Survey Results: ESG Practitioners Underprepared for Changing Global Regulations and Challenging Reporting Requirements

Blog by Julie Iskow, Workiva President and COO

Blog by Julie Iskow, Workiva President and COO

As ESG reporting requirements continue to evolve, businesses are faced with increasing complexity to report their ESG performance in a transparent and cohesive story to their varied stakeholders. Regulators, investors, customers, and other stakeholders have identified what’s essential now, but this is only part of what will be essential for tomorrow’s reporting. To navigate this era of change in ESG, businesses must be forward-looking and flexible in their planning.

Taking the pulse

To understand the current state of ESG reporting across the globe, our latest ESG survey took the pulse of ESG practitioners to find out how they are tackling the challenges and opportunities around their reporting processes. We commissioned an independent research agency to gather insights from 1,300 decision makers for whom ESG reporting and strategy is the primary or secondary responsibility from their seats in finance, ESG, sustainability, HR, compliance, operations, and legislative affairs.

The survey respondents come from 13 countries in North America, Europe, and APAC and are working in energy (including oil and gas), financial services, manufacturing, retail and wholesale, food and beverage, construction, technology, telecoms, professional services, real estate, and transportation industries.

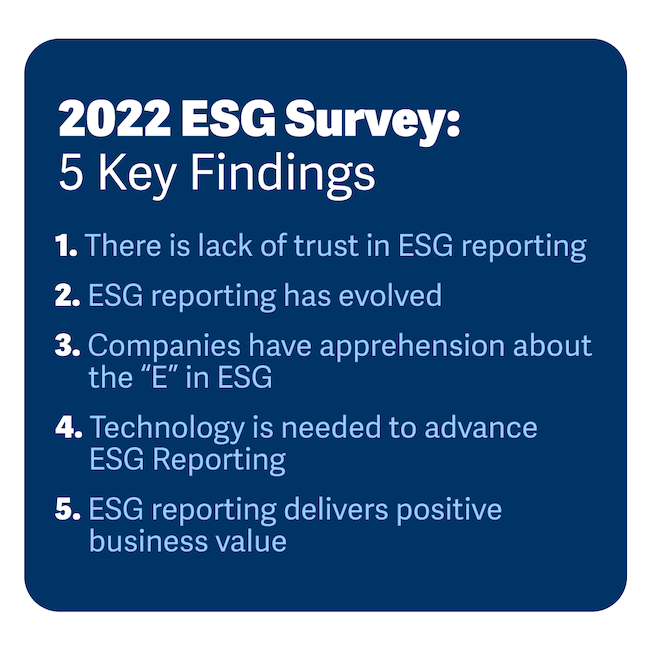

As we looked at the survey data, five key takeaways emerged:

One: There is a lack of trust in ESG reporting

Nearly two thirds of senior decision makers feel their organization is underprepared to meet their ESG goals and regulatory reporting mandates. Further, 72% don’t have confidence in the data currently being reported to stakeholders, despite 68% of businesses having appointed an ESG-specific role to oversee reporting.

Two: ESG Reporting has Evolved

ESG reporting was noted to be a relatively recent undertaking for most companies, with 58% of those surveyed confirming their organization began formally reporting ESG, climate/sustainability, or corporate social responsibility data in just the last 1-3 years. According to the findings, ESG reporting is being handled by a wide range of departments within organizations, signaling the need for significant cross-team collaboration.

Three: Apprehension around the ‘E’ in ESG

While progress is needed across all facets of ESG, tackling the ‘E’ is a major focus for organizations. ESG practitioners predicted that over the next 18 months internal ESG budgets will be devoted primarily to the reporting of environmental factors, such as calculating greenhouse gas protocols to measure scope 1, 2, and 3 emissions and achieving investor- grade carbon disclosures.

Four: Technology is Needed to Advance ESG Reporting

Given the increasing importance of delivering transparent, accurate data to key stakeholders, there is a clear need for ESG reporting to be simplified through technology. Globally, respondents noted that technology was important for compiling and collaborating on ESG data, as well as validating data for accuracy and mapping disclosures to regulations and framework standards.

Despite this, half of respondents do not feel individual departments within their organization have the systems necessary to provide data for ESG reporting. In fact, one in five reported that their organization does not employ technology suitable for managing the ESG reporting process and program initiatives. Only a third of overall respondents said their organization uses technology and data very well to make decisions on advancing ESG strategy, indicating there is significant scope to improve efficiencies and performance in this area.

Five: ESG Reporting Delivers Positive Business Value

Importantly, the survey revealed that companies are seeing business value in their current ESG reporting. Over 70% of respondents stated that their organization’s ESG reporting has already generated a positive impact across several areas, including customer retention and recruitment, cost savings, insurance and credit agency engagement, and the reduction of long-term risk. The majority of respondents also noted that ESG reporting has improved employee morale, employee recruitment efforts, and investor and stakeholder relationships.

Challenge = opportunity

This is the time for businesses to examine their current approach and rethink how they advance ESG reporting to make it more measurable, transparent, and hence, credible. Effective leaders focus on what is most material to their business and stakeholders in the long term, use data and analytics to drive ESG efforts, link goals to managing performance and risk, and know there is not a one-size-fits-all approach to ESG for all companies or situations.

Technology is key to the seamless integration of financial and non-financial data from disparate teams and sources into one centralized platform. By streamlining reporting, companies can better meet the requirements of regulators, investors, customers, employees, and other stakeholders for trusted, transparent data – now and as demands evolve.

Please download the full report of our ESG Reporting Global Insights 2022; Current challenges, planned investments and technology opportunities survey, as well as an infographic of key findings. While challenges around communicating ESG corporate value to stakeholders still exist, the survey data demonstrates that businesses who prioritize ESG reporting see clear positive outcomes.

If your company is struggling with producing investor-grade, audit-ready ESG reports, Workiva offers reporting solutions including an ESG-focused tool, ESG Explorer, that gives companies the ability to browse multiple frameworks and standards to identify the disclosures that matter for ESG reporting in one location.