GoDaddy Venture Forward 2024 Annual Report | U.S. Edition: A Snapshot of Microbusinesses

A deep dive into the latest data of online microbusinesses, their outsized impact, and their growth across regions and industries.

As originally published by GoDaddy’s Venture Forward research initiative

Behind GoDaddy Venture Forward

Venture Forward quantifies the presence and impact of over 20 million online microbusinesses on their local economies, providing a unique view into the attitudes, demographics, and needs of the entrepreneurs who create and operate them.

GoDaddy knows that to truly advocate and empower entrepreneurs, you first have to really understand them. In 2018, we began analyzing millions of microbusinesses, which we defined as an entity with a discrete GoDaddy domain and an active website, and the majority of whom have fewer than 10 employees. We measured their effect on household incomes and unemployment, together with renowned academics at the University of Iowa and University of Arizona, and established they had an outsized impact on these and other economic health indicators.

In 2019, we began surveying the entrepreneurs who own these ventures, nationally and across cities, at least once a year, to better understand their mindsets and circumstances.

In 2020, we built a proprietary Microbusiness Activity Index and established causality with economists at the UCLA Anderson Forecast. We also created a data hub to update and share our data publicly so those advocating for and studying entrepreneurs could access more information, including measurements of microbusiness density by geography, down to the ZIP code. We update this data on a quarterly basis.

In 2021, we expanded our research to the United Kingdom, and this year, in 2024, we added Australia and Canada to our regularly updated data sets including regional and survey insights.

For more details on our research methodology and other findings, please read About Us on the Venture Forward website.

"Microbusinesses are creating jobs. They’re hiring directly as they grow, they’re hiring indirectly, orthey’re bringing that money back into the community."

