New CAD 1bn CAB 2028 Is the Largest-ever Maple Green Bond

Originally published by European Investment Bank

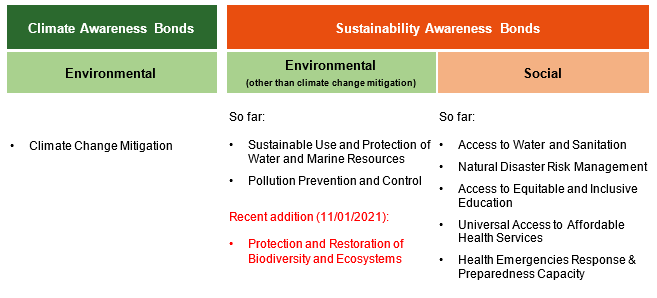

Proceeds from Climate Awareness Bonds are allocated to EIB’s lending to activities contributing substantially to climate change mitigation in line with evolving EU sustainable finance legislation. The so-called EU Taxonomy Regulation, aiming to ‘establish the criteria for determining whether an economic activity is environmentally sustainable’, entered into force in July 2020.

Mike Field, Director at Scotiabank’s Group Treasury: “Scotiabank continues to execute on and track ahead of plan in its Green, Transition, Social & Sustainable portfolio mandate, an important component of the Bank’s OSFI/LAR HQLA eligible Liquidity Portfolio. EIB’s second CAB transaction has enhanced our understanding of their approach to the evolving EU standards and the desired impact of their program. We particularly value the reasonable assurance provided by the auditors on the framework’s external review, as well its alignment to the EU Sustainability Taxonomy.”