PSEG Announces 2022 Second Quarter Results

Originally published on PSEG NewsRoom

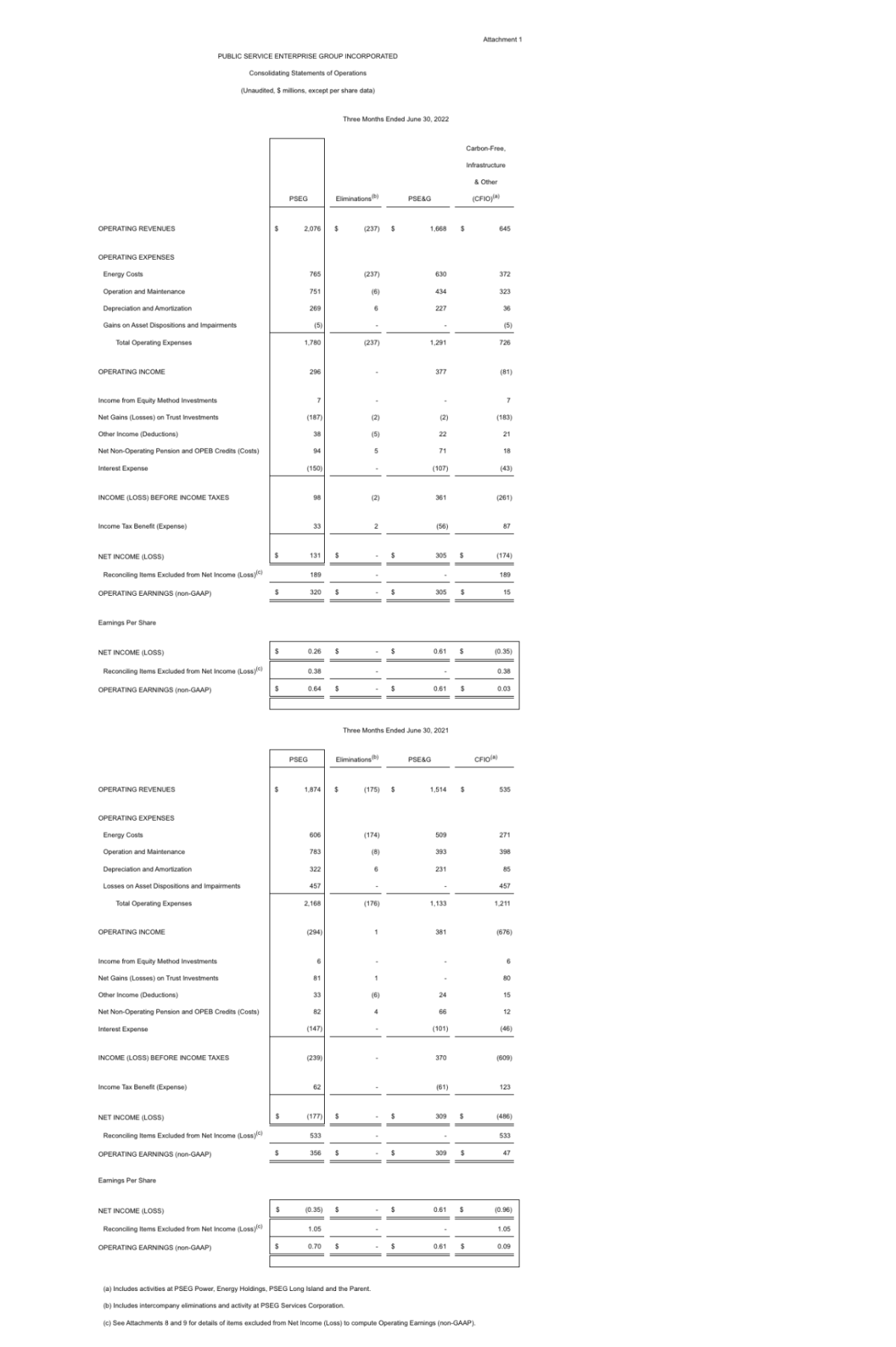

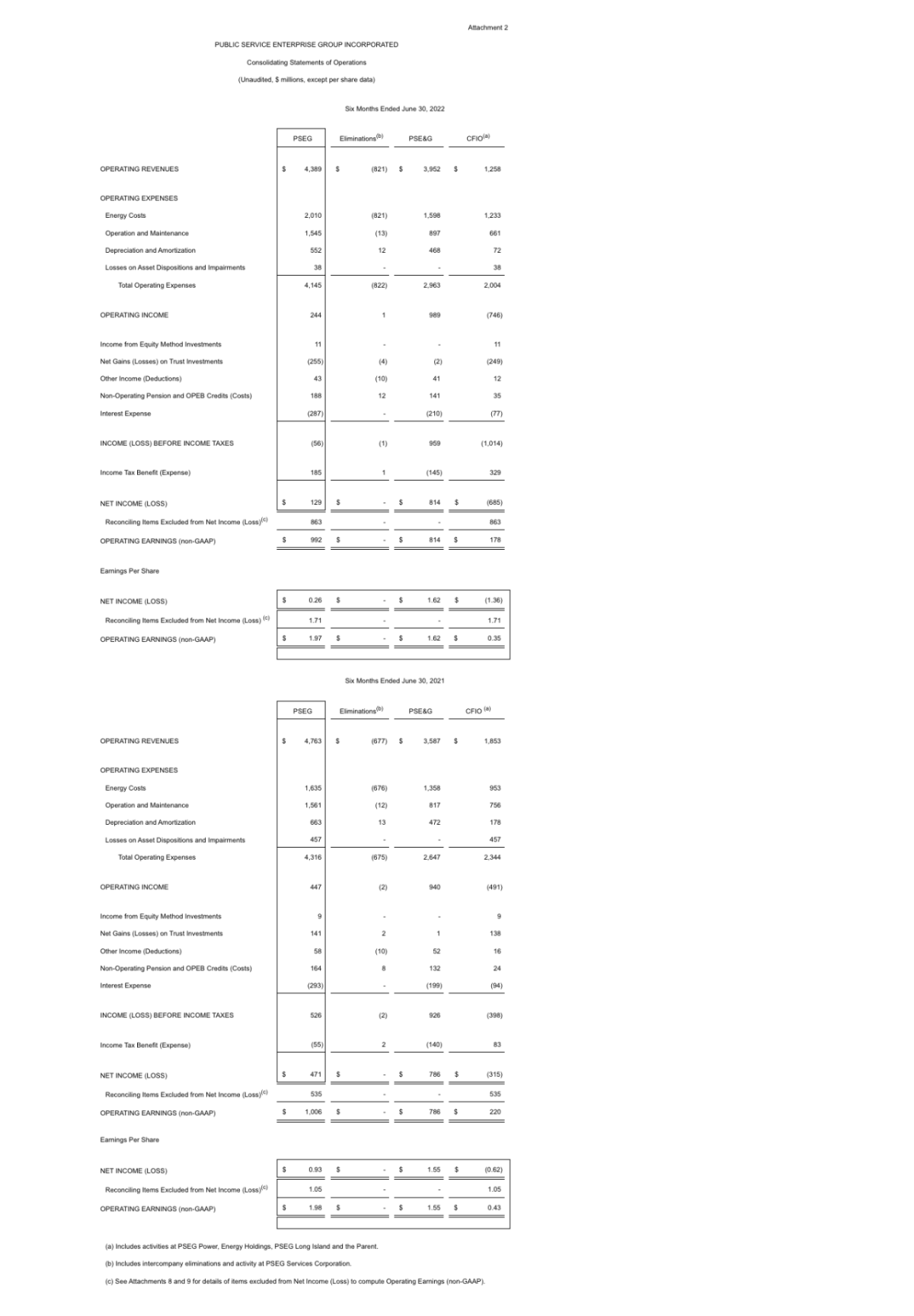

NEWARK, N.J., August 3, 2022 /3BL Media/ - Public Service Enterprise Group (NYSE: PEG) reported Net Income of $131 million, or $0.26 per share for the second quarter of 2022, compared to a Net Loss of $177 million, or $0.35 per share, in the second quarter of 2021. Non-GAAP Operating Earnings for the second quarter of 2022 were $320 million, or $0.64 per share, compared to non-GAAP Operating Earnings of $356 million, or $0.70 per share in the second quarter of 2021.

Izzo continued, "As I step down from my CEO duties on September 1, PSEG is well positioned to enter its 120th year of serving New Jersey with essential energy services that help to power the economic engine of the State and advance its energy policy leadership. In my role as executive chair of the board through the end of 2022, I will continue to advocate on behalf of PSEG in key policy arenas. With Ralph LaRossa at the helm, PSEG will further advance its Powering Progress vision of a future where people use less energy, and it's cleaner, safer and delivered more reliably than ever. PSEG's dedicated workforce will continue the public service heritage that recently earned us the 2022 EEI Edison Award, the electric utility industry's highest honor, in recognition of PSE&G's infrastructure modernization programs focused on protecting our customers and communities from extreme weather conditions. The June 2022 approval of a four-year, $511 million investment in our Infrastructure Advancement Program (IAP) will extend these reliability improvements to the "Last Mile" of our distribution system, as we prepare the grid for the rapid transition to electric vehicles and enable a greater blend of renewable energy resources."