— Fox Business May 2024

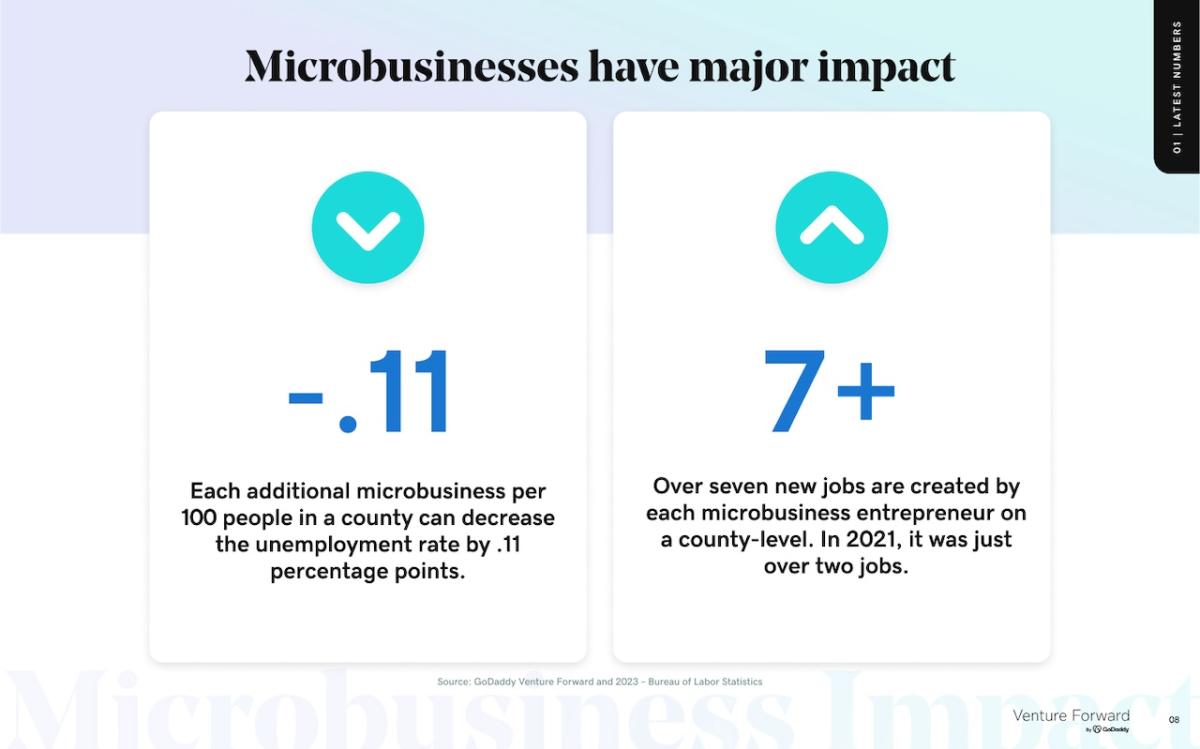

Microbusinesses have major impact

- -.11: Each additional microbusiness per 100 people in a county can decrease the unemployment rate by .11 percentage points.

- 7+: Over seven new jobs are created by each microbusiness entrepreneur on a county-level. In 2021, it was just over two jobs.1

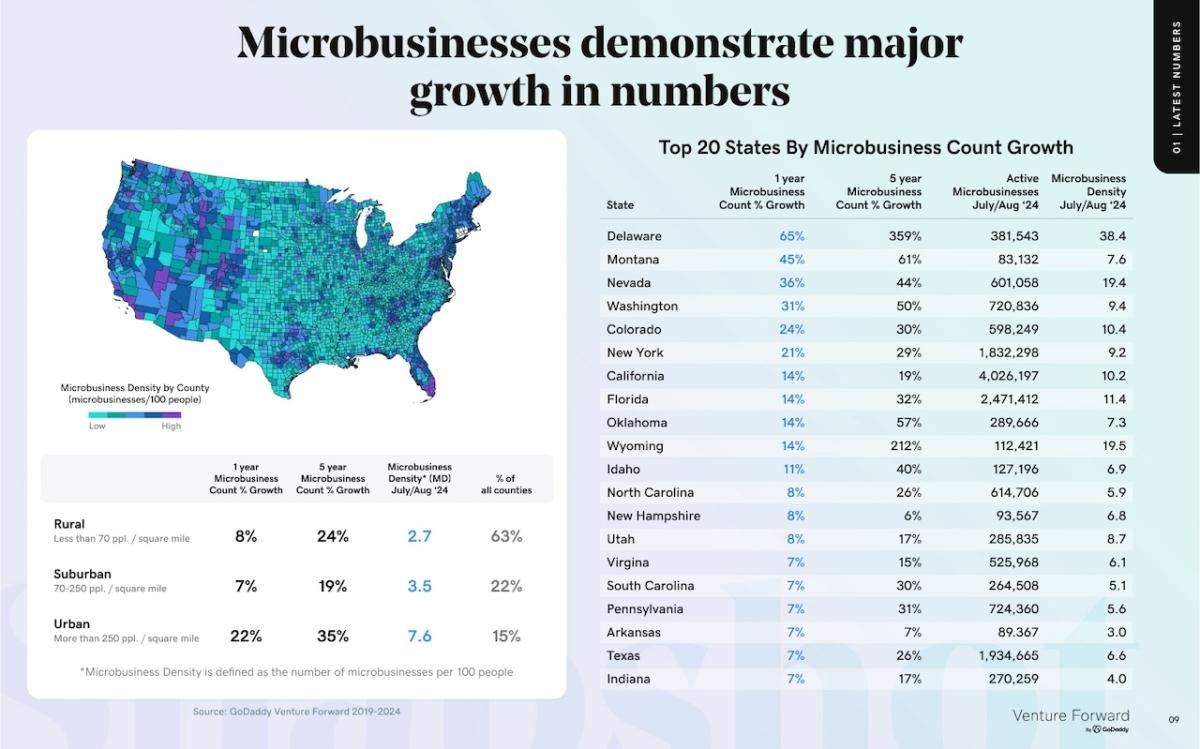

Microbusinesses demonstrate major growth in numbers2

| 1 Year Microbusiness Count % Growth | 5 year Microbusiness Count % Growth |

Microbusiness Density* (MD) July/Aug '24 |

% of all counties | |

| Rural Less than 70 ppl. / square mile |

8% | 24% | 2.7 | 63% |

| Suburban 70-250 ppl. / square mile |

7% | 19% | 3.5 | 22% |

| Urban More than 250 ppl. / square mile |

22% | 35% | 7.6 | 15% |

*Microbusiness Density is defined as the number of microbusinesses per 100 people

