Inaugural U.S. Financial Health Pulse Report Finds Only 28 Percent of People in America are Financially Healthy

Landmark Financial Health Pulse from the Center for Financial Services Innovation delves beyond headline economic data to reveal people in America are struggling in many aspects of their financial lives

CHICAGO, Nov. 1, 2018 /3BL Media/ – The Center for Financial Services Innovation (CFSI), the nation’s authority on consumer financial health, in partnership with the Omidyar Network, MetLife Foundation, and AARP, today unveiled its inaugural U.S. Financial Health Pulse, the first-ever annual benchmarking survey around a composite financial health framework that provides a holistic look at how people in America manage their finances day-to-day, build resilience, and pursue opportunities over time.

Conducted on an annual basis, the U.S. Financial Health Pulse will provide recurring insights into the changing nature of financial health of people in America--specifically how individuals spend, save, borrow and plan--and will track those financial health measures over time. While many standard economic indicators such as employment and consumer spending data suggest consumers are doing well financially, the individual financial behaviors and household-level data documented in this initial report depict a more sobering reality.

Key findings show:

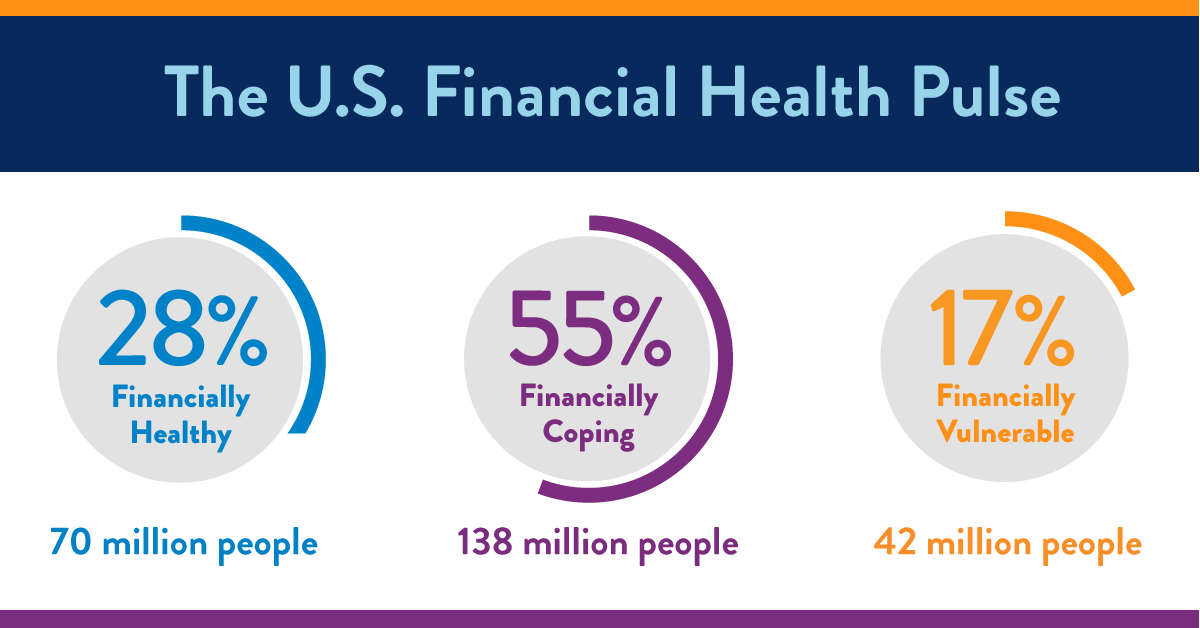

- Only 28 percent of people in America are considered financially healthy;

- Nearly half of people in America (47%) spent more than or equal to their income in the last 12 months;

- More than a third of all people in America (36%) are unable to pay all of their bills on time;

- Nearly one-in-five Americans (17%) are considered financially vulnerable, and almost half of these individuals (45%) have less than one week’s worth of expenses saved; and

- Nearly a third of Americans (30%) say they have more debt than is manageable.

Uniquely, the U.S. Financial Health Pulse provides deep insights into financial realities such as the lack of short- and long-term savings of people in America. By measuring and then documenting the interconnection between spending, saving, borrowing and planning, the data from this first report show that these financial issues are pervasive, and that despite an overall strong economy, many people in America are struggling.

