Proactive Approach to Reliability, Resiliency Keys to Confidence in U.S. Power Grid

By the Black & Veatch Insights Group

Across the U.S., a myriad of challenges is intensifying scrutiny about the resiliency and reliability of the ever-aging grid infrastructure.

Load demands are rising due to growing consumer electric vehicle (EV) charging networks, enterprise fleet electrification, cloud computing and manufacturing growth. Extreme climate events – flooding, droughts, ice storms, hurricanes and wildfires – are causing outages and damaging aging infrastructure that for more than a generation has been the sector’s biggest headache. Utilities are grappling with integrating renewable energy onto the grid.

Talk of upgrading and hardening the grid has been a hot topic for decades. Now, the need is edging closer to an inflection point in an industry with an array of competing interests, many of them carrying a considerable price tag.

Black & Veatch’s 2023 Electric Report — expert analyses of survey results from more than 650 U.S. power sector stakeholders — highlights the industry’s widening awareness of what’s needed to strengthen distribution and transmission systems in a rapidly decarbonizing world. Along the way, the report highlights the sector’s strategies for addressing headwinds such as disruptive high-impact, low-frequency events that test grid reliability and resilience, how digitalization of systems comes into play, and how priorities in grid modernization are being addressed.

The biggest takeaway: Being proactive – not reactive – always is the winning strategy.

High-Impact, Low-Frequency Events

Extreme weather events – from Texas ice storms to New Jersey hurricanes and California wildfires – are widely accepted as grid-impacting emergencies that often vary by region but demand the attention of the power and utility Industries. Over the past decade, the frequency and impact level of extreme weather events has increased, and it’s more acknowledged that such events are inevitable. The energy system’s ability to better absorb impact and recover quicker in the wake of these occurrences is a significant part of the investment impetus for bolstering system resiliency.

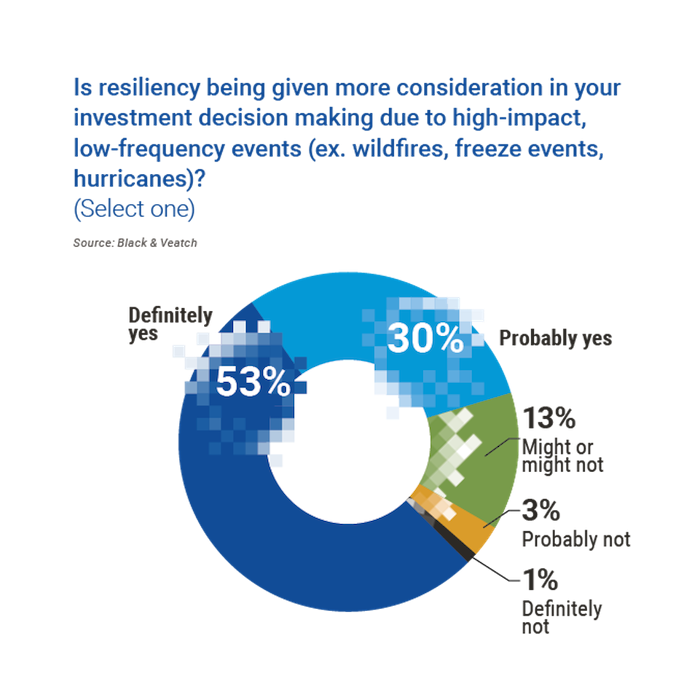

When asked if resiliency is being given more consideration in investment decisions due to high-impact, low-frequency events, more than eight in 10 respondents — 83 percent — answered “yes.” More than half of that pool responded “definitely.”

While the majority of respondents said they are taking extreme climate events into consideration, less than half (48 percent) have incorporated high-level or long-term climate risk analyses into their resilience planning. Still, it’s encouraging to see momentum rising, with 13 percent more respondents planning to address climate risk modeling over 2022’s survey.

In the world of risk management, it’s no small matter. According to a Black & Veatch eBook, “Three Climate Modeling Considerations for Utilities,” natural disasters have caused $1.4 trillion in damage in the recent years. Utilities that leverage climate modeling and data analytics can better prepare for future extreme weather events.

