Water Utilities Show High Aspirations Toward Reducing Energy or Achieving Energy Neutrality

Water Utilities Show High Aspirations Toward Reducing Energy or Achieving Energ…

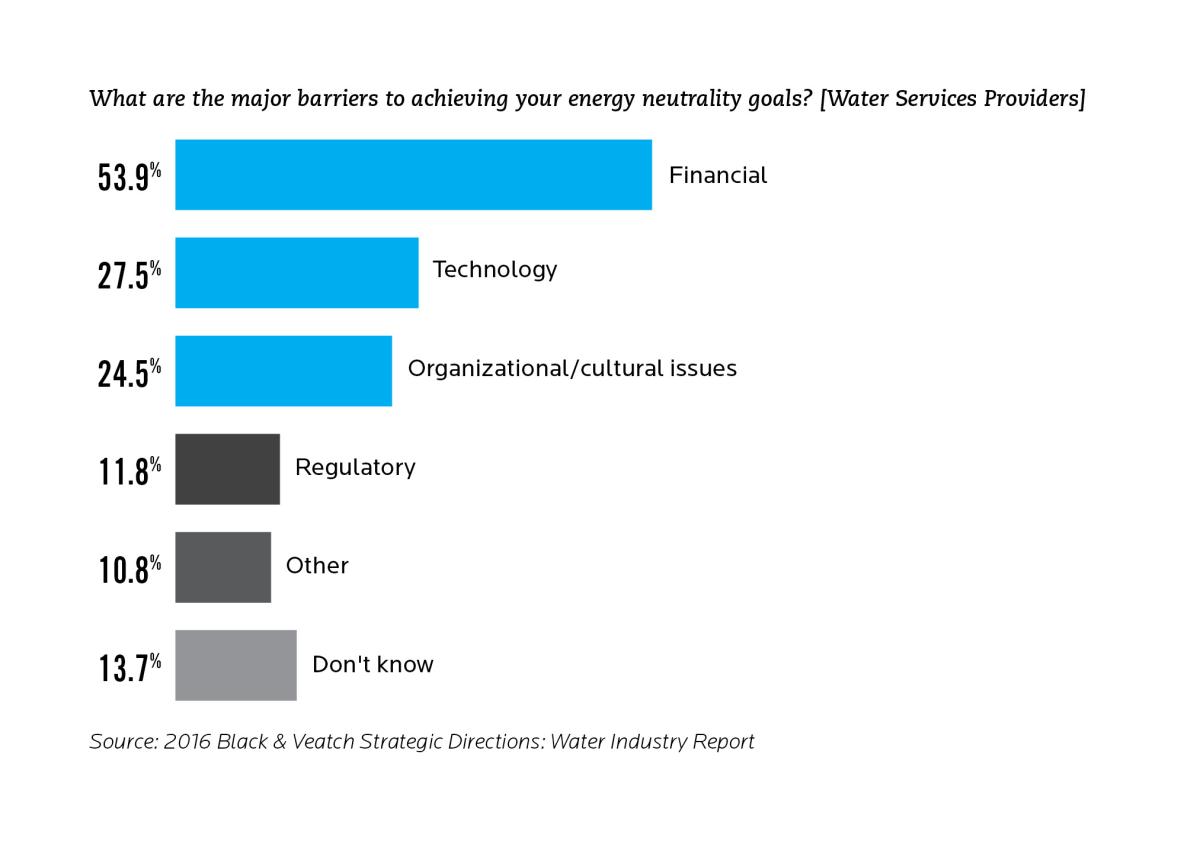

Water and wastewater utilities in the U.S. have high aspirations for energy reduction goals, or even moving toward energy neutral operations, but barriers are plentiful. Fortunately, approaches are being developed that can help system operators make significant progress in overcoming these obstacles.

According to the 2016 Black & Veatch Strategic Directions: U.S. Water Industry report, more than half of survey respondents say they have energy reduction goals in place – albeit somewhat moderate. Forty-six percent of the respondents cited a 5 to 10 percent energy reduction as a realistic goal.