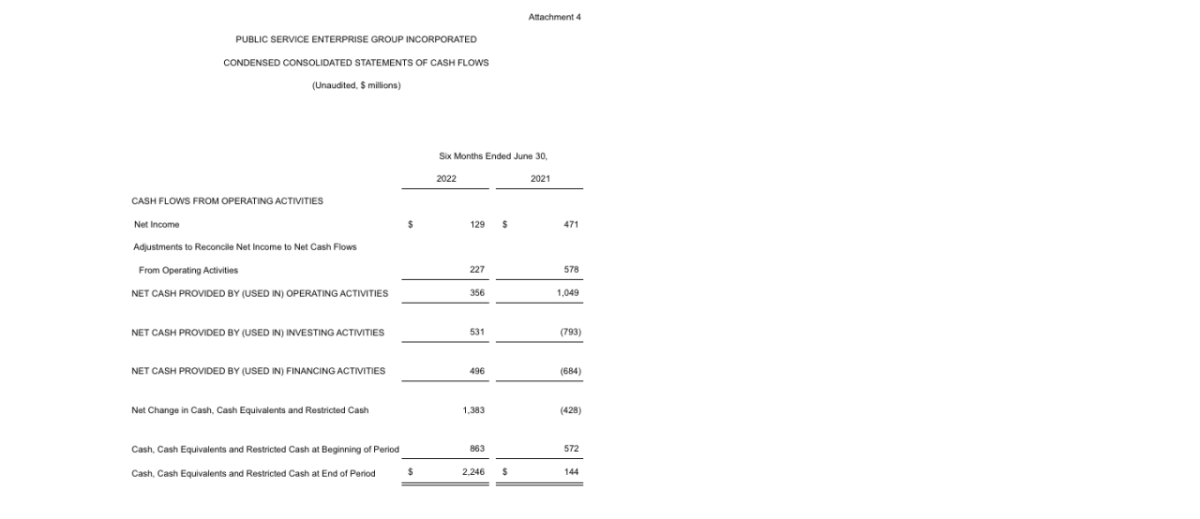

The following table provides a reconciliation of PSEG's Net Income/(Loss) to non-GAAP Operating Earnings for the second quarter. See Attachments for a complete list of items excluded from Net Income/(Loss) in the determination of non-GAAP Operating Earnings.

PSEG CONSOLIDATED (unaudited)

Second Quarter Comparative Results

| Income/(Loss) ($ millions) 2022 |

Income/(Loss) ($ millions) 2021 |

Diluted Earnings (Per Share) 2022 |

Diluted Earnings (Per Share) 2021 |

|

| Net Income/(Loss) | $131 | $(177) | $0.26 | $(0.35) |

| Reconciling Items | 189 | 533 | 0.38 | 1.05 |

| Non-GAAP Operating Earnings | $320 | $356 | $0.64 | $0.70 |

| PSEG Fully Diluted Average Shares Outstanding* | 500M | 504M |

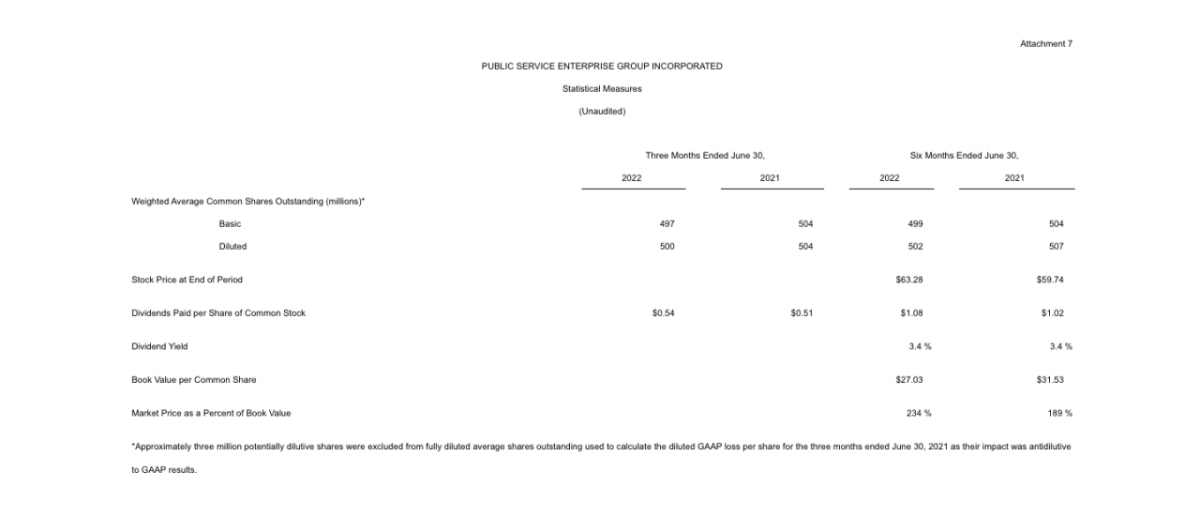

*Approximately three million potentially dilutive shares were excluded from fully diluted average shares outstanding used to calculate the diluted GAAP loss per share for the three months ended June 30, 2021 as their impact was antidilutive to GAAP results. For non-GAAP per share calculations, we used fully diluted average shares outstanding of 507 million, including the three million potentially dilutive shares as they were dilutive to non-GAAP results. M=Million.

Ralph Izzo added, "We are re-affirming our 2022 non-GAAP Operating Earnings guidance of $3.35 - $3.55 per share. The Conservation Incentive Program (CIP) continues to reduce variances in sales revenue due to energy efficiency savings, weather and economic impacts, resulting in more stable utility margins. Our regulated investment programs continue to add predictable rate base growth while improving reliability and resiliency, and helping the State reach its clean energy goals. We also reiterate our multi-year earnings per share CAGR of 5% to 7% from the mid-point of 2022 guidance to 2025, in large part driven by continued growth in the utility's investment programs, including obtaining a return of and on capital investments that will be recovered specifically through the next base rate case to be filed by year-end 2023."

PSEG 2022 Non-GAAP Operating Earnings Guidance

| ($ millions, except EPS) | 2022E |

| PSE&G | $1,510 - $1,560 |

| Carbon-Free, Infrastructure & Other | 170 - 220 |

| PSEG non-GAAP Operating Earnings | $1,680 - $1,780 |

| PSEG non-GAAP Operating EPS | $3.35 - $3.55 |

E = Estimate

Guidance for Carbon-Free, Infrastructure & Other excludes results related to the fossil generating assets sold in February 2022.

