GRESB, Explained

If you’ve been following Measurabl, or the world of sustainability reporting at-large, you’ve probably come across the mysterious acronym “GRESB”. Unless you’re immersed in the world of commercial real estate, chances are you read it as just another piece of forgettable jargon. But don’t dismiss it so quickly! GRESB - the Global Real Estate Sustainability Benchmark - is one of the many emerging organizations issuing standards for “how thou shalt disclose” on your organization’s sustainability performance. In the case of GRESB, “thou” means real estate owners, asset managers and developers. So if that’s you, pay close attention: we’re going to take a brief walk through what you need to know about the good folks at GRESB and their survey.

What is GRESB?

GRESB is a five-year-old nonprofit entity based out of the Netherlands whose mission in life is to help real estate investors assess the sustainability performance of commercial real estate portfolios around the globe. How do they go about it? They ask! Every year, GRESB issues a survey asking about things like energy and water usage as well as waste and carbon output. They’re also interested in things like how well you treat and train your employees, if you’ve been sued for corruption and dozens of other “material indicators”.

What's in it for me?

Money! Endowments, pension funds, as well as private and public institutional investors of all stripes look to GRESB’s annual survey as the barometer of your sustainability performance. Don’t want to participate? Think again — you may be putting your company at risk of not receiving investor dollars because they think you’re not running the company to the highest possible standards.

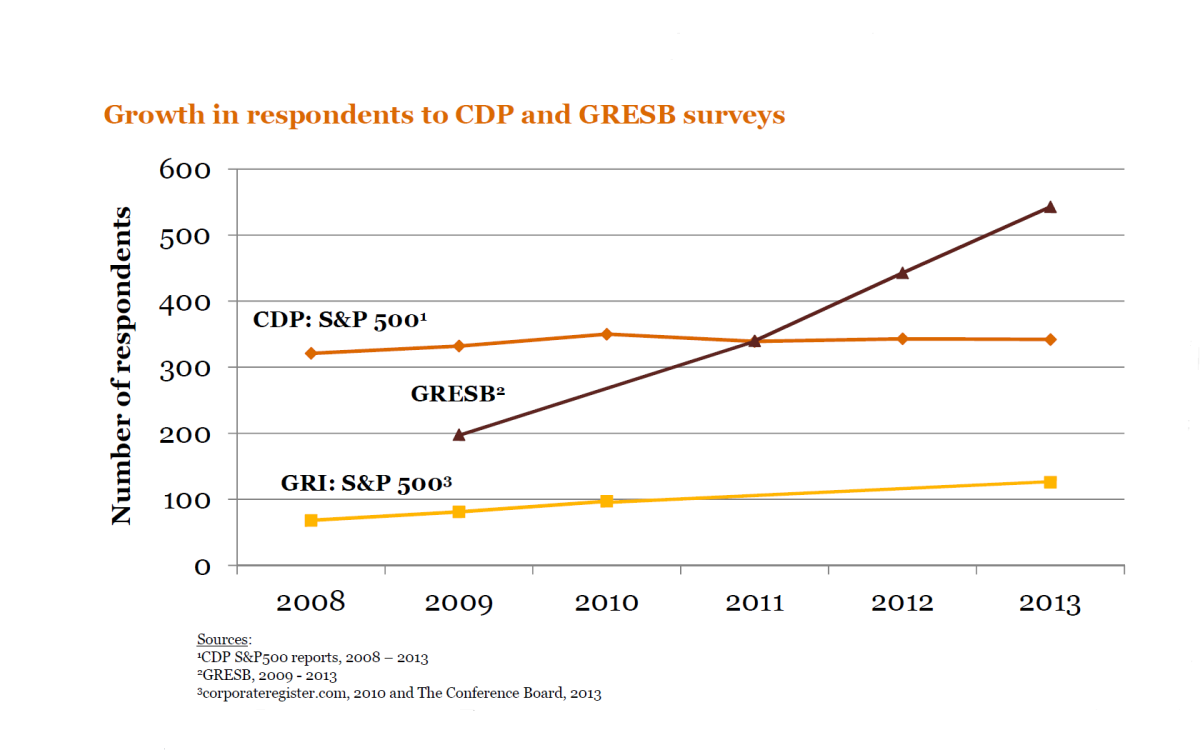

This logic is increasingly compelling. In 2013, 543 property companies and funds participated in the survey, representing $1.6 trillion in gross asset value (GAV) and covering almost 49,000 assets in 46 countries — about a 40% increase in participation versus the prior year. Building on trends in previous years, the 2013 results showed an increase both in the level of sustainability disclosure and in the sustainability performance of private and listed real estate portfolios. In other words, more folks are doing it and the competition is getting stiffer.

How does it work?

GRESB issues its survey in April of each year. The survey itself has changed every year, sometimes substantially as GRESB gets better at asking meaningful questions. Companies have a three-month window to respond to the survey, after which point the response period closes and GRESB starts sifting through the data. The data then goes through an extensive vetting process (so don’t lie on your report!) and the results are published around September.

What does the actual survey look like?

It looks like what you might expect: a long series of questions, tables and jargon. Like last year, we expect to see about 50 questions, many of which will require lengthy explanations. These questions will be broken into seven unique “aspects”, and the responses across these questions are used to create a score. The grading rubric is not public, so we don’t know exactly how scores are calculated, but we do know they’re assigned as a percentage out of 100 with not all questions equally weighted. Greater value is placed on the quantitative component (the “Implementation & Measurement” section), which comprises two-thirds of your total score.

GRESB also includes additional aspects (if you’re lucky!) for those companies and funds that do new construction or major retrofits of their assets. The New Construction and Major Renovation module is based on the same methodology as the rest of the survey but is scored separately and not included in the overall score. Phew!

Who’s in charge?

GRESB was conceived by its Executive Directors Dr. Nils Kok and Sander Paul van Tongeren around 2008. The founding organizations behind GRESB include Maastricht University, PGGM Investments and APG Asset Management.

The day-to-day management of GRESB and its annual survey is headed by Jones Lang LaSalle veteran Elsbeth Quispel along with a dedicated staff based in both Amsterdam and Singapore. There’s also an Advisory Board and an Executive Board, each consisting of industry representatives such as consultants, investors, and real estate executives.

What does the future look like?

GRESB has made quick progress from a small European phenomena to an internationally recognized standards body. Their laser focus on commercial real estate has allowed them to seize ground not well addressed by other larger, older organizations. As a result, they’ve done a good job of understanding their niche and providing meaningful performance data to their members.

That said, GRESB faces competition from the bigger players in standardization of sustainability disclosure like GRI, CDP and DJSI. These organizations are eager to get their say about what’s important for the real estate sector to disclose. There are also upstarts like SASB who are simplifying and standardizing disclosure requirements with the backing of major foundations, corporations and traditional government institutions. Most of these bodies cooperate to some extent via “alignment” of their standards, but they can also compete fiercely for the affection of the industries they seek to support and benefactors from whom they need resources. There’s also the matter of pain versus gain - GRESB’s US growth rate underperformed last year in part due to the industry’s dissatisfaction with the complexity and cost of preparing a GRESB response.

It remains to be seen if the real estate industry is willing to continue to play ball. It is a constant balancing act between transparency and practicality that all sustainability standards bodies face. For now, the parade towards transparency is still marching on strongly.