Clearing the Air on Carbon Markets: How Nasdaq Aids Companies’ Net-Zero Journey

As companies look to achieve net-zero emissions, carbon markets are evolving into a popular pathway to help them reach their goal. According to research by Morgan Stanley, the voluntary carbon market is expected to grow from $2 billion in 2020 to around $250 billion by 2050. But while carbon markets show a lot of promise, they require scale and regulation to become a global standard in emissions reduction.

Nasdaq believes in the power of carbon markets. As a leading global exchange and innovative technology company, we are leveraging our marketplace technology to bring these markets to scale, build their integrity across the globe and help innovate the future of carbon removal.

Pressure is mounting on companies to address their carbon footprint. Governments and international regulators, like the European Union are advancing mandatory emissions reductions, while companies in the U.S. strive to meet ambitious climate targets ahead of the highly anticipated Securities and Exchange Commission (SEC) climate disclosure ruling.

Beyond regulation, climate risk is bad for business. According to S&P Global, 4% of annual economic output across the globe could be lost by 2050 due to climate change. The study also found that these effects will be felt disproportionally. In South Asia, for example, the loss is much higher, with 10-18% of their GDP at risk.

To help scale carbon markets for companies looking to reduce emissions, Nasdaq has provided technology to Climate Impact X (CIX), a global marketplace, auctions house and exchange for trusted carbon credits, and acquired a majority stake in the world’s leading crediting platform for engineered carbon removal, Puro.earth.

What are Carbon Markets?

Carbon markets allow companies to offset or reduce their carbon emissions by trading different forms of carbon credits. Each credit represents one gigaton of carbon dioxide (CO2) circumvented or removed from the atmosphere by another company, green project or green technology.

Today, there are two versions of carbon markets, compliance markets and voluntary carbon markets (VCMs). Compliance carbon markets exist mainly in the EU and Australia, where laws dictate the amount of emissions companies can release into the atmosphere. The compliance market allows a company that emits below its allotted levels to sell the remaining allowance to a larger company that goes above its allotted levels.

But a recent report from the Global Financial Markets Association and Boston Consulting Group, found that nearly 80% of emissions were not covered by compliance markets, providing an opportunity for VCMs.

VCMs allow companies to cut emissions through investment in projects that actively reduce or remove carbon from the atmosphere through natural climate solutions or green technology. For example, Microsoft (MSFT) has committed to achieving net negative emissions by 2030 as well as compensating for all historic emissions dating back to their founding in 1975. One of Microsoft’s pathways to mitigate current emissions, is by removing emissions from the atmosphere by purchasing carbon credits from Puro.earth suppliers. Puro.earth is a carbon removal crediting platform that certifies suppliers who create net-negative carbon emissions.

Purchasing credits from Puro.earth suppliers adds negative carbon emissions to neutralize Microsoft’s unavoidable and legacy emissions. Using Puro.earth in combination with current emissions mitigation measures helps Microsoft fulfill its promise to stakeholders to become net negative by 2030.

Innovating Pathways to Net Zero, CIX + Puro.earth

CIX Marketplace offers carbon credits sourced from a broad range of nature and technology-based projects. Estimates from the Natural Climate Solution Alliance suggest the nature-based carbon credits can support up to 30% of required climate change mitigation for a below-2°C pathway by 2030.

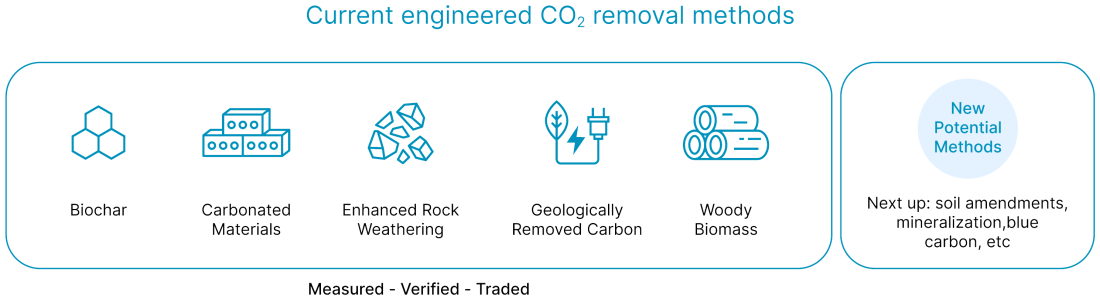

Meanwhile, Puro.earth is a standard and registry for carbon removal, allowing companies to neutralize their emissions with CO2 Removal Certificates (CORCs), the first credits for engineered carbon removal. They are based on net-negative products and processes, meaning the process removes more CO2 from the atmosphere than it produces.

