ESG Country Credit Ratings Highlight Shortcomings of Sovereign Bond Ratings

Economies driven by resource exploitation should have lower credit ratings, many developing nations higher credit ratings

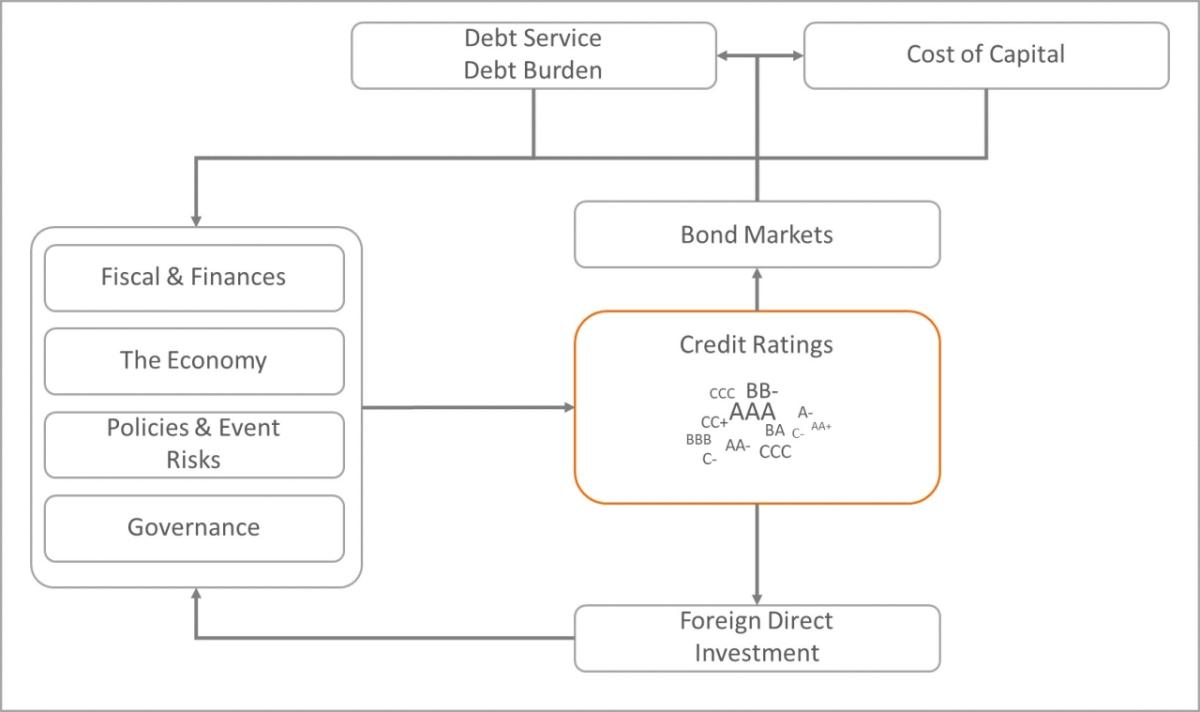

December 14, 2021 /3BL Media/ - Sovereign bond ratings are high-impact numbers: defining the interest rate a country has to pay for debt and fresh capital, as well as influencing the flow of foreign direct investment. Sovereign bond ratings therefore should be based on abroad and comprehensive base, reflecting all risks and opportunities for investors and debtors.

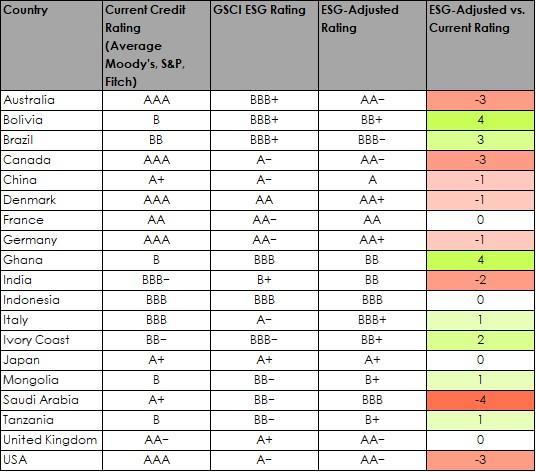

Sovereign bond ratings are heavily influenced by the large rating providers – Moody’s, S&P, and Fitch. The comparison of the conventionally applied sovereign bond ratings and ESG country credit ratings based on the Global Sustainable Competitiveness Index (GSCI) shows:

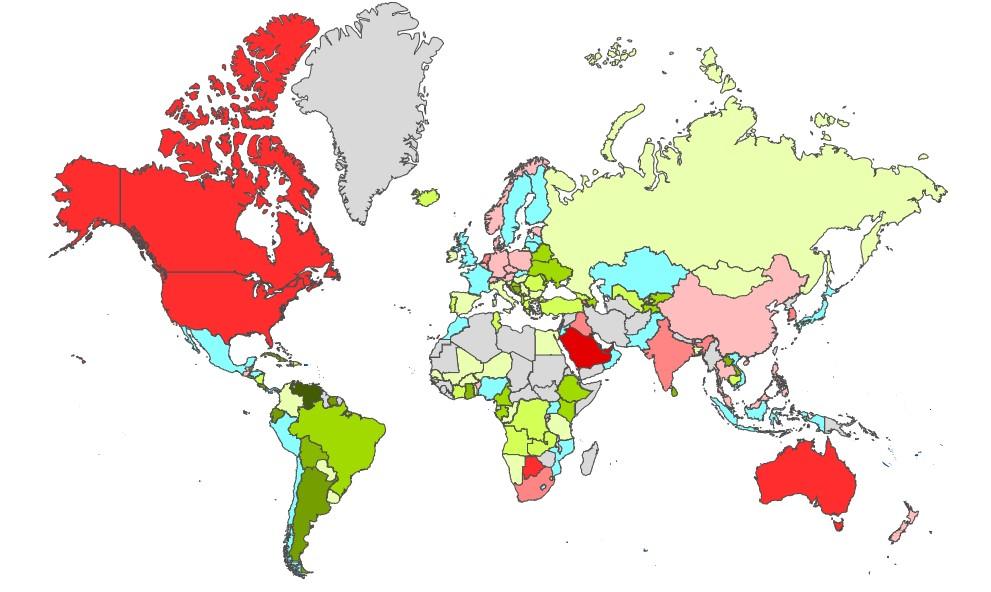

- ESG-adjusted ratings and conventional ratings show significant differences. Under a sustainability-adjusted credit rating, countries with high reliance on exploitation of natural resources would be rated lower, while some of the lesser developed countries with a healthy fundament (biodiversity, education, governance) would receive higher ratings.

- Sovereign bond ratings do not sufficiently reflect the non-tangible risks and opportunities associated with specific nation-economies

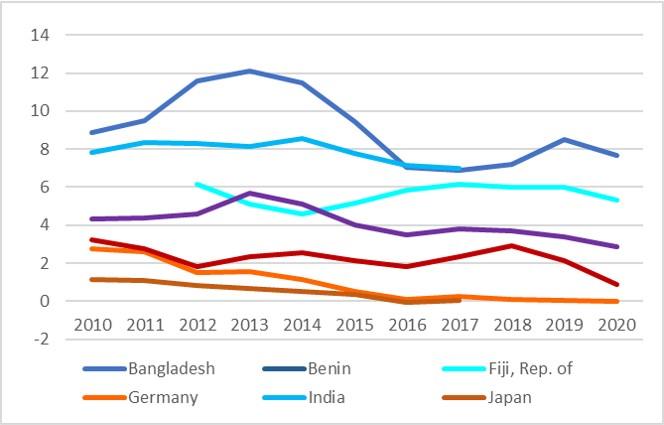

- Sovereign bond ratings show a high correlation to GDP/capita levels. Poor countries are due higher interest rates than rich countries.

- Sovereign bond ratings can in facilitate a negative circularity: bad credit ratings lead to higher cost of capital and debt servicing, which in turn led to bad credit rating.

The comparison of ESG and non-ESG ratings shows distinctive trend: countries whose current wealth is based to a significant part on the exploration of non-renewable resources have a lower rating, (i.e., would have to pay higher interest rates on their debts), in particular the oil-rich nations in the Middle East. Eastern Europe as well as South America (except Chile) would do better under sustainability-adjusted credit ratings and occur lower interest rates. A number of African countries, mainly in sub-Saharan tropical Africa, would also see their credit rating increase.

While there has been significant movement in terms of integrating ESG considerations in the financial World (including the rating agencies), ESG country credit ratings show that there is still a significant gap in integrating ESG risk and opportunities in sovereign bond ratings.

For more detailed information, download the full report here