New Guidance Offers a Roadmap for the U.S. Insurance Industry To Build Resilience Amid Increasing Climate Disasters

November 20, 2024 /3BL/ - Ceres released comprehensive guidance to help the U.S. insurance industry reimagine its future in a climate-changing world, offering a clear roadmap for maintaining insurance availability, affordability and the industry’s long-term health amid escalating and costly climate disasters.

The severity and frequency of record-breaking hurricanes, wildfires, and other unnatural catastrophes continues to destroy entire communities and economies. The U.S. faced $92 billion in economic damages in 2023, and 2024, already predicted to be the warmest on record, faces $100 billion in losses, with Hurricanes Milton and Helene expected to cost more than $50 billion each. This has caused insurers to retreat from high-risk markets and raise insurance premiums.

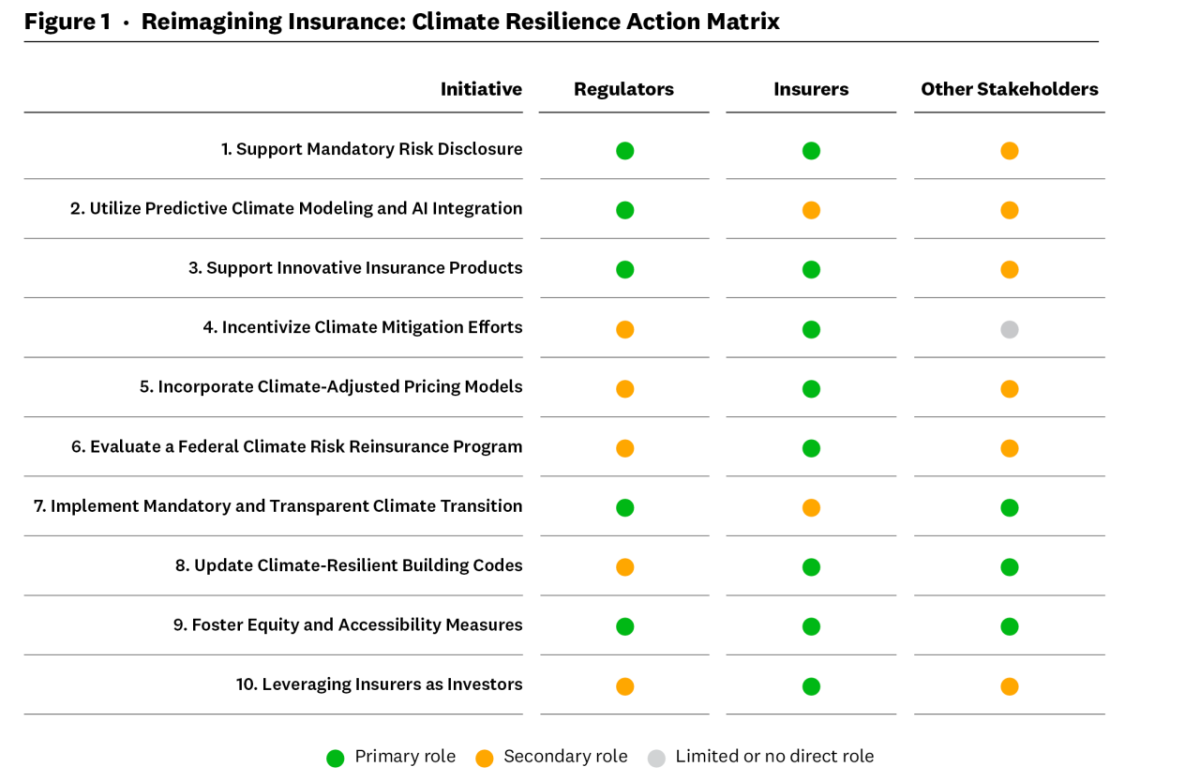

Ceres 10-Point Plan for the Insurance Industry presents a new vision for how insurance can navigate this reality, issuing a set of recommendations for insurance companies, regulators, and other industry stakeholders, including investors and governments. Ceres’ plan addresses the multifaceted approach needed from insurers and regulators to address increasing climate risks and build a more resilient and sustainable insurance sector.

"The insurance industry stands at a critical crossroads," Jaclyn de Meddici Bruneau, Director of Insurance at Ceres. "By leveraging their deep risk management and economic influence, insurers and regulators can and must do more to adapt to our increasingly changing climate. Our 10-point plan offers a clear path for their longevity and growth while strengthening the communities they serve with actions to help improve climate mitigation and resilience.”

Ceres’ 10-point plan calls for:

- Supporting Mandatory Climate Risk Disclosure: Require medium and large businesses to report climate risks and mitigation strategies.

- Utilizing Predictive Climate Modeling and AI Integration: Integrate AI and real-time climate data to improve risk assessment and pricing accuracy.

- Supporting Innovative Insurance Products: Develop parametric insurance and emerging financial instruments that can provide faster, more flexible coverage.

- Incentivizing Climate Mitigation Efforts: Offer premium discounts for properties and businesses implementing climate resilience measures.

- Incorporating Climate-Adjusted Pricing Models: Create flexible, forward-looking pricing strategies that account for long-term climate projections.

- Considering a Federal Climate Risk Reinsurance Program Form a commission to evaluate the feasibility of a federal reinsurance program to provide stability during unprecedented climate catastrophes.

- Implementing Climate Transition Action Plans: Adopt, publish, and implement a transition plan detailing your decarbonization strategies.

- Updating Climate-Resilient Building Codes: Work with state and local officials to implement strict, regionally tailored construction standards.

- Fostering Equity and Accessibility Measures: Develop targeted programs to ensure insurance coverage for vulnerable communities.

- Leveraging Insurers as Investors: Leverage the industry's $8 trillion in assets to support climate transition and resilience.

Ceres has issued a number of reports on the insurance industry and its response to a changing climate. Earlier this year Ceres released, Navigating Climate Risks: Progress and Challenges in U.S. Insurance Sector Disclosures, analyzing the insurance industry’s annual climate-related financial risk disclosures. In 2023, Ceres, in partnership with the California Department of Insurance and Manifest Climate, released the first systematic review of U.S. insurance companies’ climate risk strategies.

About Ceres Accelerator for Sustainable Capital Markets

The Ceres Accelerator for Sustainable Capital Markets is center within Ceres that aims to transform the practices and policies that govern capital markets by engaging federal and state regulators, financial institutions, investors, and corporate boards to act on climate change as a systemic financial risk. For more information, visit ceres.org/accelerator.