G&A Institute’s Research Shows 2023 Sustainability Reporting at Record Levels As U.S. Public Companies Prepare for Mandated Disclosure

Increases Continue in Both Large-Cap and Mid-Cap Companies; 87% of Smaller Half of Russell 1000® Report and S&P 500® Companies Approach 100%

NEW YORK, September 19, 2024 /3BL/ - Governance & Accountability Institute, Inc. (G&A), a leading corporate sustainability consulting and research firm, today announced the findings of its 2024 Sustainability Reporting in Focus research on trends in the 2023 publication year for companies in the S&P 500® Index and the Russell 1000® Index. The research shows substantial increases in sustainability reporting for both large-cap and mid-cap U.S. public companies [1], as the U.S. regulatory environment moves to follow Europe on required ESG reporting. The latest edition of G&A’s annual research report is available here.

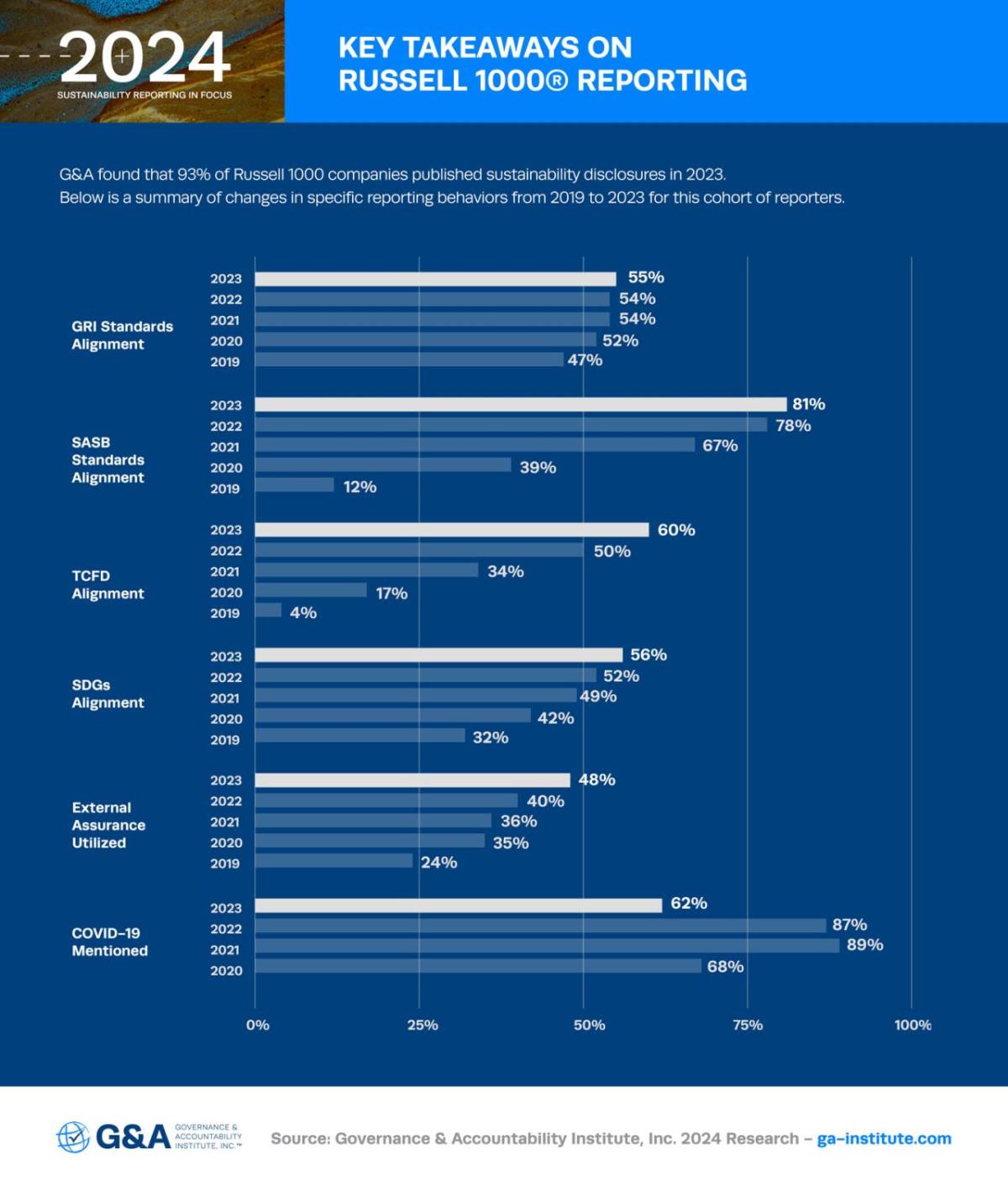

G&A’s 2024Sustainability Reporting in Focus report provides detailed data and findings from its research into U.S. company reports on sustainability (also called ESG, corporate