Ninety One Hosts Investing for a World of Change and Introduces the Road to 2030

Forum features industry experts, including keynotes Mark Carney, UN Special Envoy for Climate Action and Finance and CEO Hendrik du Toit

Ninety One Hosts Investing for a World of Change and Introduces the Road to 2030

Forum features industry experts, including keynotes Mark Carney, UN Special Envoy for Climate Action and Finance and CEO Hendrik du Toit

NEW YORK and LONDON, December 11, 2020 /3BL Media/ - Ninety One, an independent, active global investment manager, engaged more than 500 clients from 30 countries in its forum: Investing for a World of Change, and offers on-demand links to key sessions. The program features thematic updates from experts, including keynotes Mark Carney, UN Special Envoy for Climate Action and Finance and former governor of the Bank of England and Canada, with Ninety One CEO Hendrik du Toit to challenge the investment industry on doing more to secure a sustainable future. Speaking on climate change, Mr. Carney explained, “This will affect the value – in some cases positively, in some cases negatively – of every single financial asset.”

“We face clear expectations,” Mr. du Toit explained, “Active managers have to apply forward looking judgments to incorporate climate change risk in our decision making.”

Richard Garland, Head of Global Advisor hosted the event, welcomed clients and reflected, “We’re delighted to share this important analysis as we present Ninety One’s thought leadership through five key themes designed to help clients take a long-term, proactive approach in this changing landscape.” The programme provides five dominant themes set to shape the Road to 2030 having a major impact on asset allocation and investment decisions this decade:

- Rise of China

China is facing three distinct transformations: a change from fixed-asset investment to consumption; a shift up the value chain and towards technological independence in key areas like semiconductors; an outward economic expansion, for example through the ‘belt-and-road’ strategy. See session.

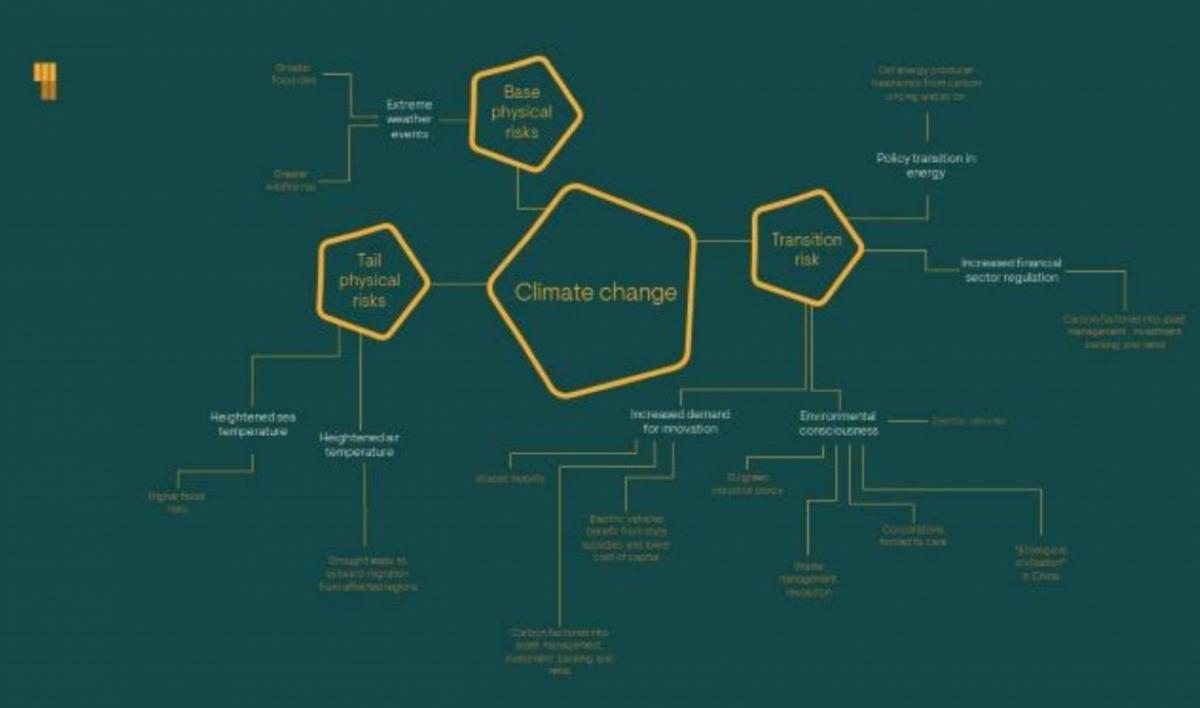

- Climate Change

Investors consider two types of climate risk: physical risks – the main ones in the next decade arise from extreme weather; and transition risks, which are the risks and opportunities arising from the response to climate change, including shifts in policy and consumer habits. See session.

- Technological Disruption

Technology impacts are expected in these areas: better healthcare, a growing abundance of goods and services, a transformation of the workplace, innovations in personal mobility, and the return of state intervention. Read highlights.

- Debt

Debt levels had been relentlessly rising internationally before the pandemic, but COVID-19 has worsened the financial position of every economy. How governments respond will influence market outcomes. Read highlights.

- Demographics

Longer lifespans will put pressure on government deficits for decades to come. Investors also need to watch for demographic impacts on GDP growth, as well as for idiosyncratic consequences of population shifts – for example on trends in property markets. Read highlights.

Ninety One’s Road to 2030 is a thematic framework designed to highlight undiscounted change. The firm believes that understanding the key long-term structural drivers is the basis of good investment thinking. Read highlights.

Ninety One

Ninety One is an independent, active global investment manager dedicated to delivering compelling outcomes for its clients, managing more than £118.0 billion in assets (as at 30.06.20).

Established in South Africa in 1991, as Investec Asset Management, the firm started offering domestic investments in an emerging market. In 2020, almost three decades of organic growth later, the firm demerged from Investec Group and became Ninety One. Today the firm offers distinctive active strategies across equities, fixed income, multi-asset and alternatives to institutions, advisors and individual investors around the world.

www.ninetyone.com

LinkedIN

Podcasts

# # #