How Investors Can Help Make the 2020s a Decade of Climate Action

Commit, report and drive change in your portfolio companies. Here are tools to help align your investments with the 1.5°C scenario and accelerate the transition to a low-carbon economy.

The world must halve carbon emissions by 2030 to stay below 1.5°C of global warming and avoid catastrophic climate change. That requires transitioning to a low-carbon economy as nearly three-fourths of global carbon emissions arise from use of fossil fuels. The COVID-19 pandemic has added to the challenge of meeting these formidable goals but is also a historic opportunity to build back better.

“The world must enable a green recovery and ramp up the fight against climate change,” says Rasmus Skov, Head of Sustainability at renewable energy company Ørsted. “For us as companies, making carbon reductions central to business strategy is not only good for the health of our planet - it’s key to staying competitive as a business. Investors must help achieve these aims.”

In practice, investors will need to encourage companies to shrink their carbon footprint, such as reducing direct emissions from energy use, improving energy efficiency, and greening their supply chains. Companies that deliver sustainable and scalable solutions to consumers are in scope, as are companies beginning to transform towards a more sustainable business model.

How do I align my investment portfolio with the 1.5°C scenario?

Begin by gaining a better understanding of your portfolio’s climate impact and exposure to fossil fuels. For a first estimate, upload your portfolios to the Paris Agreement Capital Transition Assessment (PACTA) tool developed by the 2° Investing Initiative. The tool is free and can be used as a starting point for aligning your portfolio with the 1.5°C scenario. You can then:

-

Commit to a Net Zero target and report on your progress

Commit to transitioning your investment portfolios to net-zero carbon emissions by 2050, in line with the Paris Agreement. You can do that by joining the UN-convened Net-Zero Asset Owner Alliance, which represents more than USD 4.6 trillion in assets. The Alliance builds on the work of the Science Based Targets initiative (SBTi), which will launch a framework in 2020 to help financial institutions align their lending and investment portfolios with the Paris Agreement. Also, establish a roadmap for decarbonising your portfolio and report on your progress using the Task Force on Climate-Related Disclosure (TCFD) framework.

-

Drive change in your portfolio companies

Require that all companies in your portfolio report on their carbon emissions, which is a necessary first step in taking action to reduce emissions. Encourage them to set ambitious emissions reduction targets under the SBTi, define a credible pathway with short- to medium- term actions for achieving these targets, and transparently disclose on progress.

Are you a first mover?

Investors may find it a daunting and complex task to decarbonise their portfolios and wonder if it is worth the effort. “There are benefits to increasing low-carbon investment,” says Marco Kisic, Senior ESG Analyst, Research Insights at Nordea bank. “First movers who invest to support the transition of carbon-intensive sectors could be rewarded with above-market returns, while those who don’t might see their portfolios exposed to significant risk of stranded assets.”

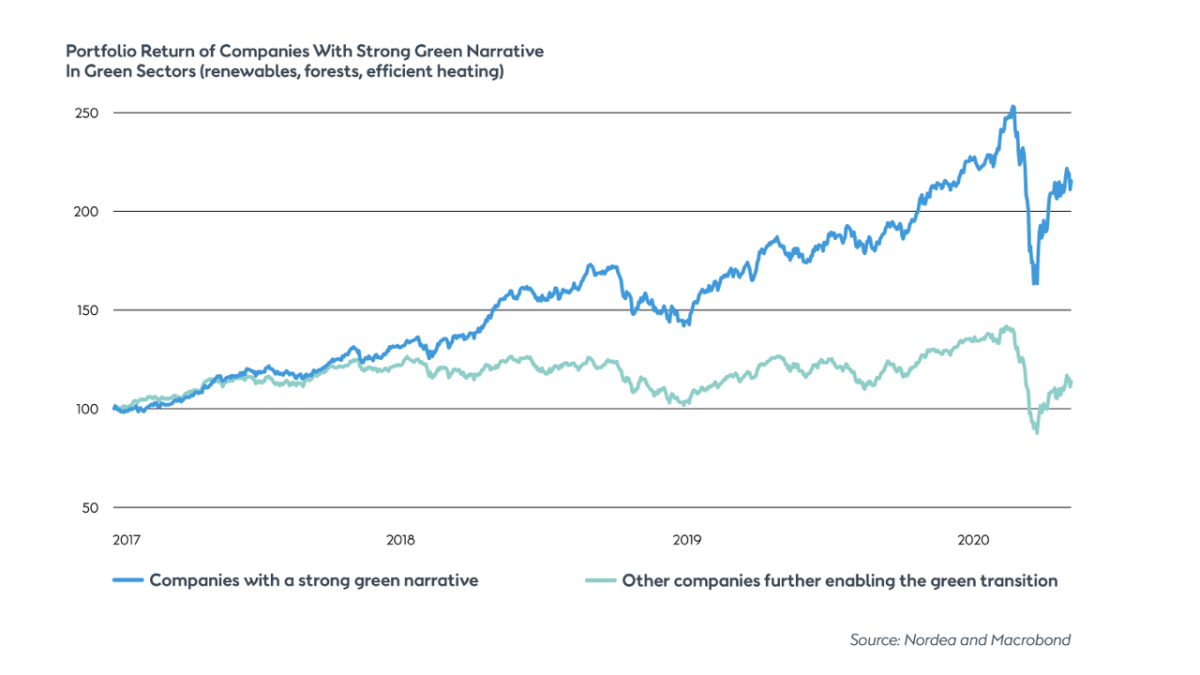

He explains that obviously green companies with a “strong green narrative”, such as energy efficiency, forestry and renewables, have had an annualized return of 21% relative to the market in 2017-2020 (see graph above). Companies that further enable the transition to a low-carbon economy, such as manufacturers of electricity transmission cables, are also expected to benefit because policy frameworks such as the EU taxonomy incentivise investments into companies with a high share of environmentally-sustainable economic activities. “This second group of companies are currently undervalued but are likely to offer the next wave of climate-opportunity outperformance,” Kisic says.

Green transformation

For its part, Ørsted demonstrates it is possible to increase profitability by making decarbonisation the keystone of business strategy. The company has transformed from a fossil-fuel based energy company to one of the world’s largest renewable energy companies, and the most sustainable company in the Global 100 index.

“Tackling the climate emergency is not only about technological solutions and financial viability, but also the will to act now. If companies and investors join forces to reduce emissions at unprecedented pace and scale, they can help make the 2020s a decade of green action to stop global warming at 1.5°C. It’s never been more urgent to invest in climate action,” says Rasmus Skov.

About Ørsted

The Ørsted vision is a world that runs entirely on green energy. The company develops, constructs and operates offshore and onshore wind farms, solar farms, energy storage facilities, and bioenergy plants, and provides energy products to its customers. The Group's revenue was EUR 9.1 billion in 2019. Ørsted will be carbon neutral by 2025 and targets net-zero emissions across the entire carbon footprint by 2040. The company generated 86% of its energy from renewable sources, and had reduced carbon emissions by 86%, in 2019. Ørsted ranks #1 in Corporate Knights' 2020 Global 100 index of most sustainable corporations and is recognised on CDP’s Climate change A List as a global leader in climate action.