EV Adoption Creates More Demand for Workplace Charging Stations

Executive Summary

- With more people driving electric vehicles (EVs), commercial property owners and large occupiers are installing EV charging stations as a crucial amenity. Last year, workplace charging sessions grew twice as fast as new installations, indicating an inability to keep pace with rising driver demand.

- The use of public transportation has decreased with the rise of hybrid work schedules, leading to an increase in vehicle traffic and changed commuting patterns.

- Post-pandemic workplace charging in North America became more concentrated from Tuesdays through Thursdays and in alignment with the highest office attendance days, according to ChargePoint, North America’s largest public networked charging port provider.

- Providing EV charging stations at workplaces is not only vital for accommodating the rapidly growing EV market, but also contributes to achieving environmental, social and governance (ESG) goals.

New workplace EV charging installations present a major opportunity for U.S. office property owners and large occupiers. More people are driving EVs due to government purchase incentives, environmental consciousness and an expanding charging infrastructure. EV drivers charge more often than gasoline drivers fill up because they tend to top-off rather than deplete batteries, making charging at workplaces a valuable amenity.

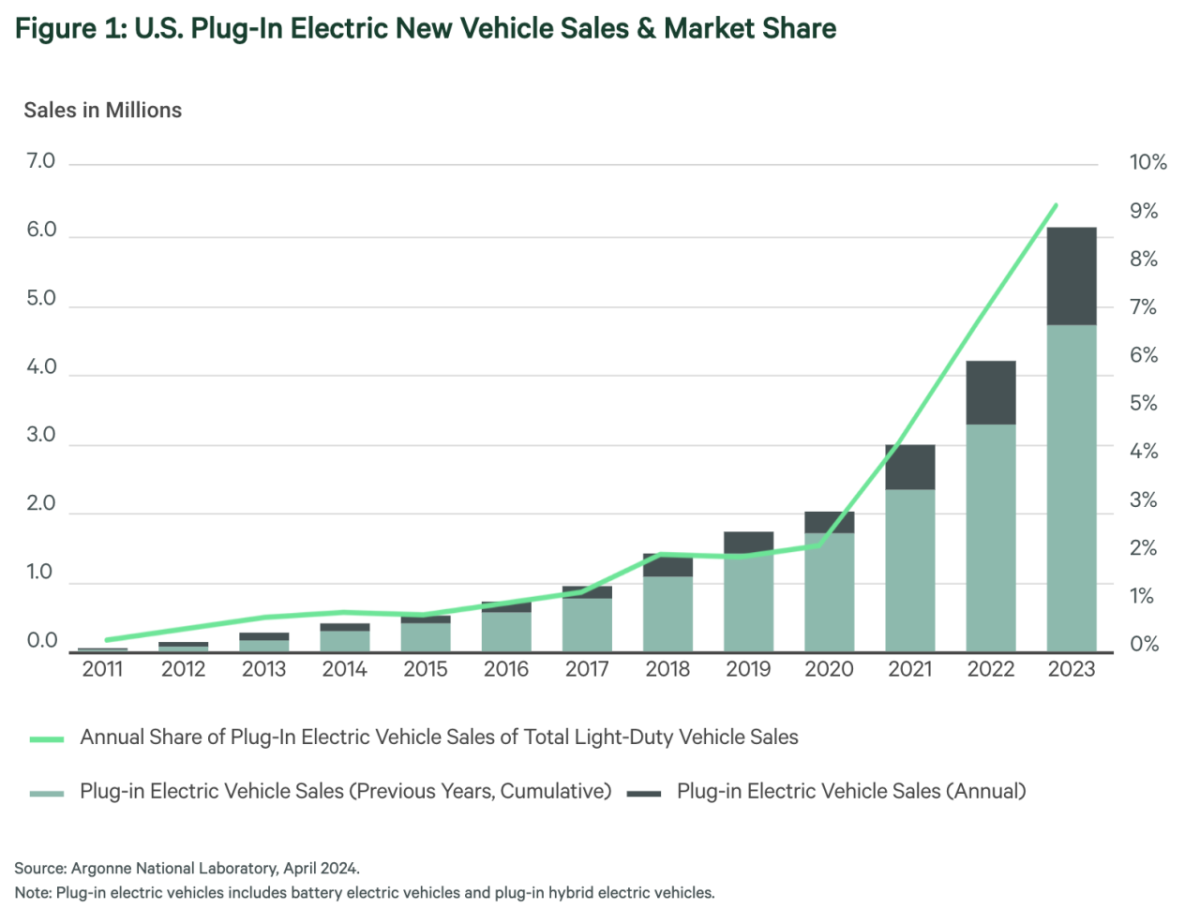

Last year, the U.S. was one of the world’s fastest-growing countries for EV sales, with sales up 50% year-over-year, according to BloombergNEF. EVs sold in the U.S. last year represented 9.2% of new light-duty vehicle sales and accounted for about 1.6% of all light-duty registered vehicles.1 The largest and fastest-growing U.S. EV markets are California, Florida, Texas, Washington, New Jersey and New York. About 37% of all U.S.-registered EVs are in California.

Looking ahead, BNEF predicted that U.S. EV registrations will grow at an average rate of 40% annually over the next five years, potentially reaching 26 million by 2028. However, in April, it issued a revised forecast of 31% year-over-year sales growth in 2024, suggesting a near-term slowdown.

