T. Rowe Price: Parents Who Stick to Their Holiday Spending Budgets Are More Likely to Shop Online

Survey finds that 83% of parents participate in at least one promotional shopping day

November 16, 2017 /3BL Media/ - T. Rowe Price’s 2017 Parents Kids & Money Survey, which sampled parents of 8 to 14 year olds nationally and their kids, found that 72% of the parents surveyed set a specific budget for holiday spending, yet 58% of the parents surveyed agree that they spend more money during the holidays than they intended.

Parents who never stick to their budget are more likely to shop exclusively in stores (36% vs. 18%). And budget followers are more likely to shop mostly or exclusively online (39% vs. 23%). The majority of parents (83%) participate in at least one promotional shopping day, which includes Black Friday (52% online; 46% in stores), Cyber Monday (44%), and Small Business Saturday (21%).

“It’s easy to overextend ourselves during the holidays and give in to impulse purchases,” says Judith Ward, a senior financial planner at T. Rowe Price and mother of two. “There is some evidence that shopping online can provide an element of impulse control and help parents stick to their budgets. And, not surprisingly, most parents who never stick to their budget aim to get everything on their kids’ wish lists, no matter the cost.”

The study also found that parents who never stick to holiday budgets are more likely than budget-followers to use alternative sources for holiday spending, including emergency funds (21% vs. 11%), payday loans (16% vs. 6%), and retirement savings (12% vs. 6%).

On the positive side, Ms. Ward noted, “It’s great to see that two-thirds of kids are shopping for others and using their own money. This is a safe way to provide money experiences for kids. We know that money conversations coupled with experience lead to money smart kids.”

To help parents have money conversations with kids, T. Rowe Price created MoneyConfidentKids.com, which provides free online games for kids; tips for parents that are focused on financial concepts such as goal setting, spending versus saving, inflation, asset allocation, and investment diversification; and lessons for educators.

HOW PARENTS ARE SHOPPING DURING THE HOLIDAY SEASON

-

Many parents stick to shopping in stores as opposed to online: 42% of parents shop for the holidays mostly in stores with some online shopping. More than a quarter of parents (28%) shop in stores exclusively. And less than one-third (31%) of parents shop mostly or exclusively online.

-

But parents who stick to their budgets are more likely to shop online: Parents who stick to their budgets are more likely to say that they mostly or exclusively shop online (39% vs. 23%), while parents who spend more than they budgeted are more likely to shop exclusively in stores (36% vs. 18%).

-

Parents wait for the holidays to make large purchases: Most parents (82%) wait for the holidays to make big purchases.

-

Parents also purchase gifts for themselves: More than half of parents (60%) shop for themselves during the holidays, and more than one-third (37%) spend more on themselves than their kids.

-

Parents actively take advantage of promotional days: Last year, 52% of parents shopped online on Black Friday, 46% shopped in stores on Black Friday, 44% shopped on Cyber Monday, 21% shopped on Small Business Saturday, and 14% made a charitable donation on Giving Tuesday.

