Orlando Homeownership to Get $6.3 Million Boost

NeighborhoodLIFT program will offer homebuyer education plus $15,000 down payment assistance grants available for eligible homebuyers in Lake, Orange, Osceola and Seminole counties; special parameters for veterans, military, teachers and first responders

ORLANDO, Fla., November 14, 2018 /3BL Media/ – Wells Fargo & Company (NYSE:WFC), NeighborWorks® America, Orlando Neighborhood Improvement Corporation (ONIC), and Neighborhood Housing Services of South Florida (NHSSF) today announced the NeighborhoodLIFT® program will launch for Lake, Orange, Osceola and Seminole counties with a $6.3 million commitment by Wells Fargo to boost local homeownership.

“The City of Orlando is committed to ensuring that our residents have access to safe, high-quality housing they can afford, and a key piece of this is to develop new policies and partnerships that remove barriers for residents who would like to pursue the American dream of homeownership,” said Orlando Mayor Buddy Dyer. “That is why we are pleased to welcome Wells Fargo’s NeighborhoodLIFT program to Orlando. Through NeighborhoodLIFT, residents may qualify for down payment assistance grants and educational and counseling services that can help them achieve the goal of owning a home.”

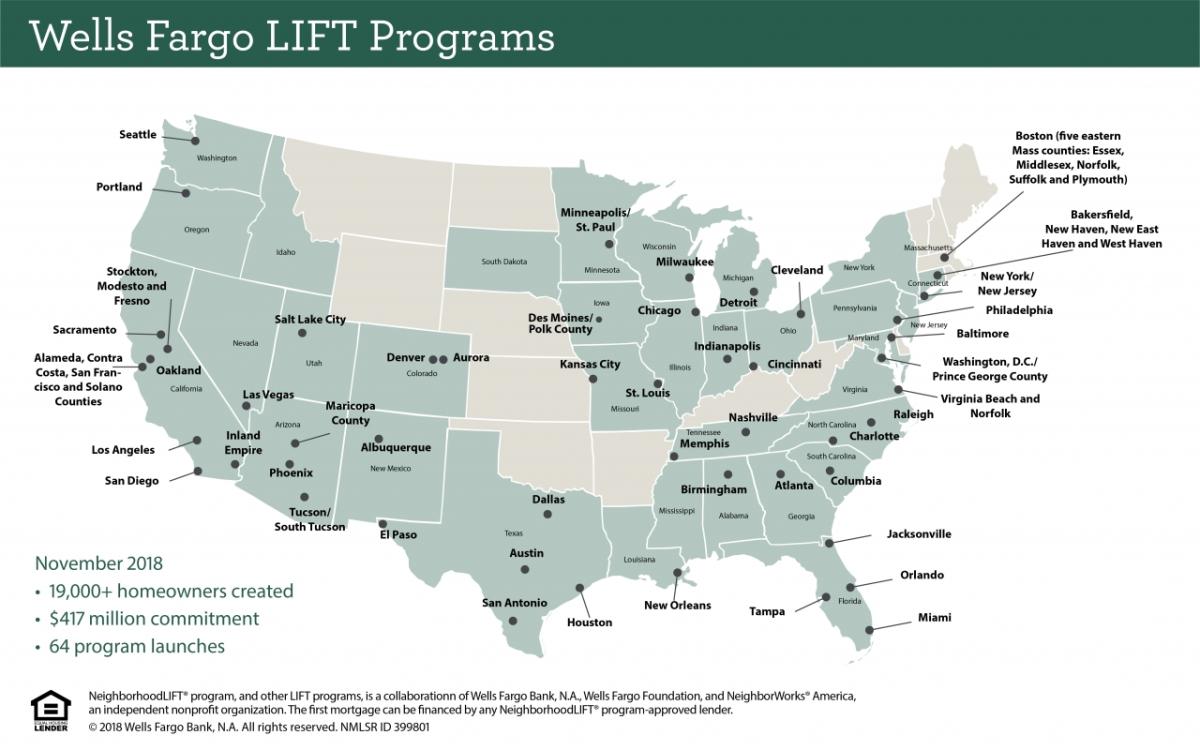

The 2018 Orlando NeighborhoodLIFT program follows the 2012 program that created 205 homeowners in the greater Orlando area. Overall, Wells Fargo has conducted 65 LIFT program events in the U.S. since 2012 that have created nearly 19,000 homeowners.

