How the Financial Industry Can Help Stop Modern Slavery

by Saskia Kort-Chick, Director of ESG Research and Engagement—Responsible Investing and Hope Sherwin, Head of Social Impact—Themis

Modern slavery is a lucrative business that can’t exist without the financial system. Yet the financial industry is largely ignorant of the problem. Asset managers have an important role to play in challenging poor practices that allow this social evil to persist.

Forced labor, debt bondage and human trafficking victimize more than 40 million people worldwide each year. Governments and companies are increasing efforts to combat many forms of human exploitation in business operations and supply chains across industries from mining to agriculture to retail. Yet, in every sector, modern slavery has one thing in common—it’s driven by the massive profits reaped from taking advantage of vulnerable people.

Financial Firms Are Exposed

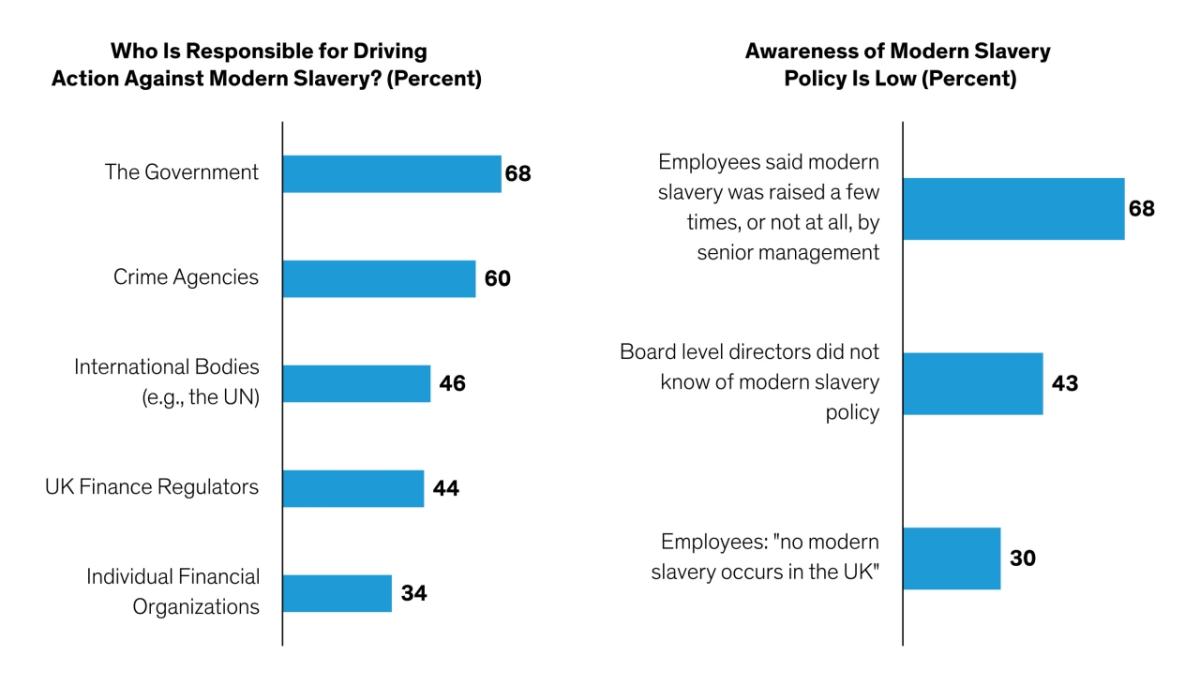

Disrupting the money flow is perhaps the best way to curb the scourge. But many people don’t see the financial services sector as sharing responsibility for fighting modern slavery, while the industry itself doesn’t see it as a high priority issue (Display). In a 2020 survey of UK financial institutions, 43% of board level directors didn’t know about their firm’s modern slavery policy while more than two thirds of employees hadn’t heard much of the issue from management.

Raising awareness starts with acknowledgment. Many people think modern slavery isn’t really a problem in developed economies. Not true. Companies across the developed world manufacture products and source materials in countries where exploitation is endemic. Trace the source of the electronic components in your phone, the fabric in your clothes or the ingredients in your food, and you can find vulnerable women and children, migrant workers and minorities toiling for puny wages, often in inhuman conditions. And in developed countries, too, large numbers of people can be found living and working in conditions of modern slavery.

Some financial firms think they aren’t exposed to modern slavery risks. After all, strict money laundering regulation is pervasive, requiring banks to know their clients and screen for transactional risks. In retail banking, systems regularly flag suspicious credit card payments that might indicate a customer may be transferring money to pay for online child abuse.

But transactional risks are only a small part of the problem. Financial institutions lend to and invest in businesses that facilitate slavery. Yet many banks aren’t monitoring for shady cash dealings at a car wash or nail salon that could indicate exploitation. And they typically won’t drill deep into a company’s supply chain or overseas operations to understand how raw materials are sourced, such as West African cocoa or Southeast Asian electronics—products at a high risk of profiting from modern slavery.

Risks Abound: From Brand and Business

Financial firms can’t afford to turn a blind eye. Reputational risk from getting caught in a slavery scandal can inflict painful damage to a brand—and a business. Just ask Australian lender Westpac, which paid a hefty $1.3 billion fine in 2020 to settle accusations that it facilitated money laundering by 250 customers that financed child exploitation.

The risks don’t stop there. Financial institutions that don’t address the problem could lose customers amid growing public awareness. Firms caught without proper oversight could face legal action and broader governance scrutiny.

Regulation is gaining momentum. Yet, despite the introduction of the modern slavery acts in the UK and Australia, awareness is still lacking. Academic studies in both countries have revealed the shortcomings of modern slavery statements by companies and failures to translate commitment to action. For example, less than half of UK companies surveyed provide “a clear and comprehensive discussion of modern slavery concerns in the context of their organizational structure, operating and supply chains,” according to a report released last month by the Financial Reporting Council. Even fewer require suppliers to live up to human rights and modern slavery standards.

Investment Firms Can Engage for Change

Financial firms shouldn’t wait for regulatory whips to crack. We believe companies should put systems in place to facilitate internal reporting of modern slavery concerns. Existing systems that screen for money laundering can be upgraded to include indicators of suspicious activity that may point to modern slavery violations by clients. Management must change the tone from the top to send a clear signal to staff about prioritizing modern slavery awareness.

Asset managers can help drive change by researching the risks to portfolio companies. This can be done through collaboration across the industry and with NGOs and other stakeholders. As shareholders, investment firms can also engage with company management, both for insight and action. With a sharper awareness of modern slavery issues, investors can ask the right questions and communicate expectations and best practices. Investment firms can also press management of banks and other financial industry players—particularly those with poor practices—to improve their oversight, disclosure and, most importantly, implementation.

AllianceBernstein has partnered with Themis and the UK government to offer a new modern slavery digital training course for UK financial institutions. With the right training, we believe financial institutions can get ahead of regulations to help disrupt the money supply that enriches human traffickers. Financial firms can set an example for their clients in other industries that taking modern slavery seriously is good business practice to help promote a more just society.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time

View original content here.