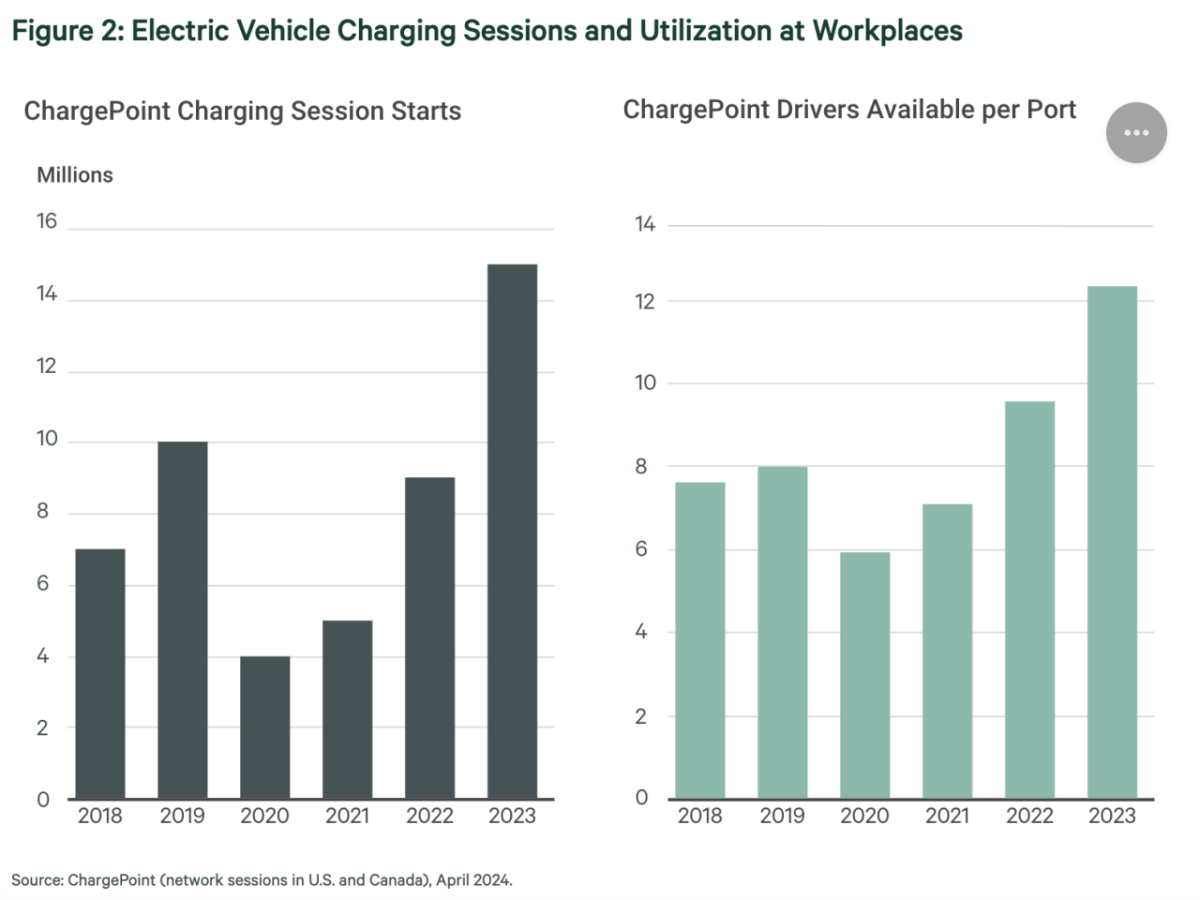

Active workplace charging ports from ChargePoint increased by 22% year-over-year in 2023.2 The number of unique drivers actively charging in workplace settings grew by 57% over the same time period. This surge in activity led to a 64% increase in charging sessions and higher utilization of existing ports. There was an average of twelve drivers per active port in 2023 compared with an average of eight pre-pandemic (2018-2019). This indicates that the growth of workplace charging ports has not kept up with rising driver demand and evolving commuting patterns.

The pandemic changed the frequency, destination and transportation mode for people commuting to work, with geographic variations. CBRE’s Spring 2023 U.S. Office Occupier Sentiment Survey revealed that office workplace attendance policies became more decisive in 2023. Two-thirds of the 207 real estate executives surveyed mandated some office attendance, while only 30% have voluntary return-to-office (RTO) policies, a decrease from over half the prior year. Technology companies had the most flexible RTO policies, with only 26% requiring employees to be in the office more than 2.5 days per week. In contrast, over half of the respondents in the financial and professional services sectors required more than 2.5 days per week in the office.