Financial Results and Outlook

PSE&G

Public Service Electric & Gas

Second Quarter Comparative Results

| ($ millions, except EPS) | 2Q 2022 | 2Q 2021 | Q/Q Change |

| Net Income | $305 | $309 | $(4) |

| Earnings Per Share | $0.61 | $0.61 | - |

Compared to the second quarter of 2021, Transmission margin was flat, as growth in rate base and other positive true-up adjustments were offset by the August 2021 implementation of a new Transmission formula rate, including a lower return on equity. For distribution, Gas margin improved by $0.02 per share over second quarter 2021, reflecting the scheduled recovery of investments made under Gas System Modernization Program II and the true up from the CIP. Electric margin rose by $0.02 per share compared to the second quarter of 2021, driven by the scheduled recovery of Energy Strong II investments and the CIP. Other margin, primarily related to appliance services, also added $0.01 per share compared with the second quarter of 2021.

O&M expense was $0.04 per share unfavorable compared with the second quarter of 2021, reflecting higher legal costs from the resumption of customer settlement proceedings as courts reopened, higher Electric operations expense and Gas tariff work. Interest expense was $0.01 per share unfavorable, reflecting higher investment. In addition, the impact of PSEG's $500 million share repurchase program had a $0.01 per share benefit on second quarter 2022 results. Flow-through taxes and other items had a net unfavorable impact of $0.01 per share compared to second quarter 2021, driven by the use of an annual effective tax rate that will reverse over the remainder of the year.

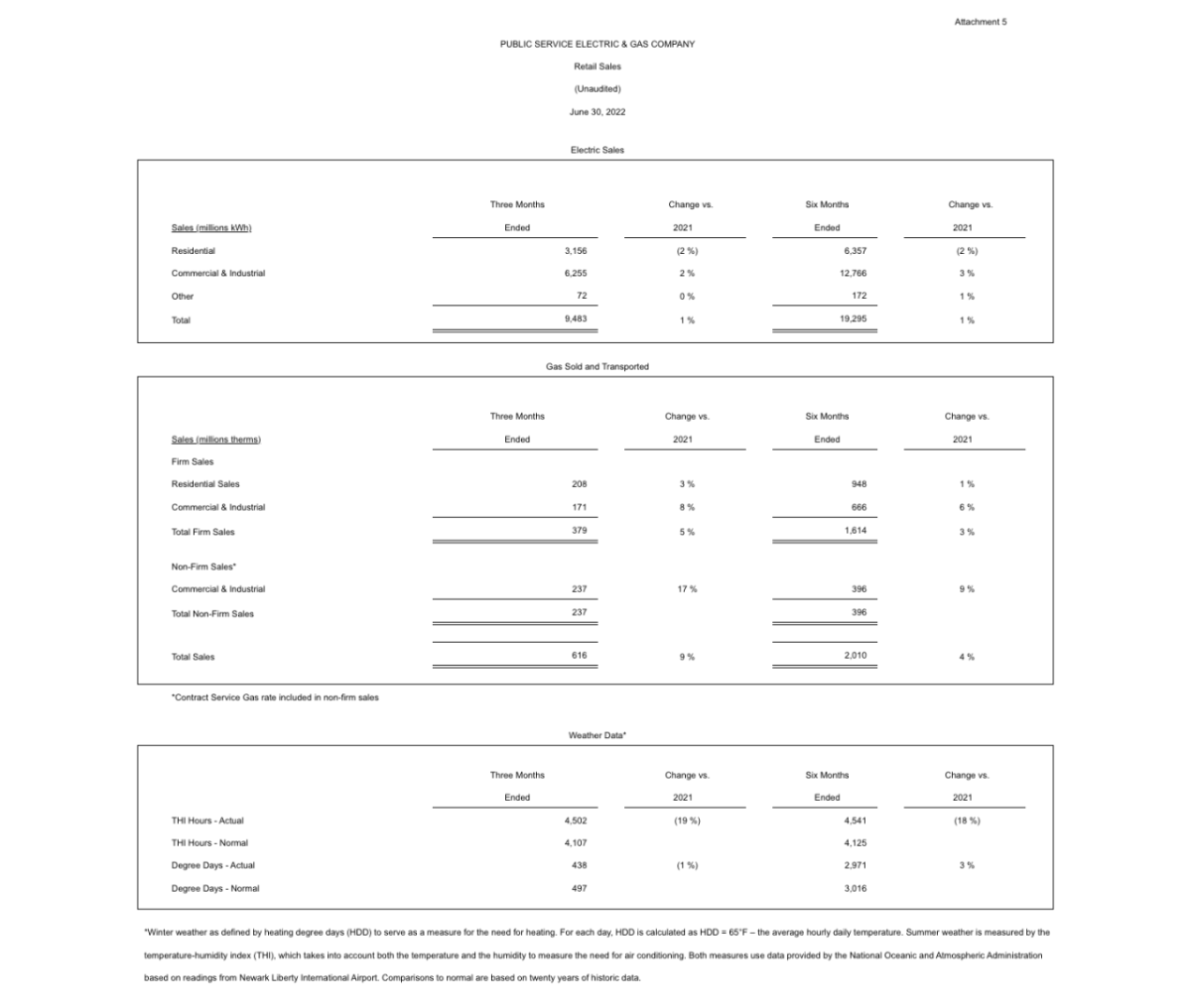

Weather during the second quarter of 2022 (measured by the Temperature-Humidity Index-THI) was warmer than normal but cooler than temperatures during the second quarter of 2021. With the CIP in effect, variations in weather (positive or negative) have a limited impact on electric and gas margins while enabling the widespread adoption of PSE&G's energy efficiency programs. For the trailing 12-months ended June 30, weather-normalized electric and gas sales reflected lower Residential (both lower by approximately 3%) and higher Commercial and Industrial (higher by 2% and 3%, respectively) sales, as more people returned to work outside the home. Growth in the number of electric and gas customers remained positive by approximately 1% during the trailing 12-month period.

