Wells Fargo NeighborhoodLIFT Program Returns to Houston to Create 300 Homeowners

As Houston continues to battle COVID-19, $5 million effort will help residents with $15,000 home down payment assistance

HOUSTON, October 5, 2021 /3BL Media/ - As the pandemic continues to put a strain on Houstonians, Wells Fargo will bring the NeighborhoodLIFT® program back to Houston for a third time to help more than 300 low- and moderate-income individuals get on a path to homeownership with $15,000 down payment assistance grants.

“Saving for a down payment is one of the biggest barriers to homeownership for many first-time home buyers, and the pandemic has made saving for it even more challenging” said Bill Daley, vice chairman of Wells Fargo Public Affairs. “The LIFT initiative will help put more than 300 Houston families on a pathway toward housing stability and building generational wealth.”

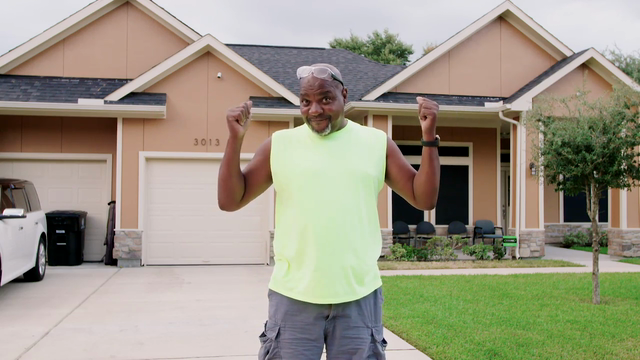

In collaboration with NeighborWorks® America and its network member Avenue, Daley announced the NeighborhoodLIFT® program today in front of the Houston home of Amanda Bridgewater, a single mother who previously received down payment assistance through NeighborhoodLIFT.

“Houston is a special place to call home, and this investment will help our local community of hardworking Houstonians with big dreams for the future,” said Mayor Sylvester Turner. “We appreciate the efforts of Wells Fargo, NeighborWorks America and its local affiliates to bring the NeighborhoodLIFT program to Houston again and help put homeownership within reach for hundreds of households.”

LIFT programs have created more than 25,000 homeowners

Today’s expansion of the NeighborhoodLIFT program celebrates more than 25,100 homeowners created through 82 LIFT launches nationwide since 2012. The $5 million commitment from Wells Fargo Bank, N.A. follows LIFT programs in 2012 and 2019 in Houston, which created more than 700 local homeowners. In addition to $15,000 home down payment assistance grants, the program includes $250,000 for 500 Houstonians to receive homeownership counseling so they can learn how to navigate the home purchasing process and determine how to best budget for ongoing homeownership costs.

Nurse Amanda Bridgewater purchased a home through Houston NeighborhoodLIFT in 2019 and learned valuable lessons about homeownership through the program.

“As a first-time homebuyer, learning all the mortgage terms was like learning a different language,” said Bridgewater. “Through the program I learned all about the homebuying process and, without LIFT, I may never have been able to buy a home. I’ve recommended the program to a few of my coworkers.”

“We’re ready to help more people like Ms. Bridgewater become homeowners with the support of NeighborhoodLIFT homebuyer education and down payment assistance,” said Mary Lawler, executive director of Avenue. “Through homeownership, she has been able to provide a safe home that’s close to school for her children, gotten a family dog and avoided the anxiety that can come with rising rental costs. NeighborhoodLIFT is a tremendous program and we are thrilled to have it back in our community for a third time to help people achieve homeownership.”

Applications for down payment assistance begin Nov. 8

Eligible homebuyers must earn 80% or less of family median income in Houston, as determined by the Federal Financial Institutions Examination Council. In Houston, the income limit is $63,840 for all borrowers. Participating homebuyers can obtain mortgage financing from any participating NeighborhoodLIFT lender and Avenue will determine eligibility and administer the down payment assistance.

“This important collaboration will assist more than 300 homeowners while maintaining social distancing guidelines via a virtual platform,” said Lisa Hasegawa, regional vice president, western region, NeighborWorks America. “In addition, the required homebuyer education provided by trained professionals will help homebuyers better understand financial commitments of homeownership, from differences in mortgage loans, to property taxes, and more.”

Homebuyers can view a list of participating lenders, learn about the steps to apply for down payment assistance, and sign-up for homebuyer education with a HUD-approved provider at www.wellsfargo.com/lift or www.avenuecdc.org/lift.

The material is also available in Spanish at www.avenuecdc.org/lift/espanol. Applications for down payment assistance may be submitted beginning Monday, Nov. 8, 2021, at 9 a.m. Central Time.

Committed to housing affordability

Since 2012, Wells Fargo has invested $521 million in NeighborhoodLIFT and other LIFT programs. While the LIFT program is focused on serving low- and moderate-income families regardless of race or ethnicity, the majority of LIFT homeowners represent people from various racial and ethnic backgrounds, with 25% of all LIFT down payment assistance recipients self-identifying as Black homeowners and 29% representing Hispanic households.

These grants are part of Wells Fargo’s housing affordability philanthropic commitment to address community needs in response to COVID-19. Since March of last year, Wells Fargo has provided more than $25 million in grant funding to national nonprofit housing and legal assistance organizations in support of housing counseling, renter stabilization, and eviction avoidance.

About NeighborWorks America and Avenue

Avenue is a chartered member of NeighborWorks America, a national organization that creates opportunities for people to live in affordable homes, improve their lives and strengthen their communities. NeighborWorks America supports a network of nearly 250 nonprofits, located in every state, the District of Columbia and Puerto Rico. Visit www.avenuecdc.org or www.neighborworks.org to learn more.

About Wells Fargo

Wells Fargo & Company (NYSE: WFC) is a leading financial services company that has approximately $1.9 trillion in assets, proudly serves one in three U.S. households and more than 10% of small businesses in the U.S., and is the leading middle market banking provider in the U.S. We provide a diversified set of banking, investment, and mortgage products and services, as well as consumer and commercial finance, through our four reportable operating segments: Consumer Banking and Lending, Commercial Banking, Corporate and Investment Banking, and Wealth & Investment Management. Wells Fargo ranked No. 37 on Fortune’s 2021 rankings of America’s largest corporations. In the communities we serve, the company focuses its social impact on building a sustainable, inclusive future for all by supporting housing affordability, small business growth, financial health, and a low-carbon economy. News, insights, and perspectives from Wells Fargo are also available at Wells Fargo Stories. Additional information may be found at www.wellsfargo.com | Twitter: @WellsFargo.