Shifting Priorities: How Sustainability and Decarbonization are Driving Modern Supply Chains

A new DP World report examines the rising importance of ESG in global supply chains

Supply chain operators have narrowed their focus on sustainability and decarbonization thanks to increasing market and regulatory pressures. According to Deloitte, “One of the hottest of the hot buttons for investors, customers, and regulators is better performance and disclosure related to a company’s climate impact.”

Deloitte’s view is supported by a recent survey-driven report that DP World conducted in partnership with Supply Chain Dive’s studioID. The report – “Supply Chains Prepping for a Greener, More Agile Future” – is based on a survey of nearly 160 leaders from across the supply chain, operations and IT sectors, which found that pressure around environmental, social, and governance (ESG) is now a top-three challenge for their supply chains, ranking right up there with demand and supply variability (41%) and inflexibility/inability to adapt quickly to change (34%), and tied with regulatory and compliance challenges (28%).

The newly elevated mission to decarbonize their supply chains has these organizations reordering their priorities and shifting how they allocate resources to set up more sustainable, lower-carbon supply chain operations.

Supplier decarbonization is a big focus.

Suppliers, of course, play a central role in any organization’s decarbonization efforts. Thus, when choosing suppliers and collaborators, respondents indicated potential partners’ decarbonization and sustainability capabilities are becoming critical decision factors.

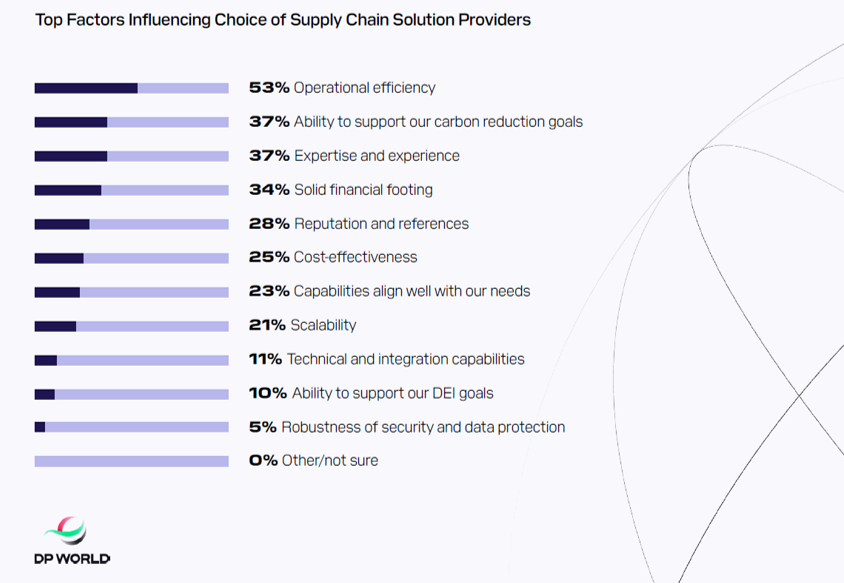

In fact, eight in 10 (84%) called these capabilities extremely or very influential in the selection process. Additionally, the ability to support respondents’ carbon reduction goals tied for the second-most-important factor influencing their choice of supply chain solution provider (37%). Their organizations are also monitoring or adding ESG requirements for their current tier one (50%) and tier two (61%) suppliers.

How are internal operations shifting?

Sustainability changes are affecting internal operations, too.

Three in five survey respondents told us they are taking or planning to take action on supply chain optimization to support their ESG goals. These activities include reducing transportation distances, consolidating shipments and optimizing inventory levels. Their companies are also adopting energy-efficient practices and investments, such as employing fuel-efficient driving practices (38%), using more energy-efficient transportation methods (38%) and reducing energy use in warehouses (35%).

These tactics should sound familiar to those who follow DP World, which recently committed to several large-scale energy efficiency investments. For example:

- We are investing $500 million to cut nearly 700,000 tons of CO2 emissions from our operations over the next five years by transitioning our global fleet of assets from diesel to electric, investing in renewable power, and exploring alternative fuels.

- DP World Chile utilizes 100% renewable electricity across all its ports and, in doing so, became the first port operator in South America to secure renewable electricity certification.

- In Canada, DP World provides shore power at its Prince Rupert and Vancouver ports. Shore power is an emissions-reduction technology that enables ships to turn off their diesel-powered auxiliary engines and plug into British Columbia's low-emission energy.

- We’re investing in nature-based solutions by planting 100,000 mangroves — one of the most effective CO2 nature-based sequestration methods — in the Jebel Ali Wildlife Sanctuary in Dubai.

- We are investing in electrification throughout South America, purchasing a fleet of 20 electric internal terminal vehicles for use at our terminal in Callao, Peru, and replacing 22 diesel RTGs at the Port of Santos in Brazil with electric versions.

Expectations are high for ESG investments.

Survey respondents are confident in the payoff they expect from their investments in ESG. Top anticipated benefits include increasing efficiency (83% call it very or somewhat significant), increasing access to needed specialized services such as labeling or kitting (52% very, 38% somewhat), and increasing the value of their organizations to business partners/other stakeholders (49% very, 41% somewhat), among other benefits.

These findings dovetail perfectly with DP World’s “Our World, Our Future" sustainability strategy, aimed at adopting the practices, mindsets and technology that will move our customers' goods and services faster and more sustainably. It’s quite clear that sustainability has broken through to become a top focus for the future of supply chains, and it needs to be a priority in every supply chain decision moving forward.