Corporate Governance at Northern Trust

Originally published in Northern Trust's 2021 Sustainability Report

Our corporate stewardship begins with rigorous oversight of our operations, and extends to embedding ESG factors into our process, our active ownership of the assets we manage and the community investments we make to advance sustainable practices and drive positive change.

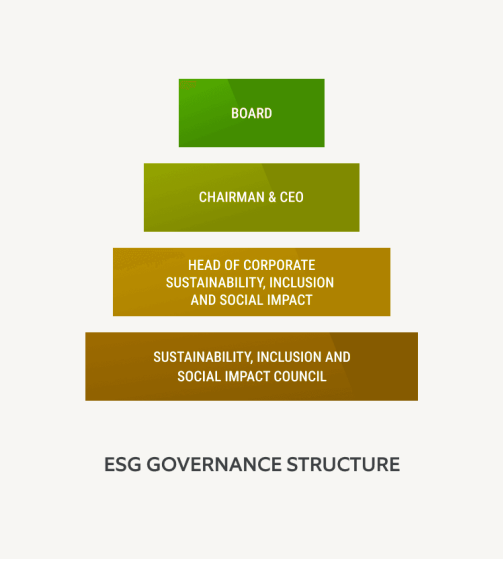

Our vision for ESG is embedded at all levels of our organization. Our board of directors, and its Corporate Governance Committee engages in active oversight of ESG matters of significance to the corporation and its subsidiaries. In addition, the board’s Business Risk Committee provides oversight of certain financial and operational risks associated with climate change and other environmental factors through its oversight of the corporation’s global risk-management framework and risk-management policies.

Our head of Corporate Sustainability, Inclusion and Social Impact, who reports directly to our chairman and chief executive officer, is responsible for the design and implementation of our enterprise ESG strategy. She also chairs the Enterprise Sustainability Council, comprised of a group of senior employees who enable the implementation of Northern Trust’s ESG strategy by reviewing emerging trends and issues that impact Northern Trust sustainability initiatives; steering adhoc working groups that accelerate alignment and resolution; reinforcing enterprise policies, programs and best practices that drive sustainable outcomes; and formulating balanced and databased enterprise views for ESG decision-making processes.

Ethics

We expect all employees to uphold our core values, exercise the highest ethical judgment and comply with the laws and regulations that govern our business. All information should be treated appropriately based on its classification. Breaches of highly sensitive client or business information may result in disciplinary action. Employees are required to take the following five courses annually: “Anti-Money Laundering (AML) & Economic Sanctions,” “Antibribery, Corruption and Fraud,” “Global Privacy and Data Protection,” “Information Security” and “Standards of Conduct.” They are also required to certify their compliance with the Code of Business Conduct and Ethics. Each of the training courses was completed by more than 99 percent of employees in 2021.

Additionally, certain employees are required to complete periodic certifications and attestations regarding personal securities transactions, political contributions and the provision of gifts and entertainment. Employees in the APAC and EMEA regions complete expanded AML, conduct and privacy training in accordance with the regulatory characteristics of those respective regions.

Government Relations and Political Contributions

Northern Trust concentrates its public policy positions in areas most relevant to its businesses, including U.S. federal, state, municipal and European Union financial regulatory reform efforts. We work with the trade associations of which we are a member and meet directly with federal, state and municipal legislators, regulators and other government officials globally to discuss our positions and make recommendations for improved policy and regulation. At the U.S. federal level, we focus on proposed regulatory and policy changes that will affect our businesses by enhancing the safety of client assets and the financial system, as well as the strength of the global economy. At the state and municipal levels, we regularly meet with elected and appointed officials to discuss public policy positions that will affect our businesses. In appropriate circumstances, we file comment letters to proposed federal regulations, copies of which are publicly available.

The Corporate Governance Committee of our board of directors provides oversight of the political, lobbying and other public advocacy activities of Northern Trust, including significant trade association memberships.

Read more.