“The headlines about high employment and steady stock market returns only tell part of the story and fail to highlight the financial reality for the millions of families in America that cannot afford medical care or are worried about putting food on the table,” said Jennifer Tescher, founder and CEO of CFSI. “The U.S. Financial Health Pulse provides a true composite framework for measuring financial health that enables us to look beyond the headlines and better understand the real financial lives of people in America.”

Additional findings from the first U.S. Financial Health Pulse report include:

- More than half (55%) of people in America are struggling with some, but not all aspects of financial health (Financially Coping);

- A significant share (17%) of people in America are struggling with most aspects of financial health (Financially Vulnerable);

- A quarter (25%) of people in America say that in the past 12 months someone in their household did not receive the healthcare they needed because it was too expensive; and

- Nearly a quarter (22%) of all people in America say they worried about whether their food would run out over the last 12 months.

The inaugural report scores respondents against eight indicators, including bill payment, spending, short-term savings, debt load, insurance, saving for retirement, planning, and credit, to assess whether they are “financially healthy,” “financially coping,” or “financially vulnerable;” the three tiers identified in the report. These initial findings connect to and build upon previous individual data points about financial health to provide a deeper contextual understanding of the state of financial health in America and form benchmarks for tracking progress over time.

“Improving the financial health of the nation will require the combined efforts of policymakers, the business community, and the social sector,” continued Tescher. “Our landmark U.S. Financial Health Pulse will give key stakeholders the data, tools and resources they need to understand, track and measure progress over time.”

The U.S. Financial Health Pulse utilizes advances in data as well as surveys; the next analysis will include customer-level transactional data to provide a unique view into Americans’ financial habits over time1. The recurring study is designed to give financial services providers, innovators, policymakers and researchers actionable insights and data on the financial lives of people in America that can serve as a blueprint for measuring opportunity and impact year-over-year. Surveys, based on CFSI’s Financial Health Score, will be fielded annually.

“As access to financial tools continues to broaden, and we turn our focus to improving household financial outcomes, more clarity on the significant financial challenges faced by Americans and their barriers to achieve financial health is needed,” said Tilman Ehrbeck, partner at Omidyar Network. “The US Financial Health Pulse will help us better understand these challenges and back innovators working toward solving them.”

The U.S. Financial Health Financial Health Pulse is made possible through a founding partnership with the Omidyar Network. Additional support is provided by MetLife Foundation, founding sponsor of CFSI’s financial health work, and AARP. The study is conducted in partnership with the University of Southern California Dornsife Center for Economic and Social Research (CESR). Additionally, CFSI is working with engineers and data analysts at Plaid to collect and analyze transactional and account data from study participants who authorize it.

“MetLife Foundation is focused on solutions to improve the financial health of low- and moderate-income people around the globe,” said Dennis White, president and CEO, MetLife Foundation. “We look forward to seeing how data from the U.S. Financial Health Pulse drives the development of products and services that help people here in the U.S. take meaningful steps toward a more secure financial future.”

Survey results used to develop the U.S. Financial Health Pulse will be made available to academic researchers tracking the financial health of people in America.

“We know that how people spend, save, borrow and plan for retirement impacts their financial well-being later in life,” said Debra Whitman, executive vice president and chief public policy officer, AARP. “That’s why the U.S. Financial Health Pulse will be an essential tool to help us design policy solutions that will have a real impact on Americans’ lives.”

For additional findings or more information regarding the U.S. Financial Health Pulse, please visit http://cfsinnovation.org/financialhealthpulse

About CFSI

The Center for Financial Services Innovation (CFSI) is the nation’s authority on consumer financial health. CFSI leads a network of financial services innovators committed to building a more robust financial services marketplace with higher quality products and services, specifically for those who are struggling. Through its Compass Principles and a lineup of proprietary research, insights, and events, CFSI informs, advises, and connects members of its network to seed the innovation that will transform the financial services landscape. For more on CFSI, go to www.cfsinnovation.org and follow us on Twitter at @CFSInnovation.

Media Contacts:

Naomi Adams Bata

CFSI

312-881-5847

Stephanie Hicks

Cosmo PR for CFSI

805-295-9455

1Statistically significant survey fielded to 5,000 members of the University of Southern California Dornsife Center for Economic and Social Research “Understanding America Study” online panel (April-June 2018)