Leading Trends in Sustainable Investing: From ESG to Impact

Leading Trends in Sustainable Investing: From ESG to Impact

2022 Report on US Sustainable Investing Trends: Executive Summary

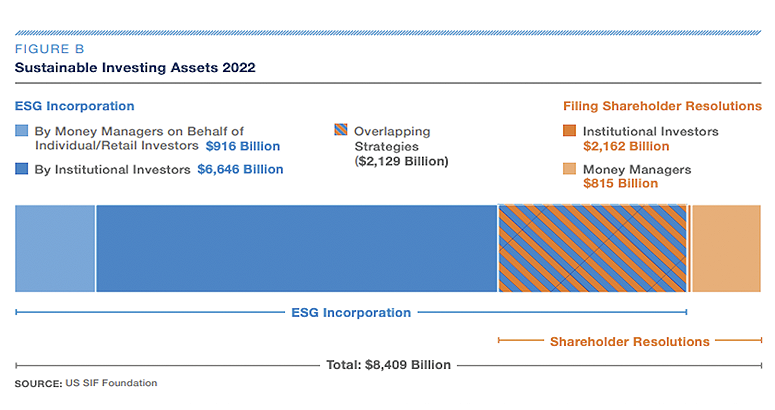

The US SIF Foundation’s 14th edition of the biennial Report on US Sustainable Investing Trends identifies $8.4 trillion in total US sustainable investment assets under management at the beginning of 2022. This represents 13 percent of the total US assets under professional management. These totals reflect the Trends Report’s new modified methodology.

Here are four sections: Executive Summary, ESG Incorporation by Money Managers, ESG Incorporation by Institutional Investors, and Sustainable and ESG Investors Advocacy.

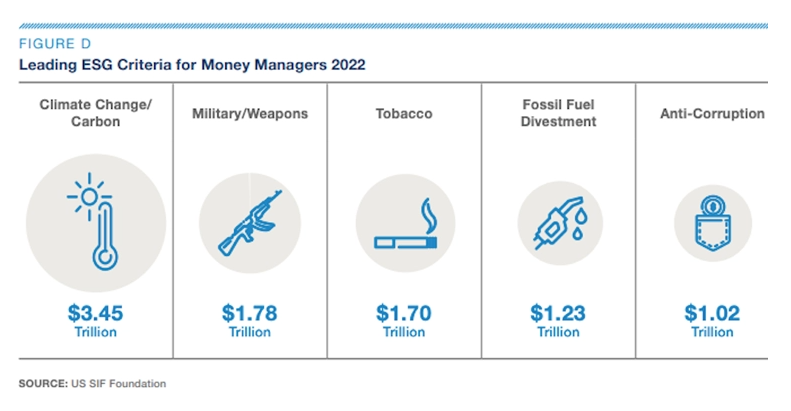

ESG Incorporation by Money Managers

Using the US SIF Foundation’s new modified methodology, the 2022 Report on US Sustainable Investing Trends identified 349 money managers and 1,359 community investment institutions incorporating Environmental, Social and Governance (ESG) criteria into their investment decision-making processes across a total of $5.6 trillion in assets under management (AUM).

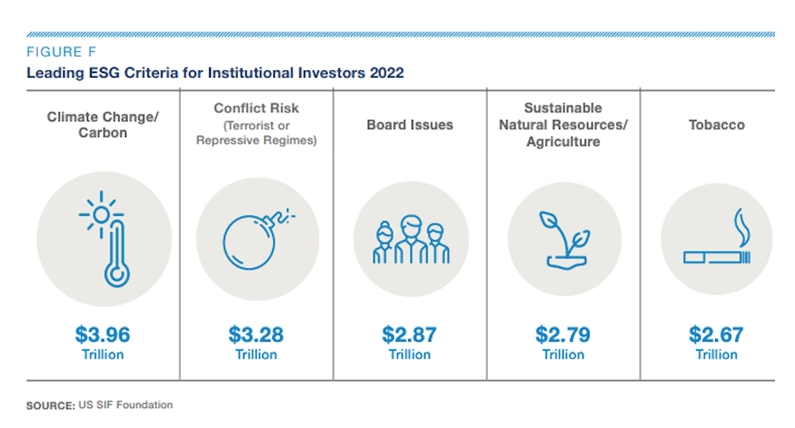

ESG Incorporation by Institutional Investors

The US SIF Foundation using a new modified methodology for their 2022 Trends Report identified 497 institutional asset owners applying ESG incorporation practices across $6.6 trillion in assets under management. The group included institutional asset owners and plan sponsors such as public funds, insurance companies, educational institutions, faith-based institutions, foundations, labor funds, hospitals, and family offices.

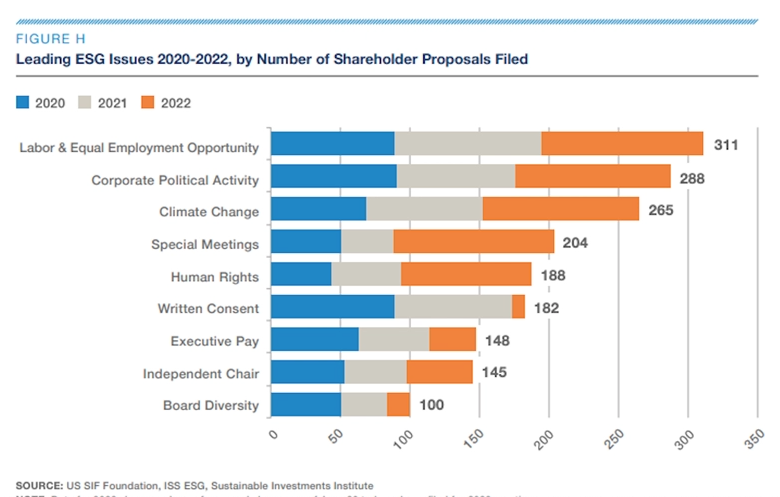

Sustainable and ESG Investors Advocacy

According to the 2022 Trends Report, from 2020 through the first half of 2022, 154 institutional investors and 70 investment managers collectively controlling nearly $3.0 trillion in assets at the start of 2022 filed or co-filed shareholder resolutions on environmental, social or governance (ESG) issues. Investors also focused on disclosure and management of corporate political spending and lobbying.

Read more about each of these sections in the January 2023 issue of the award-winning GreenMoney, now in its 30th year of publishing, all at- https://GreenMoney.com

========