On June 29, the New Jersey Board of Public Utilities approved the settlement of the Infrastructure Advancement Program authorizing PSE&G to invest $511 million over the next four years for grid modernization and "Last Mile" reliability improvements that support New Jersey's clean energy goals.

PSE&G invested approximately $741 million during the second quarter and approximately $1.4 billion year to date through June 30, and is on track to execute its planned 2022 capital investment program of $2.9 billion. The 2022 capital spending program includes infrastructure upgrades to its transmission and distribution facilities, as well as the continued rollout of the Clean Energy Future investments in energy efficiency, energy cloud (smart meters), electric vehicle charging infrastructure, and the newly approved IAP.

PSE&G's forecast of Net Income for 2022 is unchanged at $1,510 million - $1,560 million.

PSEG Carbon-Free, Infrastructure & Other

Carbon-Free, Infrastructure & Other

Second Quarter Comparative Results

| ($ millions, except EPS) | 2Q 2022 | 2Q 2021 | Q/Q Change |

| Net Loss | $(174) | $(486) | $312 |

| Loss Per Share (EPS) | $(0.35) | $(0.96) | $0.61 |

| Non-GAAP Operating Earnings* | $15 | $47 | $(32) |

| Non-GAAP Operating EPS | $0.03 | $0.09 | $(0.06) |

| Fully Diluted Avg. Shares Outstanding** | 500M | 504M |

*Non-GAAP Operating Earnings for 2Q 2022 exclude the results of fossil generation sold in February 2022.

**Approximately three million potentially dilutive shares were excluded from fully diluted average shares outstanding used to calculate the diluted GAAP loss per share for the three months ended June 30, 2021 as their impact was antidilutive to GAAP results. For non-GAAP per share calculations, we used fully diluted average shares outstanding of 507 million, including the three million potentially dilutive shares as they were dilutive to non-GAAP results. M=Million.

Carbon-Free, Infrastructure & Other (CFIO) reported a Net Loss of $174 million ($0.35 per share) for the second quarter of 2022 and non-GAAP Operating Earnings of $15 million ($0.03 per share). This compares to a second quarter 2021 Net Loss of $486 million and non-GAAP Operating Earnings of $47 million, which included results of the divested fossil and solar assets.

For the second quarter of 2022, electric gross margin declined by $0.25 per share, primarily due to the sale of the 6,750 MW fossil portfolio in February 2022 and the sale of the Solar Source portfolio in June 2021. This reduction in gross margin includes recontracting approximately 8 TWh of nuclear generation at a $3/MWh lower average price. In addition, zero emission certificates added $0.01 per share due to the absence of the Hope Creek refueling outage in the year-earlier quarter. Separately, lower margins at Gas Operations resulted in a $0.01 decline in gross margin versus the second quarter of 2021.

Year over year, second quarter cost comparisons were better by $0.22 per share due to the divestitures, driven by lower O&M, depreciation and interest expense that will mainly benefit first-half 2022 results. The third and fourth quarters of 2021 reflected the Solar Source sale in June, the cessation of fossil depreciation from August onward, and the retirement of PSEG Power's outstanding debt in October. Parent activity was $0.01 per share unfavorable compared with second quarter 2021, as a result of higher interest expense. Taxes and other were $0.01 unfavorable compared to the second quarter 2021.