responsibility, corporate citizenship, or social impact reports). G&A’s team analyzes corporate report content including reporting frameworks and standards used – such as the Global Reporting Initiative (GRI), Sustainable Accounting Standards Board (SASB), and Task Force on Climate-Related Financial Disclosures (TCFD) -- as well as alignment with initiatives such as the UN Sustainable Development Goals (SDGs), trends in external assurance, and CDP reporting. For the first time, G&A’s 2024 research includes sector-specific analysis of reporting trends within all 11 sectors of the Global Industry Classification Standard (GICS®), to provide additional insights into reporting behavior per industry sector.

Key takeaways from G&A’s most recent research include:

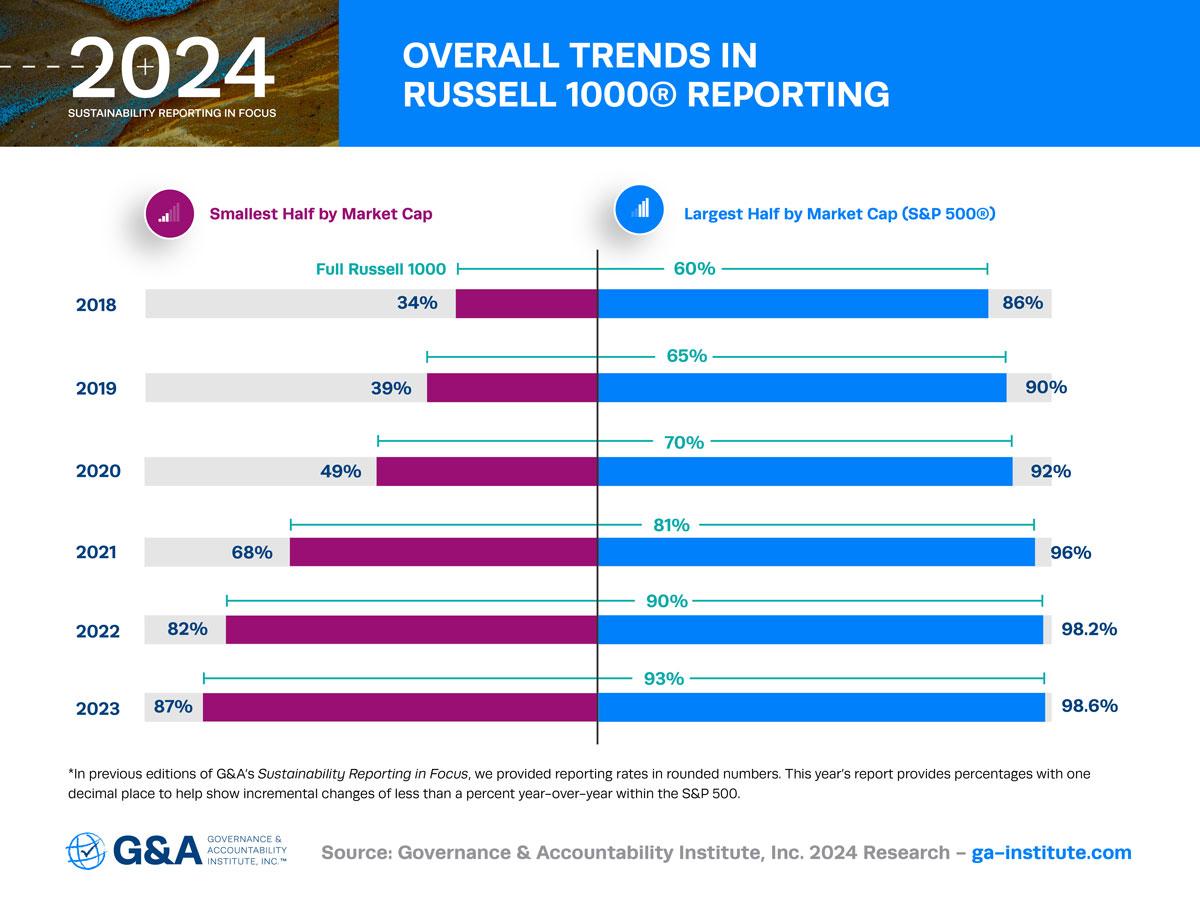

- A record 93% of Russell 1000 companies published a sustainability report in 2023 - an increase from 90% in 2022.

- The smaller half by market cap of the Russell 1000 (mid-cap companies with approximately $2 billion-$4 billion in market cap) had the greatest increase in reporting in 2023, reaching 87% compared to 82% in 2022.

