Support for Sustainable Investment Decisions

Posted from Moody's 2017 CSR Report

We’ve seen sustainability move from buzzword to business imperative as people, companies and governments increasingly seek to make environmentally and socially conscious investments. For example, more than 1,700 asset managers and owners, who collectively manage approximately $68 trillion in assets, have signed on to the United Nations–supported Principles for Responsible Investment as of December 2017. This response represents a real market need for better data and tools to assess impact — one we are well positioned to address as experts in data, analytics and credit worthiness.

Our ESG Initiative

Moody’s Investors Service has been incorporating environmental, social and governance (ESG) considerations into its credit analysis for years for those sectors that are most exposed to these considerations. In 2016, we launched a dedicated ESG Initiative to expand the products and services that help global investors, governments and issuers understand the material links between sustainability and creditworthiness. Our specialized ESG offerings include Green Bond Assessments (GBAs), climate risk analysis and sector-specific research on carbon transition risks.

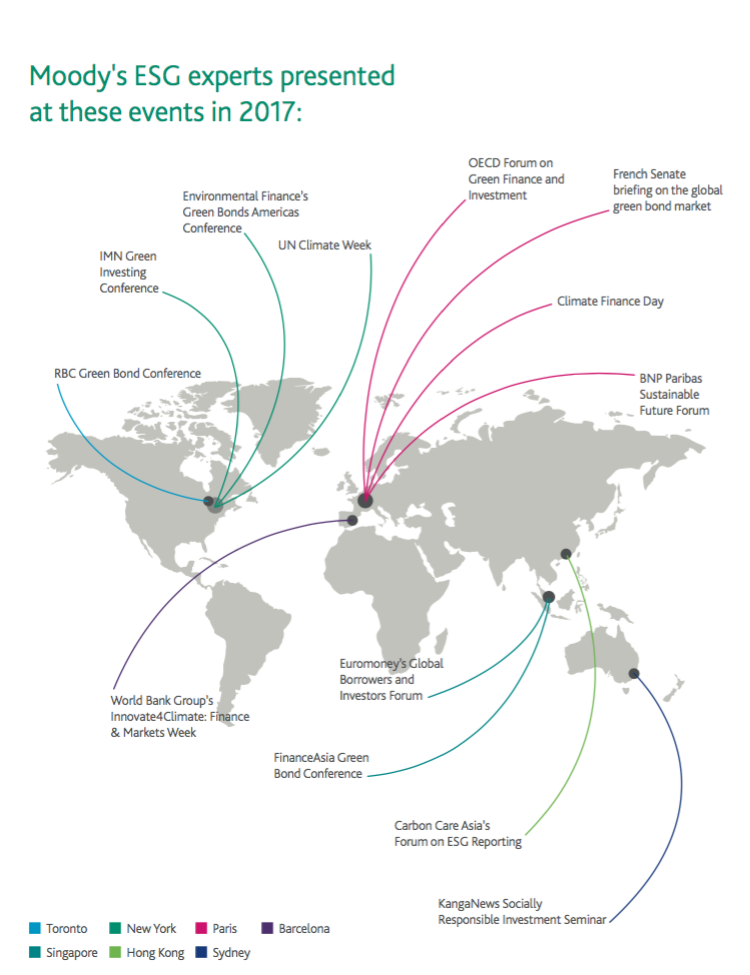

In 2017, Moody’s ESG Initiative formed a dedicated analytical team to scale up environmental research and products designed to bring transparency and comparability to the marketplace. Drawing upon talent from across the company as well as external subject-matter experts, our ESG Initiative now includes a dozen dedicated professionals for ESG and nearly 100 analysts working across three ESG Working Groups covering the Asia-Pacific, EMEA (Europe, Middle East and Africa) and Americas regions.

Learn more in Moody's 2017 CSR Report