The Wait Is Over - SEC Announces Draft Rule on Climate-Related Disclosures

G&A's Sustainability Highlights (04.01.2022)

The Wait is Over - SEC Announces Draft Rule on Climate-Related Disclosures

The long-anticipated new rule for corporate climate change disclosures in registrations and certain periodic reports (such as 10-K filings) has been issued by the U.S. Securities & Exchange Commission. The 500+ page draft is now in the required 60-day public comment period, after which the SEC will consider the comments received and move toward the commissioners’ approval of the Final Rule before year-end 2022.

The draft rule calls for mandated disclosures to begin in calendar years 2023-2025 for the prior fiscal year, depending on size of company and other factors. The announcement of the rule should come as no surprise to corporate boards and managements, and many companies have been preparing for this type of mandate for a decade and more. G&A Institute research shows 90 percent of the S&P 500 companies are publishing annual sustainability reports and disclosing ample volumes of ESG data including climate change data regarding greenhouse gas (GHG) emissions which our research also shows is the most common type of ESG information assured by external auditors.

The SEC has been focused on mandating corporate climate change disclosure for more than a decade. In January 2010, the agency issued guidance in an Interpretive Release on existing disclosure requirements related to business risk on the issue of climate change impacts.

In September 2021, as a follow up to the 2010 action, the SEC published a “Sample Letter to Companies Regarding Climate Change Disclosures” regarding the types of information that may be required disclosure, such as the impact of legislation, regulations, and international accords; indirect consequences of climate change on business trends; and physical impacts of climate change.

The draft rule issued on March 21 provides guidance for disclosure by domestic or foreign registrants of “certain climate-related information,” including:

- Mandated filings such as Form 10-K would be required to include information on climate-related risk and actual or material impacts on the company business, strategy, and outlook.

- “Governance” and oversight of the filer’s GHG emissions accounting, climate-related risks and related risk management processes would be explained.

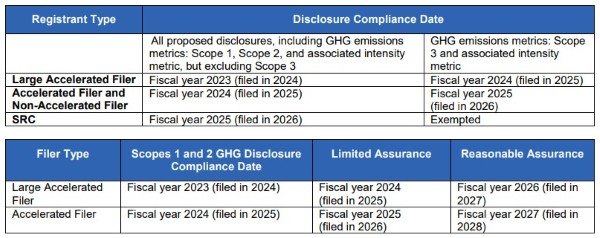

- “Limited” at first and then “Reasonable” assurance would be required for Scopes 1 and 2 GHG disclosures from 2025 filings out to 2028 filings depending on status of company – “Large Accelerated Filer” or “Accelerated Filer. (See table below for specific time periods for your company).

- If a company adopts climate-related targets and goals, they will need to develop and disclose transition plans to demonstrate how they will reach those goals.

- Large, accelerated filers would begin filings to meet the rule requirements in 2024 for fiscal year 2023 GHG emissions for Scope 1 (direct) and Scope 2 (indirect) and associated intensity metrics. Other companies would have a year or two longer to comply –” (see table below for specific time periods for your company).

- Material Scope 3 categories would be required for large, accelerated reporters starting in 2025 for fiscal year 2024 data; Other companies would have a year or two longer to comply” – see table below for specific time periods for your company).

Important Note: Smaller Reporting Companies (SRC) would be exempted from reporting Scope 3 data.

There is helpful information detailed in the Fact Sheet issued by SEC and in related background information that we have included for you in our Top Stories. The G&A team is now seeing a flow of advice, guidance, and perspectives on the proposed rule by law firms, accounting firms, and other entities, and we will include these in future issues of the newsletter.

This is just the introduction of G&A's Sustainability Highlights newsletter this week. Click here to view the full issue.