- The larger half by market cap of the Russell 1000 (i.e., the S&P 500) are nearing 100% reporters with 98.6% publishing a report in 2023 - a slight increase from 98.2% in 2022.

- SASB continued to be the most widely used sustainability standard, with 81% of Russell 1000 reporters aligning with SASB in 2023 – up from 78% in 2022.

- GRI reporters remained fairly consistent among the Russell 1000 with an overall annual increase from 54% to 55% in 2023, with the increase being led by the smallest half of the Russell 1000 moving from 40% to 42% in 2023.

- Alignment with TCFD continued to increase, with 60% of Russell 1000 reporters following TCFD recommendations in 2023, compared to 50% in 2022 and only 4% in 2019.

Click here to view a graphical representation of the data noted above.

Louis Coppola, G&A’s Executive Vice President and Co-Founder, commented, “The shift to mandatory reporting offers an unprecedented opportunity to enhance investor confidence, stakeholder trust, and operational resilience. This is the moment to “grab the bull by the horns” and embrace the future with clear-eyed determination. This is an era where leadership in sustainability will define success. Sustainability is no longer a sideline issue; it is at the heart of what makes a business thrive in today’s economy.”

Hank Boerner, G&A’s Chairman, Chief Strategist and Co-Founder, added, “The G&A team is encouraged by the increased volume and more comprehensive nature of sustainability reporting by U.S. companies, especially since it is still voluntary. When ESG disclosures are eventually mandated, which we expect will occur soon through pending and proposed measures, we believe companies reporting today will be well ahead in meeting these requirements. While many of the changes in ESG reporting standards and frameworks are being shaped by the European Union, we expect U.S. regulators and investors to continue to push for increased disclosure on important non-financial information.”

ABOUT G&A’s 2024 SUSTAINABILITY REPORTING IN FOCUS

This new report marks the 13th annual edition in G&A’s annual research series tracking the publication of sustainability reports by the largest U.S. publicly-traded companies. In 2012, G&A published its first annual research on 2011 sustainability reporting trends of the S&P 500 companies, which at the time showed just 20% of these companies were publicly reporting on sustainability. In 2019, G&A expanded this research to include all companies in the Russell 1000 Index, and in 2024, it further expanded to provide detailed analysis by the 11 GCIS sectors.

G&A proudly recognizes our research team of talented analysts who made significant contributions to this study:

G&A Research Supervisor: Elizabeth Peterson, Vice President of Sustainability Consulting

G&A Research Team Leader: Natali Alsunna, Sustainability Analyst

G&A Intern Analysts:

- Emma Haynes, Intern Team Leader

- Madeline Blankenship

- Keira Campbell

- Jake Nachman

- Yadira Aguilar

For more information on our team of research analysts please click here.

ABOUT G&A INSTITUTE, INC.

Founded in 2006, Governance & Accountability Institute, Inc. (G&A) is a sustainability consulting and research firm headquartered in New York City. G&A helps corporate and investor clients recognize, understand, and develop winning strategies for sustainability and ESG issues to address stakeholder and shareholder concerns. G&A’s proprietary, comprehensive full-suite process for sustainability reporting is designed to help organizations achieve sustainability leadership in their industry and sector and maximize return on investment for sustainability initiatives.

Since 2011, G&A has been building and expanding a comprehensive database of corporate sustainability reporting data based on analysis of thousands of ESG and sustainability reports to help steer strategy for our clients and improve their disclosure and reporting.

More information is available on our website at ga-institute.com.

ABOUT THE S&P 500®

The S&P 500 is widely regarded as one of the best gauges of large-cap U.S. equity market performance, measuring the stock performance of approximately 500 large-cap companies covering approximately 80% of the total U.S. equity market capitalization. For 2023, S&P Dow Jones Indices estimated that US$16.0 trillion in assets was indexed or benchmarked to the index. More information is available here.

ABOUT THE RUSSELL 1000®

The Russell U.S. indices are market-weighted indices that serve as leading benchmarks for institutional investors to track current and historical market performance by specific market segment (large/mid/small/micro-cap) or investment style (growth/value/defensive/dynamic). The Russell 1000 Index includes the largest publicly-traded U.S. companies by market cap, which make up approximately 93% of the total U.S. equity market capitalization. The indices/benchmarks are provided by FTSE Russell, a wholly-owned subsidiary of the London Stock Exchange Group (LSEG). More information is available here.

CONTACT:

Louis D. Coppola, Executive Vice President & Co-Founder

Governance & Accountability Institute, Inc.

Tel 646.430.8230 ext. 14

Email: lcoppola@ga-institute.com

[1] Definitions of market cap sizes: https://www.finra.org/investors/insights/market-cap