“This reflects that many respondents have high aspirations, but what they believe is achievable is fairly modest,” said Jon Doane, Director of Water and Energy Services for Black & Veatch’s water business. “However, if utilities focus on taking incremental energy reduction steps annually – even at 5 percent – the cumulative savings will be very significant.”

Doane said the opportunities in energy neutrality are central to the utilities’ ability to enhance the resilience and reliability of their operations.

“If a utility makes the needed changes to generate or recover some of its own power, the resilience of its operations increases, and it reduces its reliability on the electric utility that serves it,” he noted.

Going All in on Net-Zero Energy

Twenty-six percent of respondents said they will eventually aim to produce on-site all the energy needed to meet or exceed the energy required to operate their facility. This fits with the emerging paradigm of treatment plants being seen as resource recovery facilities, since more energy is embedded in the wastewater than is required to treat it.

“The commitment to energy neutrality will entail broader and more costly efforts that target all aspects of the utility plant,” said Andrew Shaw, Global Practice and Technology Leader in Sustainability and Wastewater for Black & Veatch. “That will mean upgrading to more advanced equipment, including the latest in blower technologies and aeration control valves.”

Shaw said that many utilities with more modest energy efficiency targets are counting on digester-gas technologies to drive their future energy recovery plans. For instance, wastewater companies that plan to incorporate microturbines to improve energy use rose to 18 percent from 12 percent the previous year.

Using Performance Contracting to Achieve Goals

Many utilities are turning to public-private partnerships to provide much-needed funding in their drive toward energy neutrality. Black & Veatch provides Energy Savings Performance Contracting (ESPC) for utilities.

For instance, the Upper Occoquan Service Authority in Virginia has saved approximately $500,000 each year through work on an ESPC. The improvements included installation of cogeneration facilities and replacement of aeration blowers with high-efficiency, gearless turbo blowers, all delivered using a progressive design-build approach.

“Benefits to this approach of implementing energy savings include a single-source responsibility, combined with the ability to adjust the final project to meet the utility’s specific needs,” Doane said. “In addition, there are guarantees unique to an ESPC that provide the utility certainty in the performance of the improvements and the savings generated.”

Targeting Phosphorus Recovery

A small – yet steadily increasing – number of utilities are considering or implementing a phosphorus recovery system amid a more stringent regulatory environment on the state level, according to Scott Carr, Global Practice and Technology Leader for Biosolids and Residuals Management for Black & Veatch. More than two-thirds of those surveyed said the main driver for implementing a recovery system is to reduce effluent phosphorus loads, and 56 percent cited the need to address environmental concerns such as sustainability.

At the Stickney Water Reclamation Plant near Chicago, for example, Black & Veatch carried out a design-build project for the Metropolitan Water Reclamation District of Greater Chicago to construct the world’s largest nutrient recovery facility. This is part of the district’s plan to reduce and beneficially reuse phosphorus loads at the plant.

The plant uses nutrient recovery technology as a solution to manage the overabundance of phosphorus and create a revenue stream through the sale of fertilizer, the product derived from the recovery of phosphorus. The nutrient recovery facility became fully operational in mid-2016.

Financing Energy Neutrality at Facilities

Many survey respondents also cited their concerns about declining customer water use and the resulting lower revenues to recover fixed base operating costs. Energy use reduction or energy neutrality offers the opportunity to effectively help address these financial issues, Doane said.

In many cases, utility finances are structured, with 80 percent being fixed costs such as plant operations, pipes and labor, among other costs. The remaining 20 percent are variable costs that depend on such factors as water use and power costs.

“This points to the need for taking steps toward energy neutrality, even on an incremental basis,” Doane said. “Recovering those variable costs can make a huge difference.”

Additionally, he said there is now a stronger recognition that the cost of system water loss is greater than the lost revenue, and therefore is an avenue that should be addressed.

“The energy used in water treatment and conveyance for non-revenue water is essentially wasted energy,” Doane said. “Especially in areas with high electricity costs, water utilities need to account for energy inefficiencies associated with non-revenue water as they determine the threshold for remedial action.”

For many utilities, achieving lower water loss percentages can be vital for improving energy efficiency and increasing revenues.

“Any steps that can be made toward reducing power costs are going to be very important in a utility’s financial viability,” Doane said.