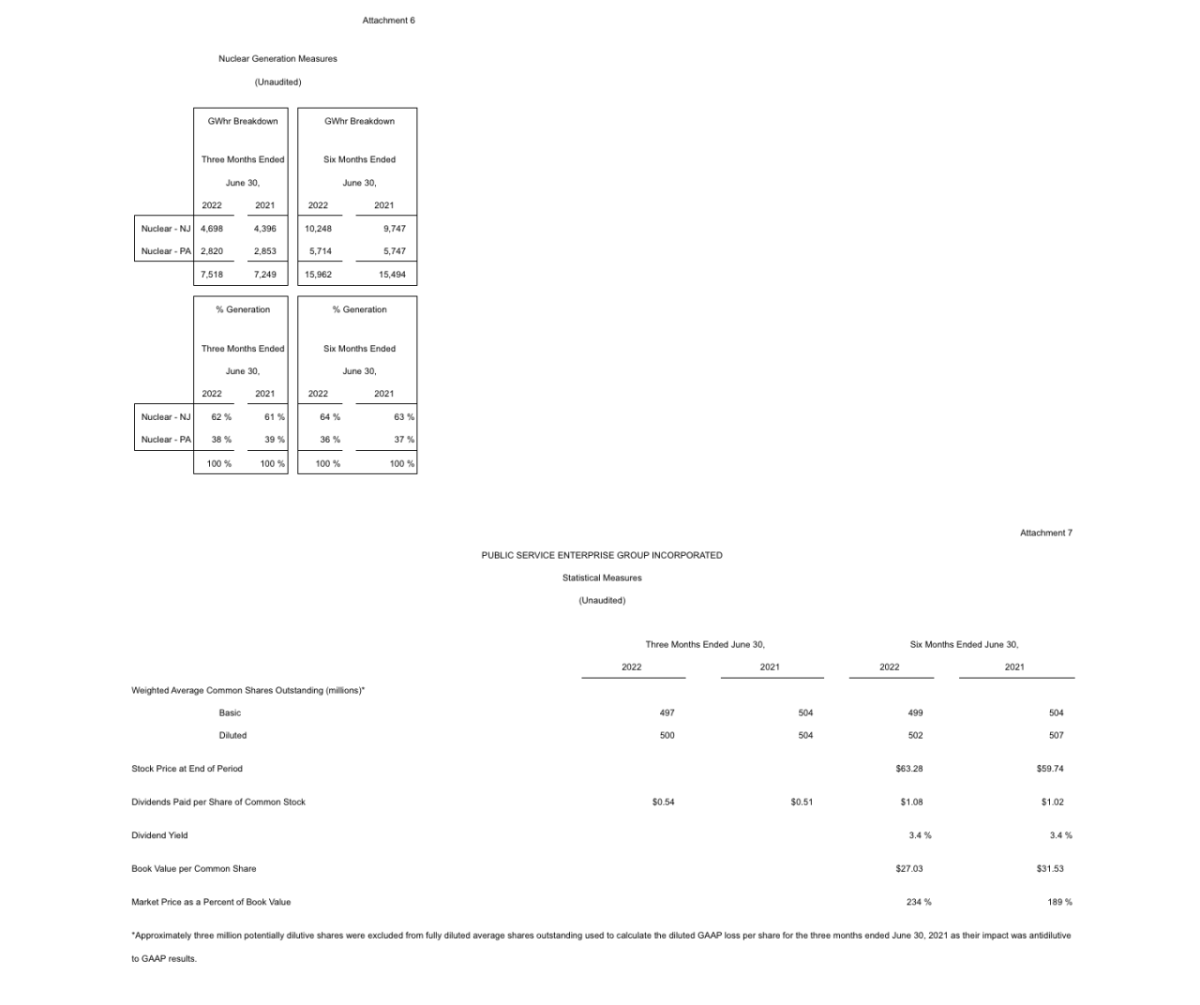

Nuclear generating output increased by over 3.7% to 7.5 TWh in the second quarter of 2022, reflecting the absence of a refueling outage at Hope Creek in the year-earlier quarter. The capacity factor of the nuclear fleet for the year to date period through June 30 was 95.1%. PSEG is forecasting generation output of 14 to 16 TWh for the remaining two quarters of 2022, and has hedged approximately 95% - 100% of this production at an average price of $28 per MWh. For 2023, PSEG is forecasting nuclear baseload output of 30 to 32 TWh and has hedged 95% - 100% of this output at an average price of $31 per MWh. For 2024, PSEG is forecasting nuclear baseload output of 29 to 31 TWh and has hedged 55% - 60% of this output at an average price of $32 per MWh.

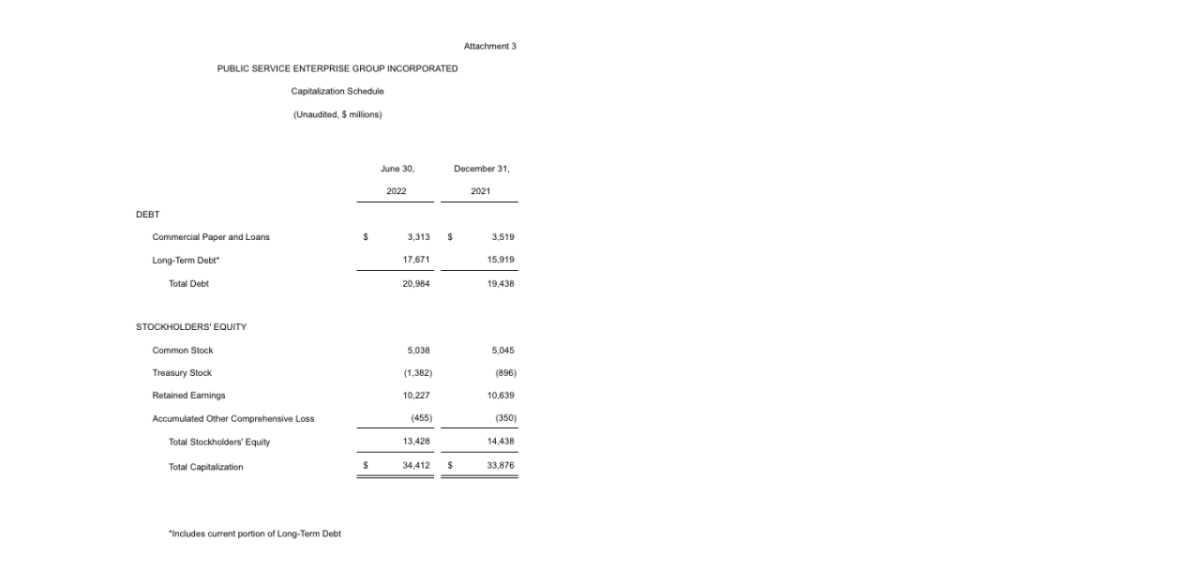

PSEG Power had net cash collateral postings of $2.1 billion at June 30 related to out-of-the-money hedge positions from higher energy prices during the first half of 2022. At the end of July, PSEG Power had net cash collateral postings of $2.5 billion. The majority of this collateral relates to hedges in place through the end of 2023 and is expected to be returned as PSEG Power satisfies its obligations under those contracts.

