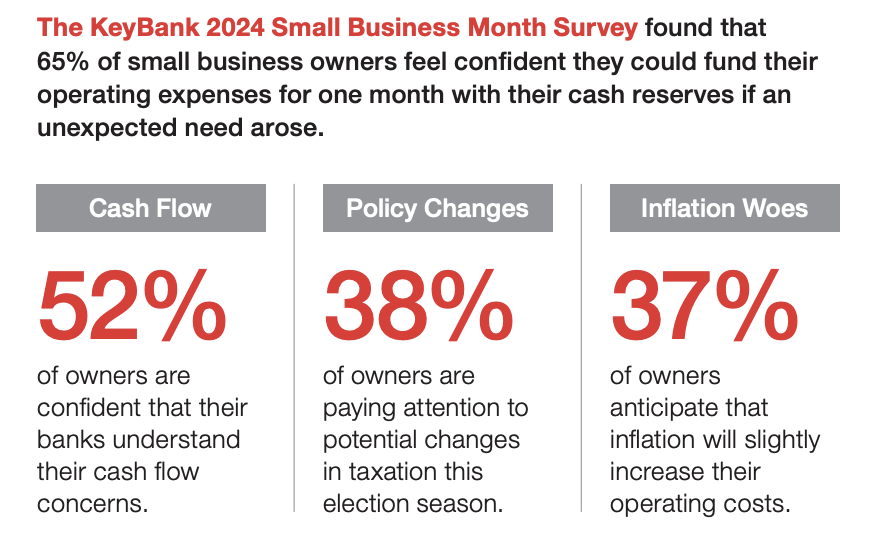

CLEVELAND, May 2, 2024 /3BL/ — Often the first to feel the effects of inflation and economic volatility, small business owners are optimistic about their businesses, even as economic challenges remain. KeyBank’s 2024 Small Business Survey found that 65% of small business owners feel confident they could fund their operating expenses for one month with their cash reserves, if an unexpected need arose.

Still, 37% of business owners anticipate that inflation will slightly increase their operating costs and 27% expect a significant increase in operating costs in the next 12 months. The top challenges small business owners anticipate this year are fluctuating sales/revenue (35%), delayed payments from clients/customers (29%) and high overhead costs (28%).

Despite these concerns, small business owners are well-adjusted and taking precautionary measures to protect their businesses—and the employees and communities they serve. They are already implementing cost-cutting measures (32%), increasing cash reserves (30%) and exploring alternative financing options (22%). As one of the top indicators of financial resilience in the US, their actions could be the first signal of an improving economic environment.

“Running a business is not an easy task, and when coupled with uncertain economic conditions, rampant inflation and high interest rates, small business owners are faced with ambiguity,” said Mike Walters, President of Business Banking at KeyBank. “Their resilience is a testament to years of weathering financial uncertainty, and with their confidence remaining strong they’re able to power through the last leg of inflation and keep themselves on track for economic growth.”

Leaders Leverage Bank Relationships for Education and Resources

Banks are at a pivotal moment to help their small business clients navigate cash flow and business operation concerns—and small business owners are turning to them for advice. The top three pieces of advice owners have received are: cut costs by reducing discretionary spending (34%), establish an emergency fund (22%) and diversify revenue streams by introducing new products or services (20%).

While more than half (52%) of small business owners are confident that their banks understand their cash flow concerns, almost 20% are unsure if their banks do so – pointing to an opportunity for banks and business owners to expand their relationships.

“In times of uncertainty, trusted advice from qualified professionals can be a lifeline for business owners, but many may not be aware of the advice and solutions their relationships with their bankers can provide,” said Walters. “Bank services extend beyond just traditional checking and savings accounts to cash flow and credit solutions. Maintaining a strong relationship with your bank can lead to uniquely tailored strategies.”

KeyBank, a top SBA lender1, has provided more than $4.5 billion in small business loans and lines of credit. Learn more about KeyBank’s opportunities and programs for your small business by visiting key.com/small-business. KeyBank offers a range of tools, including the KeyBank Small Business Check-In, KeyBank Small Business Financial Review and the Business Cash Flow Calculator.

Fraud Becomes a Watchpoint

As business operations have become mainly digital, fraud has become a pain point among small business owners who are most concerned about payment fraud, such as unauthorized transactions or unauthorized electronic fund transfers (44%), followed by identify theft (37%), malware and ransomware attacks (28%) and phishing and email scams (27%). Fraud prevention has become a focus for small business owners who continue to be vigilant of evolving fraud tactics and implement preventative measures to stop potential future attacks. Learn more about advice KeyBank provides to business owners about business security and risk management.

Navigating the U.S. Presidential Election

An election season creates a period of unease amongst Americans, and for business owners, political noise is magnified as potential policy changes could affect their business directly. While preparing for uncertainties, the top policy changes most owners are paying attention to are taxation (38%), employment and labor laws (25%) and healthcare policies (25%). Small businesses are the key to the country’s economic health, and while they currently feel confident, owners are keeping a close eye on potential policy changes.

Methodology

This survey was conducted online by Survey Monkey. 1,983 respondents, ages 18-99, located in the United States, who own or operate a small-to-medium size business with an annual gross revenue of less than $10 million, completed the survey in March 2024.

ABOUT KEYBANK

KeyBank's roots trace back nearly 200 years to Albany, New York. Headquartered in Cleveland, Ohio, KeyCorp is one of the nation's largest bank-based financial services companies, with assets of approximately $187 billion at March 31, 2024.

Key provides deposit, lending, cash management, and investment services to individuals and businesses in 15 states under the name KeyBank National Association through a network of approximately 1,000 branches and approximately 1,200 ATMs. Key also provides a broad range of sophisticated corporate and investment banking products, such as merger and acquisition advice, public and private debt and equity, syndications and derivatives to middle market companies in selected industries throughout the United States under the KeyBanc Capital Markets trade name. For more information, visit https://www.key.com/. KeyBank Member FDIC.

CFMA #240415-2550581

This material is presented for informational purposes only and should not be construed as individual tax or financial advice. KeyBank does not provide legal advice. Key.com is a federally registered service mark of KeyCorp. ©2024 KeyCorp

1Source: Statistics released by the U.S. Small Business Administration (SBA) in October 2023 for total approved loans through the SBA’s 7(a) lending program during the federal fiscal year ending October 2023.