Supply Chain Issues Aren’t Improving

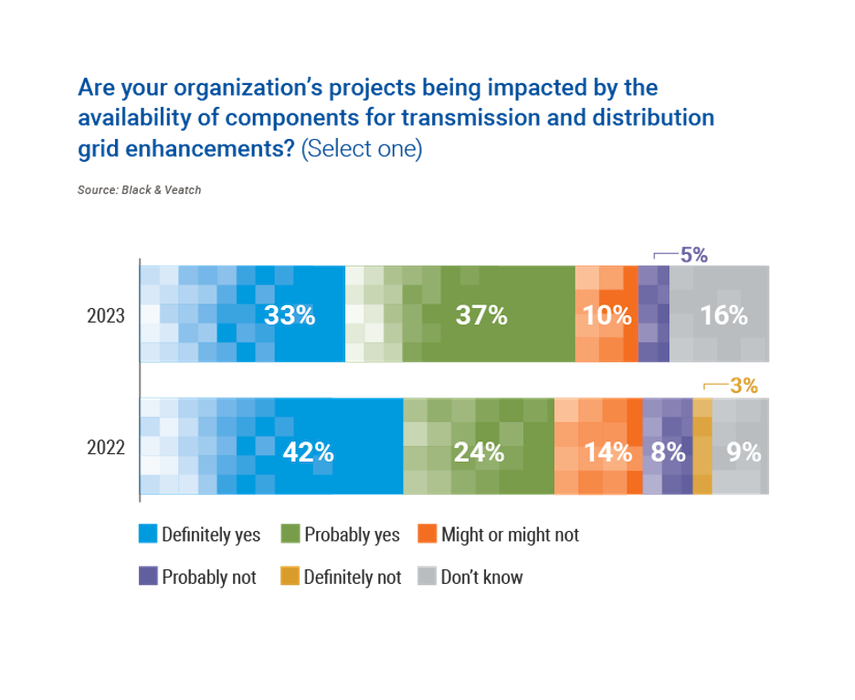

Despite the end of the pandemic, procurement challenges — supply chain issues — remain rampant due to the sheer volume of work. Seven in 10 respondents said their organization’s resilience and reliability projects are impacted by the availability of components for transmission and distribution improvements. This data — up from 66 percent in 2022 — validates that the supply chain remains a significant obstacle to deploying much-needed grid modernization projects.

Drilling deeper, 30 percent of respondents report that their enterprises are delaying resilience and reliability projects because they cannot get firm pricing or project financing – or they have equipment concerns. Specific to how their utility has addressed supply chain challenges, half of respondents say they’ve delayed projects because of them — below only contingency planning (67 percent) and selected different vendors (51 percent). Only 4 percent said they either didn’t experience or didn’t choose to address supply chain issues.

Delayed solutions mean the situation will worsen as infrastructure continues to age and load continues to grow.

Renewable Energy is Growing, but Integration Lacking

As the world presses to lower its carbon footprint, deploying more low-carbon energy is a great step in combating climate change. But the absence of an effective way to efficiently manage interconnections is causing quite a strain on the grid. As detailed in a Black & Veatch whitepaper, “Five Trends Energy Utilities Can’t Ignore When Preparing for the Future,” infrastructure improvements and capacity upgrades are needed to harness the resiliency and reliability benefits of renewables.