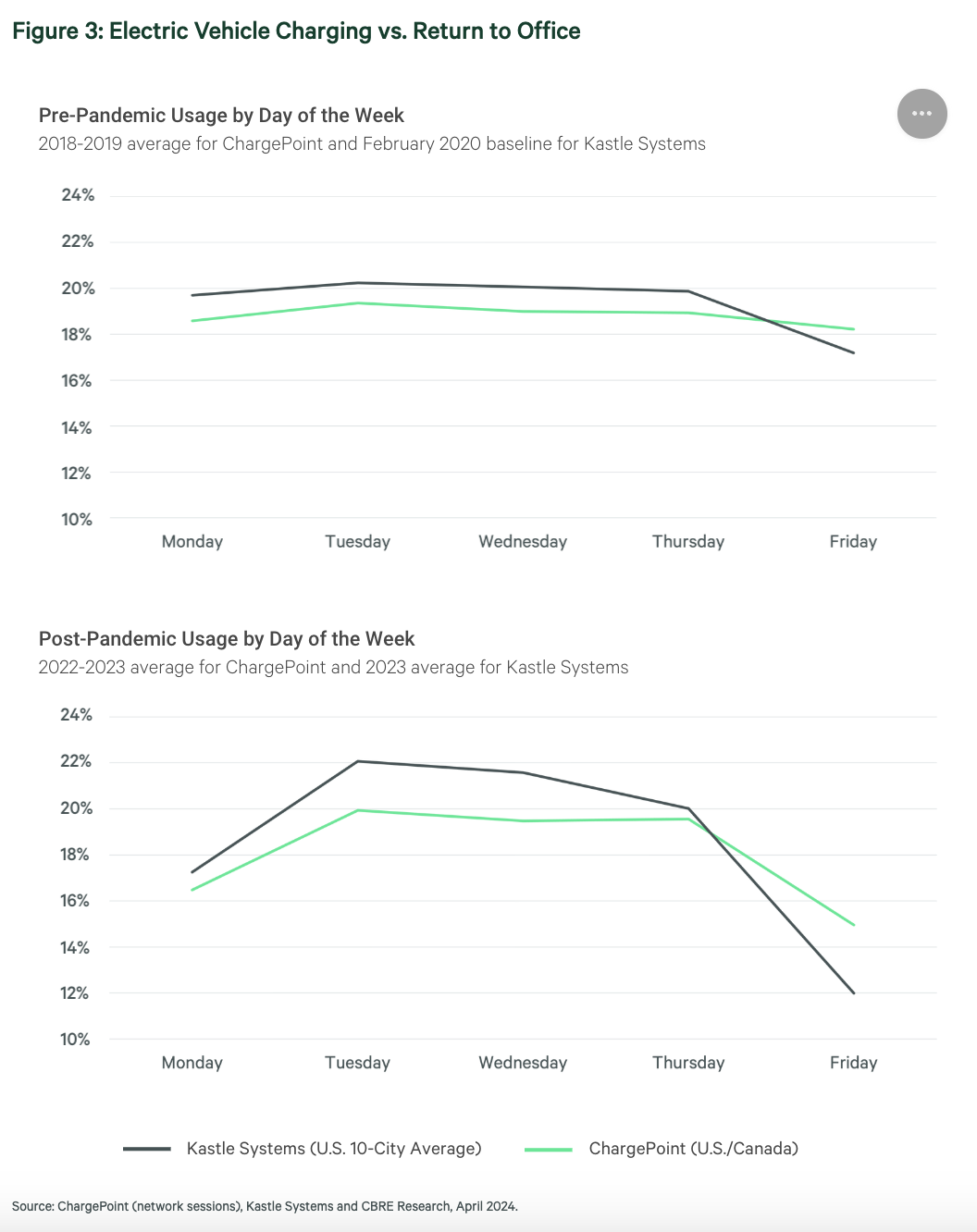

People are using public transportation less as hybrid work schedules become increasingly common. Total U.S. public transit usage in 2023 was 71% of pre-pandemic levels, according to the American Public Transportation Association. Meanwhile, vehicle traffic volumes in California have nearly returned to pre-pandemic levels, though the timing and dispersion of congestion has shifted.3 This shift suggests changes in the day of week and time of day that drivers are commuting to their workplaces. For EV drivers, ChargePoint data shows increases in charging sessions that align with RTO schedules.

Kastle Systems data shows office attendance is highest across all markets on Tuesdays through Thursdays and lowest on Mondays and Fridays. According to ChargePoint, popular workplace charging days similarly shifted from Mondays through Thursdays in 2018-2019 to Tuesdays through Thursdays in 2022-2023. Austin, TX had the most change, transitioning from relatively flat charging behavior from Mondays through Fridays to peak charging occurring on Tuesdays and Thursdays, with a significant decline on Fridays. However, charging trends vary across top U.S. EV markets. For example, more Texans than Californians charge their vehicles at the workplace over the weekend, while Californians are more likely to do so on weekdays. This is partly due to better availability of charging infrastructure away from workplaces. The average time of day to start charging sessions remained consistent with pre-pandemic trends, peaking in the morning with a smaller surge around lunchtime.