Top 20 States By Microbusiness Count Growth

| State | 1 year Microbusiness Count % Growth |

5 year Microbusiness Count % Growth |

Active Microbusinesses July/Aug '24 |

Microbusiness Density July/Aug '24 |

| Delaware | 65% | 359% | 381,543 | 38.4 |

| Montana | 45% | 61% | 83,132 | 7.6 |

| Nevada | 36% | 44% | 601,058 | 19.4 |

| Washington | 31% | 50% | 720,836 | 9.4 |

| Colorado | 24% | 30% | 598,249 | 10.4 |

| New York | 21% | 29% | 1,832,298 | 9.2 |

| California | 14% | 19% | 4,026,197 | 10.2 |

| Florida | 14% | 32% | 2,471,412 | 11.4 |

| Oklahoma | 14% | 57% | 289,666 | 7.3 |

| Wyoming | 14% | 212% | 112,421 | 19.5 |

| Idaho | 11% | 40% | 127,196 | 6.9 |

| North Carolina | 8% | 26% | 614,706 | 5.9 |

| New Hampshire | 8% | 6% | 93,567 | 6.8 |

| Utah | 8% | 17% | 285,835 | 8.7 |

| Virgina | 7% | 15% | 525,968 | 6.1 |

| South Carolina | 7% | 30% | 264,508 | 5.1 |

| Pennsylvania | 7% | 31% | 724,360 | 5.6 |

| Arkansas | 7% | 7% | 89.367 | 3.0 |

| Texas | 7% | 26% | 1,934,665 | 6.6 |

| Indiana | 7% | 17% | 270,259 | 4.0 |

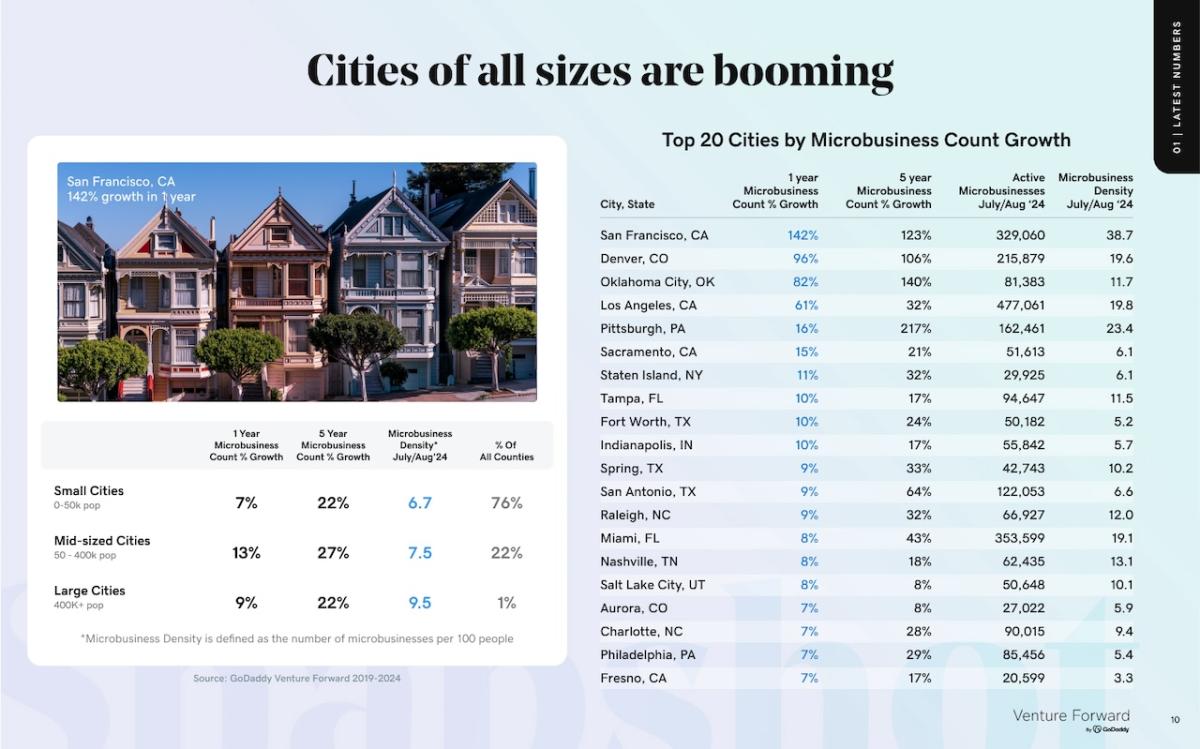

Cities of all sizes are booming2

| 1 Year Microbusiness Count % Growth |

5 Year Microbusiness Count % Growth |

Microbusiness Density* July/Aug'24 |

% Of All Counties |

|

| Small Cities 0-50k pop |

7% | 22% | 6.7 | 76% |

| Mid-sized Cities 50 - 400k pop |

13% | 27% | 7.5 | 22% |

| Large Cities 400K+ pop |

9% | 22% | 9.5 | 1% |

*Microbusiness Density is defined as the number of microbusinesses per 100 people