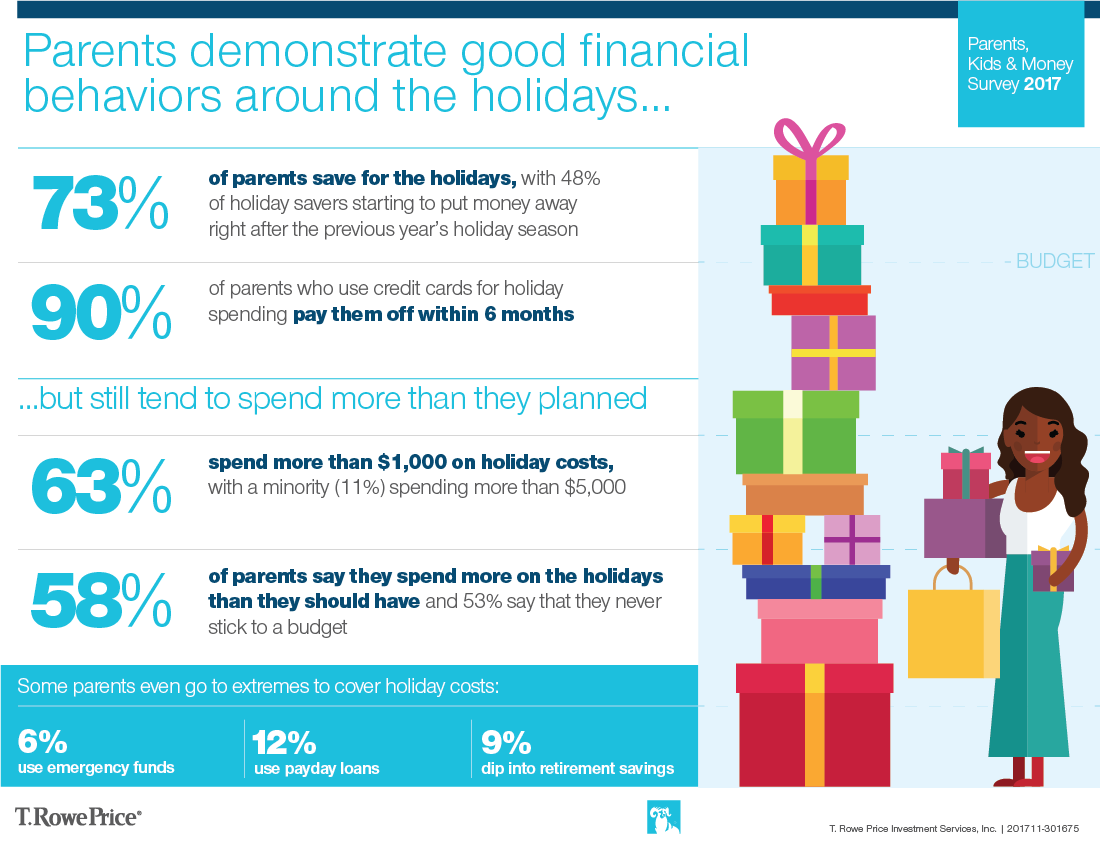

PARENTS AND CHILDREN PRACTICE some GOOD FINANCIAL BEHAVIORS AROUND THE HOLIDAYS

-

Parents are saving for the holidays early in the year: Nearly three-quarters of parents (73%) save for the holidays, with almost half (48%) of holiday-savers starting to put money away right after the previous year’s holiday season.

-

Most parents pay off holiday expenses quickly: 59% of parents use credit cards to pay for holiday spending, but most pay them off in a short time frame, with 90% paying them off within six months.

-

Kids are getting money experiences during the holidays: 67% of kids buy presents for others and two-thirds of them (66%) use their own money to pay for the presents. Thirty-four percent of kids who give gifts say that their parents usually cover the costs.

PARENTS HAVE A TENDENCY TO GO OVERBOARD ON HOLIDAY SPENDING

-

Parents overspend during the holidays: More than half of parents say they spend more on the holidays than they should have (58%) and that they never stick to a budget (53%). Most parents (63%) spend more than $1,000 on holiday costs, with a minority (11%) spending more than $5,000.

-

Parents aim to get all gifts on their kids’ wish lists: Many parents (58%) try to get everything on their kids’ wish lists, and most kids (66%) expect them to buy everything on their lists. Trying to cross off everything on kids’ wish lists is more common among parents who never stick to their budgets, with 75% of budget breakers trying to get everything on their kids’ lists. Conversely, only 39% of parents who stick to their budget try to get their kids everything on their wish lists.

-

Some parents go to extremes to cover holiday costs: 16% of parents have used the money in their emergency fund; 12% have used payday loans; and 9% of have used retirement savings to cover costs.

MONEY CONFIDENT KIDS is a registered trademark of T. Rowe Price Group, Inc.

201711-301671

ABOUT THE SURVEY

The ninth annual T. Rowe Price Parents, Kids & Money Survey, conducted by Research Now, aimed to understand the basic financial knowledge, attitudes, and behaviors of both parents of kids ages 8 to 14 and their kids ages 8 to 14. The survey was fielded from January 18, 2017, through January 26, 2017, with a sample size of 1,014 parents and 1,014 kids ages 8 to 14. The margin of error is +/- 3.1 percentage points.

ABOUT T. ROWE PRICE

Founded in 1937, Baltimore-based T. Rowe Price Group, Inc. (troweprice.com) is a global investment management organization with $971 billion in assets under management as of October 31, 2017. The organization provides a broad array of mutual funds, subadvisory services, and separate account management for individual and institutional investors, retirement plans, and financial intermediaries. The company also offers a variety of sophisticated investment planning and guidance tools. T. Rowe Price's disciplined, risk-aware investment approach focuses on diversification, style consistency, and fundamental research. For more information, visit troweprice.com or our Twitter, YouTube, LinkedIn, and Facebook sites.

CONTACT US

Heather McDonold

T. Rowe Price

410-345-6617

heather_mcdonold@troweprice.com

Monique Bosco

T. Rowe Price

410-345-5740