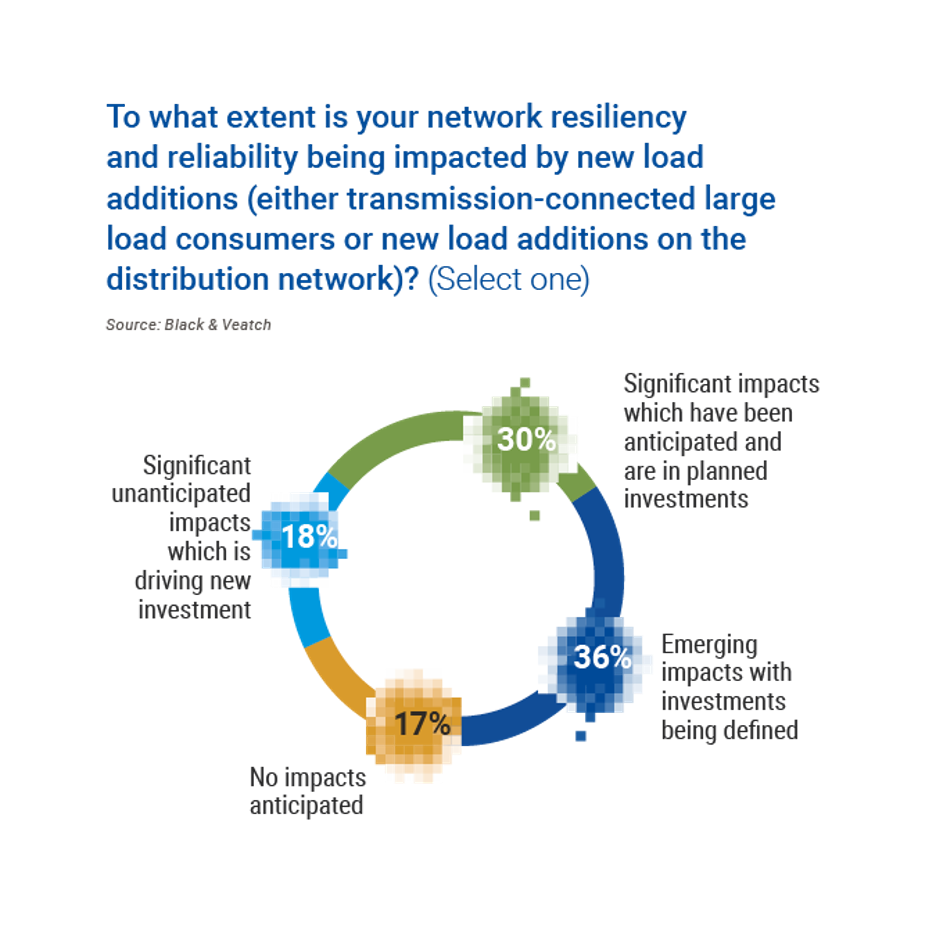

Contrary to what the industry saw in prior decades when load growth on the grid was stagnant, there’s now a notable increase. Some 83 percent of respondents reported emerging and/or significant impacts from new load additions. Although 30 percent anticipate significant impacts while 18 percent don’t, almost all respondents agreed that load growth is affecting their network resiliency and reliability.

Respondents also expressed little confidence that queue reform, contemplated by the Federal Energy Regulatory Commission (FERC), will positively impact renewable interconnections; only 12 percent said “definitely yes.” Pessimism lingers within the industry that regulation can solve this issue at a time when hundreds of gigawatts in the queue cannot connect to the grid. As long as the industry is slow to integrate renewables, decarbonization efforts and generation additions needed to maintain reliability increasingly are at risk.

All told, the survey data confirms that U.S. energy utilities agree on their main resiliency and reliability challenges: high-impact climate events, supply chain obstacles and inefficient mechanisms to spur grid deployment that supports generation interconnects. Fortunately, many utilities also are embracing relevant solutions such as climate risk modeling, infrastructure improvements and grid modernizations.

Grid-modernizing pursuits promise high returns on infrastructure investments through improved reliability and reduced operating costs — if these investments are strategic. Passed in late 2021, theInfrastructure Investment and Jobs Act (IIJA) — also known as the Bipartisan Infrastructure Law— continues to influence these improvements and associated regulations; nearly $65 billion has been allotted to fund grid upgrades nationwide. But Black & Veatch’s survey data also revealed that utilities need more guidance (potentially from expert advisory partners) on how to secure funding and strategize when and where to spend it.

In many ways, fate favors the proactive, knowing that challenges to resiliency and reliability aren’t going away any time soon.