Outlook

Workplace EV charging has become a valuable amenity, with roughly 70% of prime U.S. office buildings equipped with charging ports.4 CBRE’s Occupier Survey reported that 30% of companies favor offices with EV chargers, a preference that rises to 40% at large companies. While charging alone may not be enough to bring workers back to the office, it could incentivize them to visit more and stay longer to charge their vehicles. On the ChargePoint network, 63% of workplace chargers are free for authorized users, who are typically employees.

EV chargers are increasingly recognized as a strategic asset for companies seeking to draw more employees back to the office and for property owners seeking to attract and retain tenants. Workplace charging sessions accounted for 28% of all charging sessions on the ChargePoint network in 2023, second only to the 40% share of home charging. Providing smart EV charging at workplaces is, therefore, crucial to accommodating the rapidly growing EV market while helping to achieve corporate ESG goals.

1 Registration data from U.S. Department of Energy, 2022. CBRE estimated 2023 EV registrations using sales data.

2 Includes general, government and municipal workplaces in the U.S. and Canada, but excludes retail and places open to the public.

3 National Library of Medicine. “Rush hour-and-a-half: Traffic is spreading out post-lockdown.” https://www.ncbi.nlm.nih.gov/pmc/articles/PMC10499251/

4 Includes about 10% of U.S. office building inventory by sq. ft.