| Top 20 Cities by Microbusiness Count Growth | ||||

|

City,

|

1 year Micro- business Count % Growth |

5 year Micro- business Count % Growth |

Active Micro- business July/ Aug '24 |

Micro- business Density July/ Aug '24 |

|

San Francisco,

|

142% | 123% | 329,060 | 38.7 |

|

Denver, CO

|

96% | 106% | 215,879 | 19.6 |

|

Oklahoma City,

|

82% | 140% | 81,383 | 11.7 |

|

Los Angeles, CA

|

61% | 32% | 477,061 | 19.8 |

|

Pittsburgh, PA

|

16% | 217% | 162,461 | 23.4 |

|

Sacramento, CA

|

15% | 21% | 51,613 | 6.1 |

|

Staten Island, NY

|

11% | 32% | 29,925 | 6.1 |

|

Tampa, FL

|

10% | 17% | 94,647 | 11.5 |

|

Fort Worth, TX

|

10% | 24% | 50,182 | 5.2 |

|

Indianapolis, IN

|

10% | 17% | 55,842 | 5.7 |

|

Spring, TX

|

9% | 33% | 42,743 | 10.2 |

|

San Antonio, TX

|

9% | 64% | 122,053 | 6.6 |

|

Raleigh, NC

|

9% | 32% | 66,927 | 12.0 |

|

Miami, FL

|

8% | 43% | 353,599 | 19.1 |

|

Nashville, TN

|

8% | 18% | 62,435 | 13.1 |

|

Salt Lake City, UT

|

8% | 8% | 50,648 | 10.1 |

|

Aurora, CO

|

7% | 8% | 27,022 | 5.9 |

|

Charlotte, NC

|

7% | 28% | 90,015 | 9.4 |

|

Philadelphia, PA

|

7% | 29% | 85,456 | 5.4 |

|

Fresno, CA

|

7% | 17% | 20,599 | 3.3 |

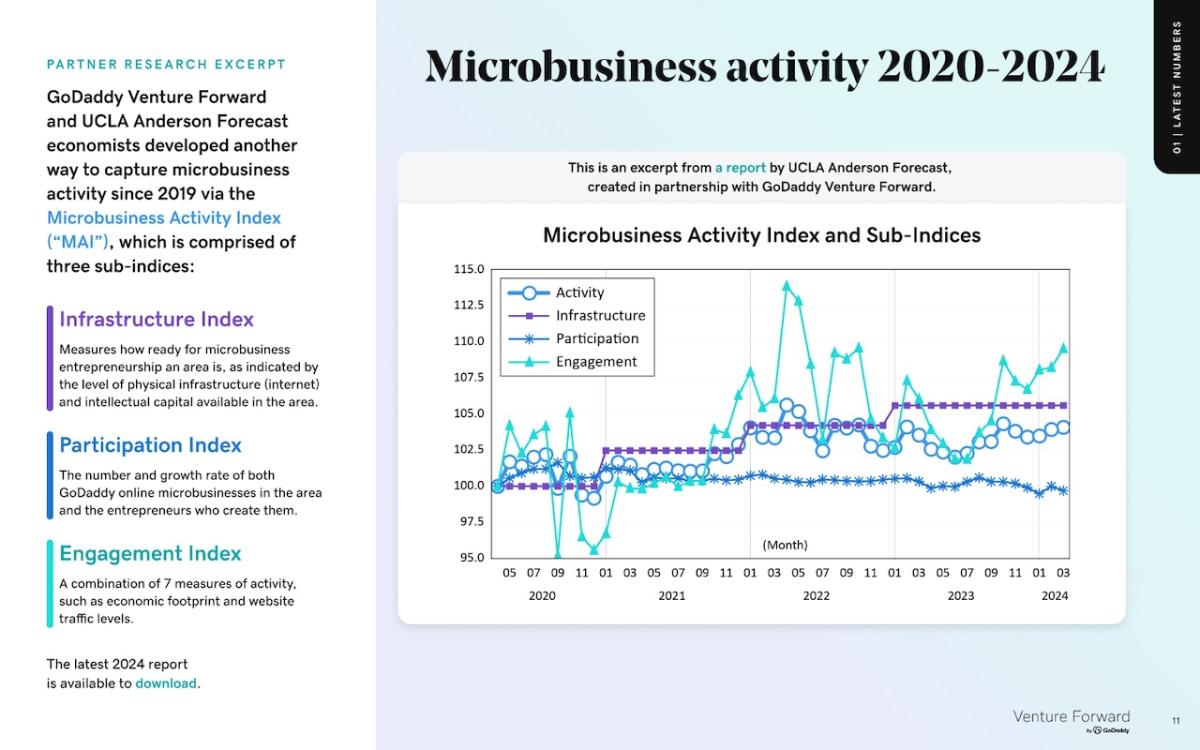

Partner research excerpt

GoDaddy Venture Forward and UCLA Anderson Forecast economists developed another way to capture microbusiness activity since 2019 via the Microbusiness Activity Index (“MAI”), which is comprised of three sub-indices:

Infrastructure Index

- Measures how ready for microbusiness entrepreneurship an area is, as indicated by the level of physical infrastructure (internet) and intellectual capital available in the area.

Participation Index

- The number and growth rate of both GoDaddy online microbusinesses in the area and the entrepreneurs who create them.

Engagement Index

- A combination of 7 measures of activity, such as economic footprint and website traffic levels.

The latest 2024 report is available to download.