“While reducing carbon emissions remains the most critical action, we also need carbon removal technologies that physically capture carbon from the atmosphere, stabilize it, and place it in durable storage for thousands of years, said Fredrik Ekström, Chair of Puro.earth and Head of Nasdaq Stockholm.

Currently, Puro.earth has five innovative and scalable methods of carbon removal available through various suppliers:

- Biochar: produced from biomass through pyrolysis (heated in the absence of oxygen), Biochar is a stable form of carbon that can endure in soil for hundreds of years, making it an ideal technology for scalable carbon removal.

- Geologically Removed Carbon: the process of capturing and storing CO2 in underground geologic formations.

- Carbonated Materials: Manufactured carbonated materials that remove more CO2 than the production emits. This process offers the potential for the utilization of industrial byproducts and waste materials such as steel slag, mine tailings and alkaline wastes, reducing their environmental impact while creating value through carbon removal.

- Enhanced Rock Weathering: Using technology to fast-track the natural process of carbon removal when silicate rocks weather, capturing carbon from the atmosphere permanently.

- Terrestrial Storage of Biomass: Buried or covered biomass can be preserved over time for thousands of years. This engineered method offers a large scale, affordable and fully additional carbon removal solution.

Since Nasdaq acquired a majority stake in the business, Puro.earth has issued 250,000 CORCs, removing 250,000 metric tons of CO2 from the atmosphere, the equivalent of one year of greenhouse gas emissions from 55,633 gasoline-powered passenger vehicles.

Nasdaq’s partnership has also led to new and exciting developments in the coming years from both Puro.earth and CIX. Recently, the two teamed up to spur innovation in VCMs. Together, the partners will help to address growing imbalances in demand and supply in VCMs by making it easier for businesses and financial institutions globally to access high-quality credit types which remove carbon from the atmosphere.

Scaling Carbon Markets with Nasdaq Technology

At a recent roundtable discussion hosted by UBS Investment Bank, experts noted that improvements are needed to scale carbon markets to be impactful emissions reducers. According to participants, carbon markets require improvements across data, analytics and market-wide governance and regulations.

Director of CIX Exchange, Ellery Sutanto, recognizes the need for more transparency and integrity in VCMs. “It is crucial for exchanges like ours to reduce uncertainties and lower barriers to entry in transacting carbon credits. Collectively, we can build the foundations of trust and establish the right kind of environment for efficient price discovery and trading,” Sutanto said.

In 2022, CIX chose Nasdaq to bring its exchange to scale, increasing integrity and transparency across the marketplace.

“Nasdaq’s technology is built on rigorous regulatory, reliability and security standards proven in the financial industry, which in turn enables CIX to bring exchange-grade trading functionalities to VCMs,” said Sutanto.

CIX aims to help improve integrity, liquidity and transparency in carbon markets through its core venues and solutions:

- CIX Marketplace: Supports corporate sustainability goals by simplifying the work businesses need to undertake before procuring carbon credits through the curation of quality projects.

- CIX Auctions: Enables buyers and suppliers to understand the competitive market value of unique and desirable projects through customizable auctions that facilitate price discovery.

- CIX Exchange: Concentrates carbon market liquidity, facilitates price transparency and helps to de-risk investments. Leveraging Nasdaq’s cloud-based trading technology, CIX can match buyers and sellers of unique carbon credit assets based on specific parameters.

- CIX Intelligence: A suite of data and analytics that aims to elevate price transparency with unique market information and insights, bringing greater certainty to decision-making.

Meanwhile, Puro.earth has leveraged Nasdaq’s expertise over the past year to scale its business to meet the expected rapid growth from corporates seeking to neutralize emissions by:

- The launch of the Puro Accelerate program

- Listing AspiraDAC, the first project for CORCs based on Direct Air Capture (DAC), on Puro.earth.

- Accrediting the world’s first gigaton-capable carbon removal methodology with 10,000+ durability, Enhanced Rock Weathering (ERW).

The Future of Carbon Markets

Puro.earth continues to expand its reach, announcing a new partnership with Xpansiv to make CORCs available on its spot marketplace CBL, the largest spot exchange for trading voluntary carbon credits and other environmental commodities. In addition, the carbon removal crediting platform is scaling up durable carbon removal by partnering with Carbonfuture and raising capital for VGrid to scale its biochar carbon removal work.

Puro.earth is also looking into a new carbon capture technology, Aquatic Storage of Biomass.

Meanwhile, Nasdaq remains committed to supporting these platforms in their mission to help companies reach their climate goals, “All of us together need to work with a very clear target that the ultimate goal now is to scale this platform and create maximum climate impact,” said Ekström.