Walk-ins are welcome for the free NeighborhoodLIFT event in Orlando Nov. 30–Dec. 1

More than 360 interested homebuyers are registered to attend the free event on Friday, Nov. 30, from 10 a.m. – 7 p.m. and on Saturday, Dec. 1, from 9 a.m. – 2 p.m. at the DoubleTree Hilton SeaWorld, located at 10100 International Dr., Orlando. Walk-ins also are welcome while grants are available for reservation. Those intending to walk in should be prepared with documents required to reserve funds posted at www.orlandoneighborhood.org/lift/.

Participating homebuyers can obtain mortgage financing from any participating lender, and ONIC and NHSSF will determine eligibility, administer the grants, and provide homebuyer and financial education. Approved homebuyers will have up to 60 days to finalize a contract to purchase a home in Lake, Orange, Osceola and Seminole counties.

“The NeighborhoodLIFT program is another example of our commitment to Central Florida and our efforts to build better communities through sustainable homeownership,” said Derek Jones, Wells Fargo North Central Florida region bank president. “The program will help hardworking families and individuals get on the path to achieve successful and sustainable homeownership.”

To be eligible, annual incomes must not exceed 80 percent of the local area median income in the county where the home is being purchased to reserve $15,000 down payment assistance grants. In addition, there are special parameters for veterans and service members, teachers, law enforcement officers, firefighters and emergency medical technicians who may reserve $17,500 down payment assistance grants within eligibility requirements including earning up to 100 percent of the area median income.

In addition, Wells Fargo has committed $225,000 for up to 450 consumers to receive complimentary face-to-face homeownership counseling. Interested homebuyers can receive a voucher at the Orlando NeighborhoodLIFT launch event that will provide in-person homeownership counseling at no charge with a participating HUD-approved housing counselor in the Orlando area. The complimentary Home Ownership Counseling grant program is an additional resource to the homebuyer education required for a NeighborhoodLIFT down payment assistance grant.

“This innovative public-private collaboration will create about 325 more homeowners in the greater Orlando area,” said Donald Phoenix, regional vice president, Southern region, NeighborWorks America. “The required homebuyer education classes provided by certified professionals better prepare NeighborhoodLIFT homebuyers to achieve their goal of sustainable homeownership.”

Approved homebuyers must be approved for home financing with an eligible lender and be in contract to purchase a home in Lake, Orange, Osceola or Seminole County. To reserve the full grant amount, participants buying a primary residence with the NeighborhoodLIFT program must commit to live in the home for five years.

“The NeighborhoodLIFT program will provide homebuyer education and down payment assistance to help families become homeowners,” said Robert Ansley, president of ONIC. “We are excited to team up with Wells Fargo and NeighborWorks America to make this opportunity available for so many deserving families.”

Since February 2012, LIFT programs have helped create nearly 19,000 homeowners in 65 communities. A video about the NeighborhoodLIFT program is posted on Wells Fargo Stories.

About ONIC, NHSSF and NeighborWorks America

Orlando Neighborhood Improvement Corporation (ONIC) has been developing affordable housing in Central Florida since 1989. Neighborhood Housing Services of South Florida has worked to strengthen communities and create affordable housing for over 30 years. Both organizations are chartered members of NeighborWorks America, a national organization that creates opportunities for people to live in affordable homes, improve their lives and strengthen their communities. NeighborWorks America supports a network of more than 245 nonprofits, located in every state, the District of Columbia and Puerto Rico. Visit http://orlandoneighborhood.org/, https://nhssf.org/, or http://www.neighborworks.org/ to learn more.

About Wells Fargo

Wells Fargo & Company (NYSE: WFC) is a diversified, community-based financial services company with $1.9 trillion in assets. Wells Fargo’s vision is to satisfy our customers’ financial needs and help them succeed financially. Founded in 1852 and headquartered in San Francisco, Wells Fargo provides banking, investment and mortgage products and services, as well as consumer and commercial finance, through 7,950 locations, 13,000 ATMs, the internet (wellsfargo.com) and mobile banking, and has offices in 37 countries and territories to support customers who conduct business in the global economy. With approximately 262,000 team members, Wells Fargo serves one in three households in the United States. Wells Fargo & Company was ranked No. 26 on Fortune’s 2018 rankings of America’s largest corporations. News, insights and perspectives from Wells Fargo are also available at Wells Fargo Stories.