Cash Deposits Can Make a Meaningful Impact on Communities

Cash Deposits Can Make a Meaningful Impact on Communities

by Jared Gonsky, a partner at LOHAS Advisors

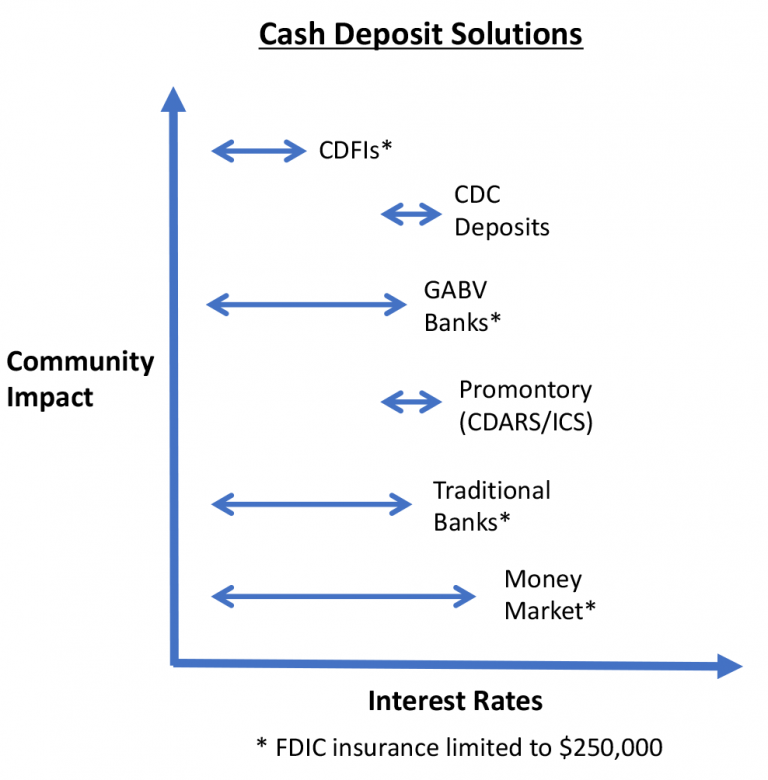

Because public and private equity investing garner most of the attention of impact investors, the liquid “cash” portion of the portfolio is often overlooked despite the availability of a variety of socially impactful options that may even yield better returns at a lower risk than traditional approaches. The most well-known of these are community development financial institutions (CDFI’s) which are banks (both nonprofit and for-profit) that must dedicate the majority of their lending dollars to their stated missions, typically tied to community benefits (e.g., lending to low-income families, investing in small businesses, etc.). Another option is the handful of banks that are part of the Global Alliance for Banking with Values (GABV) which are banks that dedicate their business practices and lending activities to align with specified social or environmental standards.

These may be ideal options for parties with smaller volumes of funds to deposit, but because FDIC insurance is limited to $250,000 in any given bank, many limit their exposure in GABV banks or CDFI’s accordingly. Others may find that the financial returns from CDFI’s (and the certificates of deposit or other products they offer) are substantially less than they can garner through other avenues and are unwilling to accept the tradeoff.

Read Jared's full article with sections on "Social Impact Money Market Alternatives", "What’s Preventing Action", and the "Size of the Opportunity" all here - https://greenmoney.com/cash-deposits-can-make-a-meaningful-impact-on-communities

======