The forecast of non-GAAP Operating Earnings for Carbon-Free, Infrastructure & Other is unchanged at $170 million - $220 million. The CFIO guidance for 2022 excludes results related to the fossil assets sold in February 2022.

PSEG will host a conference call to review its Second Quarter 2022 results with the financial community at 11AM EDT today. This event can be accessed by visiting https://investor.pseg.com/investor-news-and-events to register.

Public Service Enterprise Group (PSEG) (NYSE: PEG) is a predominantly regulated infrastructure company focused on a clean energy future. Guided by its Powering Progress vision, PSEG aims to power a future where people use less energy, and it's cleaner, safer and delivered more reliably than ever. PSEG's commitment to ESG and sustainability is demonstrated in our net-zero 2030climate vision, our pursuit of science-based emissions reductions targets and participation in the U.N. Race to Zero, as well as our inclusion on the Dow Jones Sustainability North America Index, the Bloomberg Gender-Equality Index and the list of America's most JUST Companies. PSEG's principal operating subsidiaries are Public Service Electric and Gas Co. (PSE&G), PSEG Power and PSEG Long Island. (https://corporate.pseg.com).

Non-GAAP Financial Measures

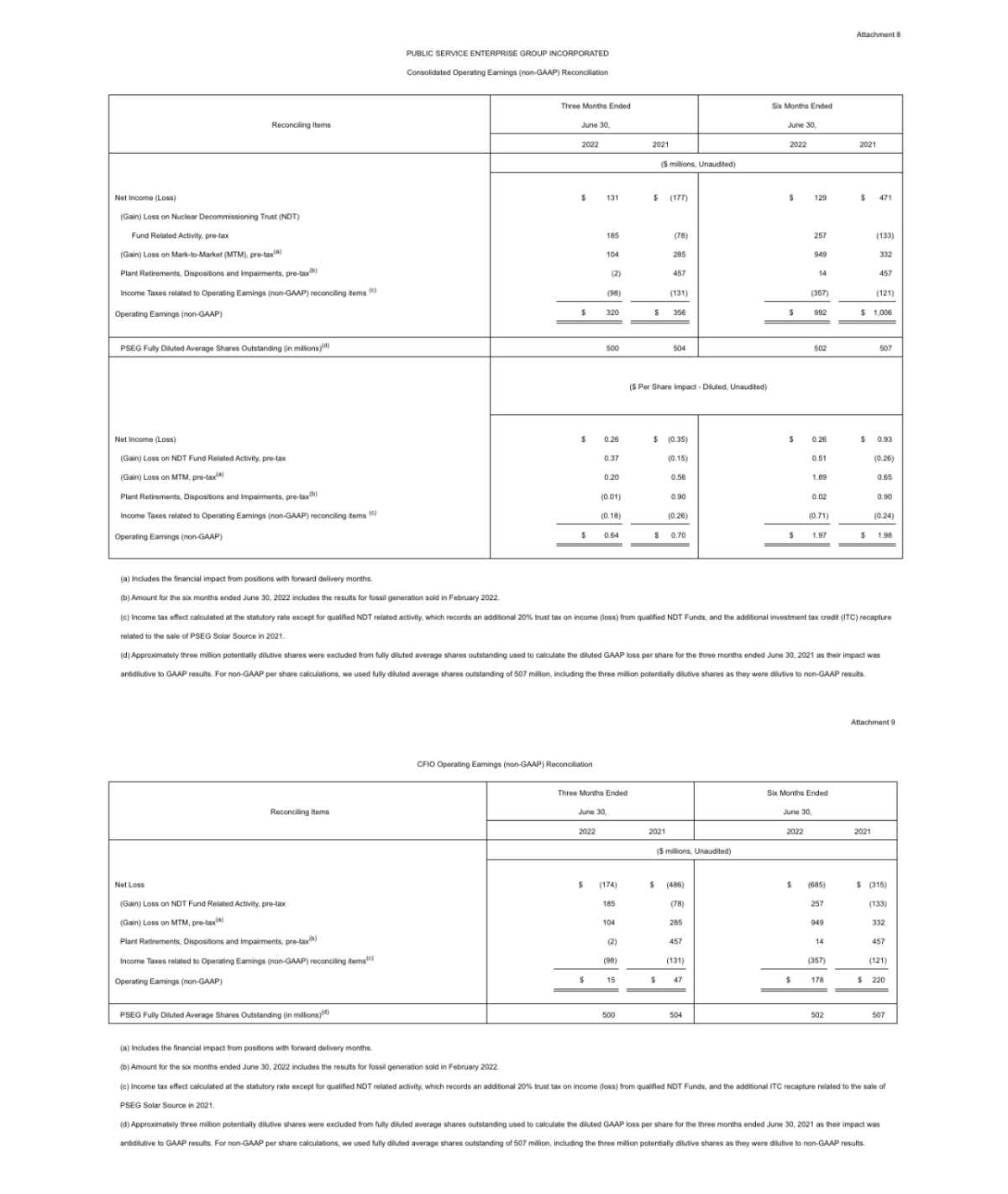

Management uses non-GAAP Operating Earnings in its internal analysis, and in communications with investors and analysts, as a consistent measure for comparing PSEG's financial performance to previous financial results. Non-GAAP Operating Earnings exclude the impact of returns (losses) associated with the Nuclear Decommissioning Trust (NDT), Mark-to-Market (MTM) accounting and material one-time items.