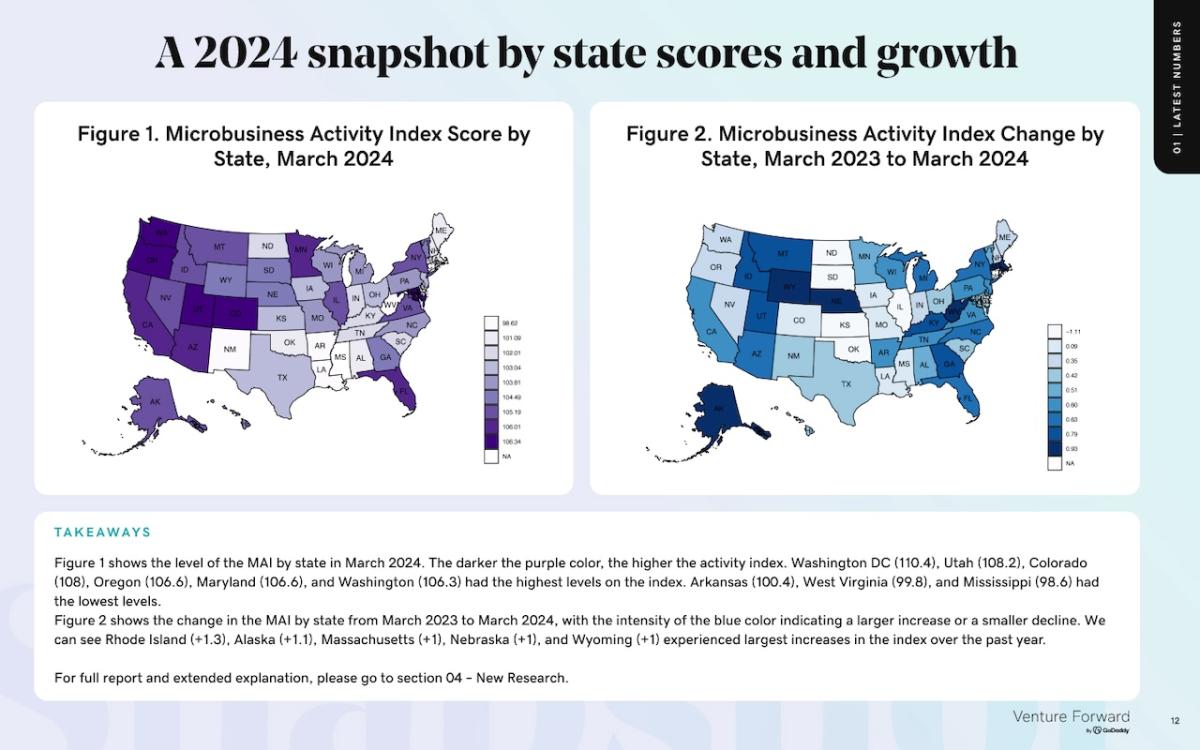

TAKEAWAYS

- Figure 1. Microbusiness Activity Index Score by State, March 2024 (above). The darker the purple color, the higher the activity index. Washington DC (110.4), Utah (108.2), Colorado (108), Oregon (106.6), Maryland (106.6), and Washington (106.3) had the highest levels on the index. Arkansas (100.4), West Virginia (99.8), and Mississippi (98.6) had the lowest levels.

- Figure 2. Microbusiness Activity Index Change by State, March 2023 to March 2024 (above) with the intensity of the blue color indicating a larger increase or a smaller decline. We can see Rhode Island (+1.3), Alaska (+1.1), Massachusetts (+1), Nebraska (+1), and Wyoming (+1) experienced largest increases in the index over the past year.

For full report and extended explanation, please go to section 04 - New Research.

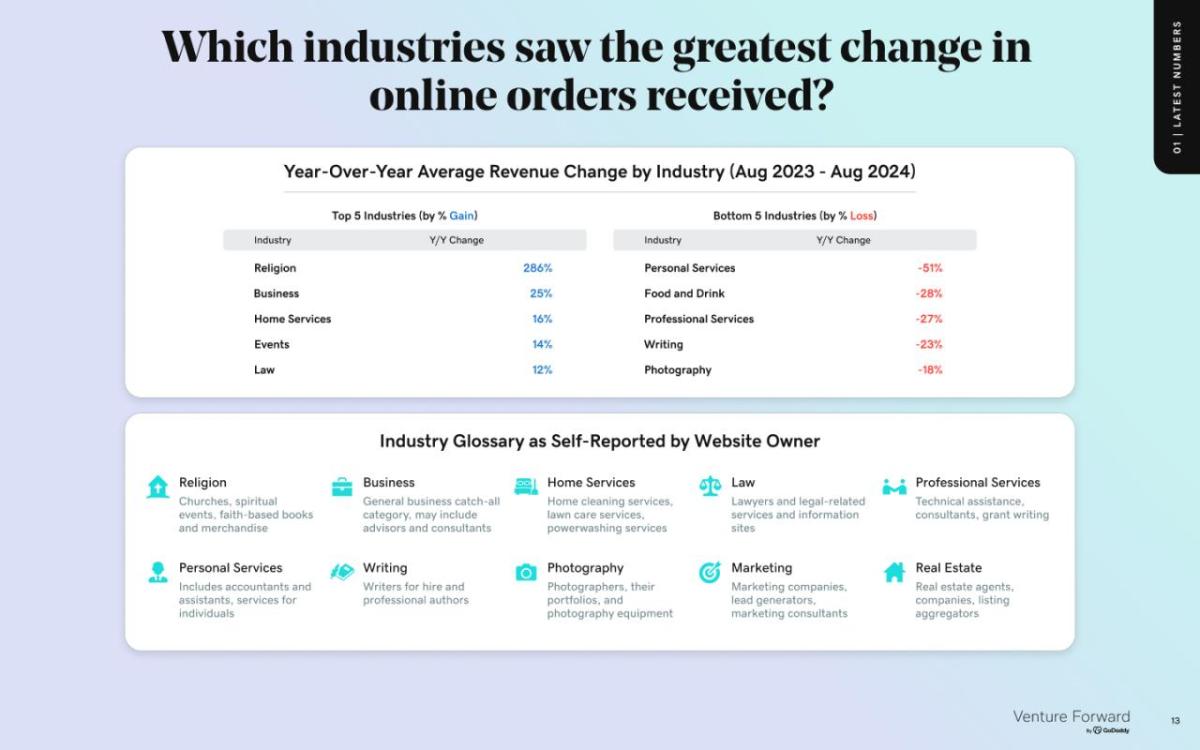

Which industries saw the greatest change in online orders received?

- Year-Over-Year Average Revenue Change by Industry (Aug 2023 - Aug 2024)

| Top 5 Industries (by % Gain) | Bottom 5 Industries (by% Loss) | ||

| Industry | Y/Y Change | Industry | Y/Y Change |

| Religion | 286% | Personal Services | -51% |

| Business | 25% | Food and Drink | -28% |

| Home Services | 16% | Professional Services | -27% |

| Events | 14% | Writing | -23% |

| Law | 12% | Photography | -18% |

Industry Glossary as Self-Reported by Website Owner

- Religion: Churches, spiritual events, faith-based books and merchandise

- Personal Services: Includes accountants and assistants, services for individuals

- Business: General business catch-all category, may include advisors and consultants

- Writing: Writers for hire and professional authors

- Home Services: Home cleaning services, lawn care services, powerwashing services