See Attachments 8 and 9 for a complete list of items excluded from Net Income/(Loss) in the determination of non-GAAP Operating Earnings. The presentation of non-GAAP Operating Earnings is intended to complement, and should not be considered an alternative to the presentation of Net Income/(Loss), which is an indicator of financial performance determined in accordance with GAAP. In addition, non-GAAP Operating Earnings as presented in this release may not be comparable to similarly titled measures used by other companies.

Due to the forward looking nature of non-GAAP Operating Earnings guidance, PSEG is unable to reconcile this non-GAAP financial measure to the most directly comparable GAAP financial measure. Management is unable to project certain reconciling items, in particular MTM and NDT gains (losses), for future periods due to market volatility.

Forward-Looking Statements

Certain of the matters discussed in this report about our and our subsidiaries' future performance, including, without limitation, future revenues, earnings, strategies, prospects, consequences and all other statements that are not purely historical constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are subject to risks and uncertainties, which could cause actual results to differ materially from those anticipated. Such statements are based on management's beliefs as well as assumptions made by and information currently available to management. When used herein, the words "anticipate," "intend," "estimate," "believe," "expect," "plan," "should," "hypothetical," "potential," "forecast," "project," variations of such words and similar expressions are intended to identify forward-looking statements. Factors that may cause actual results to differ are often presented with the forward-looking statements themselves. Other factors that could cause actual results to differ materially from those contemplated in any forward-looking statements made by us herein are discussed in filings we make with the United States Securities and Exchange Commission (SEC), including our Annual Report on Form 10-K and subsequent reports on Form 10-Q and Form 8-K. These factors include, but are not limited to:

- any inability to successfully develop, obtain regulatory approval for, or construct transmission and distribution, and solar and wind generation projects;

- the physical, financial and transition risks related to climate change, including risks relating to potentially increased legislative and regulatory burdens, changing customer preferences and lawsuits;

- any equipment failures, accidents, critical operating technology or business system failures, severe weather events, acts of war, terrorism, sabotage, cyberattack or other incidents that may impact our ability to provide safe and reliable service to our customers;

- any inability to recover the carrying amount of our long-lived assets;

- disruptions or cost increases in our supply chain, including labor shortages;

- any inability to maintain sufficient liquidity or access sufficient capital on commercially reasonable terms;

- the impact of cybersecurity attacks or intrusions or other disruptions to our information technology, operational or other systems;

- the impact of the ongoing coronavirus pandemic;

- failure to attract and retain a qualified workforce;

- inflation, including increases in the costs of equipment, materials, fuel and labor;

- the impact of our covenants in our debt instruments on our business;

- adverse performance of our nuclear decommissioning and defined benefit plan trust fund investments and changes in funding requirements and pension costs;

- the failure to complete, or delays in completing, the Ocean Wind 1 offshore wind project and the failure to realize the anticipated strategic and financial benefits of this project;

- fluctuations in wholesale power and natural gas markets, including the potential impacts on the economic viability of our generation units;

- our ability to obtain adequate nuclear fuel supply;

- market risks impacting the operation of our nuclear generating stations;

- changes in technology related to energy generation, distribution and consumption and changes in customer usage patterns;

- third-party credit risk relating to our sale of nuclear generation output and purchase of nuclear fuel;

- any inability to meet our commitments under forward sale obligations;

- reliance on transmission facilities to maintain adequate transmission capacity for our nuclear generation fleet;

- the impact of changes in state and federal legislation and regulations on our business, including PSE&G's ability to recover costs and earn returns on authorized investments;

- PSE&G's proposed investment programs may not be fully approved by regulators and its capital investment may be lower than planned;

- the absence of a long-term legislative or other solution for our New Jersey nuclear plants that sufficiently values them for their carbon-free, fuel diversity and resilience attributes, or the impact of the current or subsequent payments for such attributes being materially adversely modified through legal proceedings;

- adverse changes in and non-compliance with energy industry laws, policies, regulations and standards, including market structures and transmission planning and transmission returns;

- risks associated with our ownership and operation of nuclear facilities, including increased nuclear fuel storage costs, regulatory risks, such as compliance with the Atomic Energy Act and trade control, environmental and other regulations, as well as financial, environmental and health and safety risks;

- changes in federal and state environmental laws and regulations and enforcement;

- delays in receipt of, or an inability to receive, necessary licenses and permits; and

- changes in tax laws and regulations.

All of the forward-looking statements made in this report are qualified by these cautionary statements and we cannot assure you that the results or developments anticipated by management will be realized or even if realized, will have the expected consequences to, or effects on, us or our business, prospects, financial condition, results of operations or cash flows. Readers are cautioned not to place undue reliance on these forward-looking statements in making any investment decision. Forward- looking statements made in this report apply only as of the date of this report. While we may elect to update forward-looking statements from time to time, we specifically disclaim any obligation to do so, even in light of new information or future events, unless otherwise required by applicable securities laws.

The forward-looking statements contained in this report are intended to qualify for the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

CONTACTS

Investor Relations:

973-430-6565

Carlotta.Chan@pseg.com

Media Relations:

973-430-5924

Marijke.Shugrue@pseg.com