- Photography: Photographers, their portfolios, and photography equipment

- Law: Lawyers and legal-related services and information

- Marketing: Marketing companies, lead generators, marketing consultants

- Professional Services: Technical assistance, consultants, grant writing

- Real Estate: Real estate agents, companies, listing aggregators

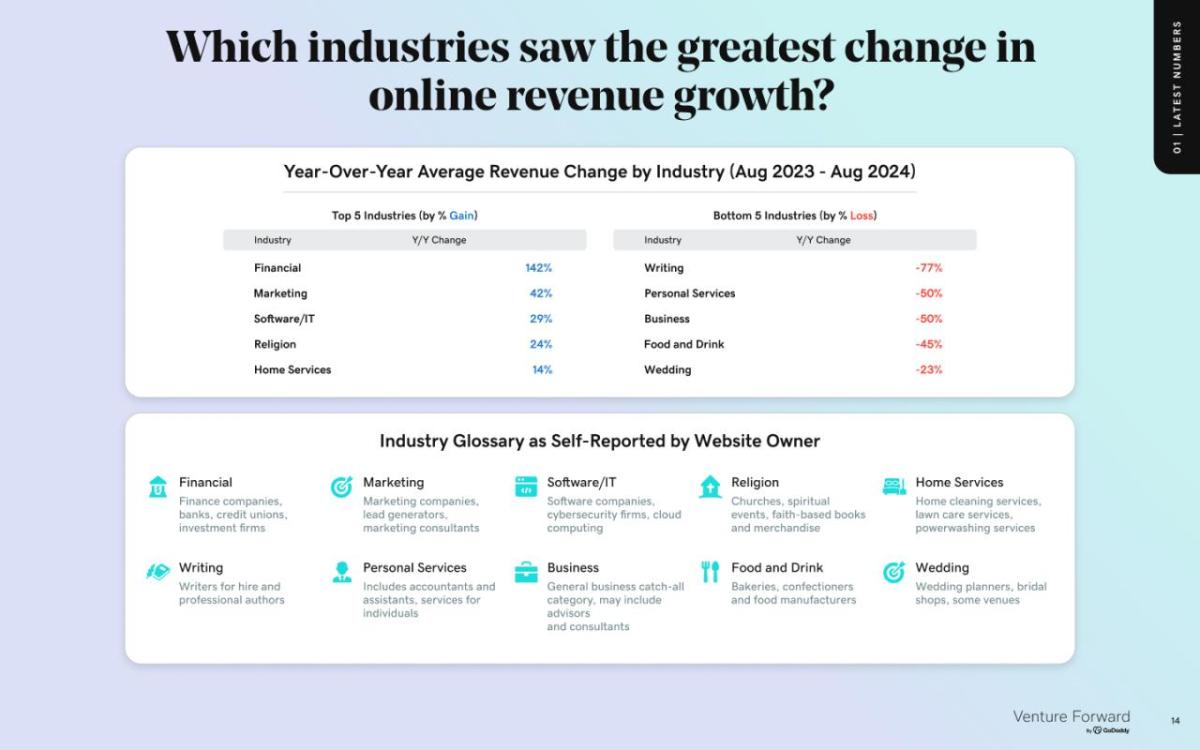

Which industries saw the greatest change in online revenue growth?

- Year-Over-Year Average Revenue Change by Industry (Aug 2023 - Aug 2024)

| Top 5 Industries (by % Gain) | Bottom 5 Industries (by % Loss) | ||

| Industry | Y/Y Change | Industry | Y/Y Change |

| Financial | 142% | Writing | -77% |

| Marketing | 42% | Personal Services | -50% |

| Software/IT | 29% | Business | -50% |

| Religion | 24% | Food and Drink | -45% |

| Home Services | 14% | Wedding | -23% |

Industry Glossary as Self-Reported by Website

- Financial: Finance companies, banks, credit unions, investment firms

- Writing: Writers for hire and professional authors

- Marketing: Marketing companies, lead generators, marketing consultants

- Personal Services: Includes accountants and assistants, services for individuals

- Software/IT: Software companies, cybersecurity firms, cloud computing

- Religion: Churches, spiritual events, faith-based books and merchandis

- Home Services: Home cleaning services, lawn care services, power washing services

- Wedding: Wedding planners, bridal shops, some venues

- Food and Drink: Bakeries, confectioners and food manufacturers

GoDaddy Venture Forward 2024 Annual Report | U.S. Edition

This report is powered by the latest data from Venture Forward, GoDaddy's research initiative to quantify the presence and impact of over 20 million global online microbusinesses on their local economies, while shining a light on the entrepreneurs behind them.

We’re here to support entrepreneurs.

Contact GoDaddy Venture Forward at VentureForward@GoDaddy.com

1Source: GoDaddy Venture Forward and 2023 - Bureau of Labor Statistics

2Source: GoDaddy Venture Forward 2019-2024