The Behavioral Science Inspiring Better Financial Habits

Originally published on the MetLife Stories blog

“It sounds like a broad statement,” says Evelyn Stark, Assistant Vice President for Financial Health, MetLife Foundation, “but people are predictable. There are certain behaviors people will repeat again and again. Take the gym for example. Everyone goes to the gym in the first week of January and works hard on their New Year’s resolutions, but by February it’s empty again. Everyone wants to do the right thing, but it’s easier not to.”

Just like creating a new fitness habit, creating and sticking to healthier financial habits can be hard. Housed in the Center for Advanced Hindsight at Duke University, Common Cents Lab is transforming the way everyday Americans interact with money to help boost their financial health.

An insight into the Lab

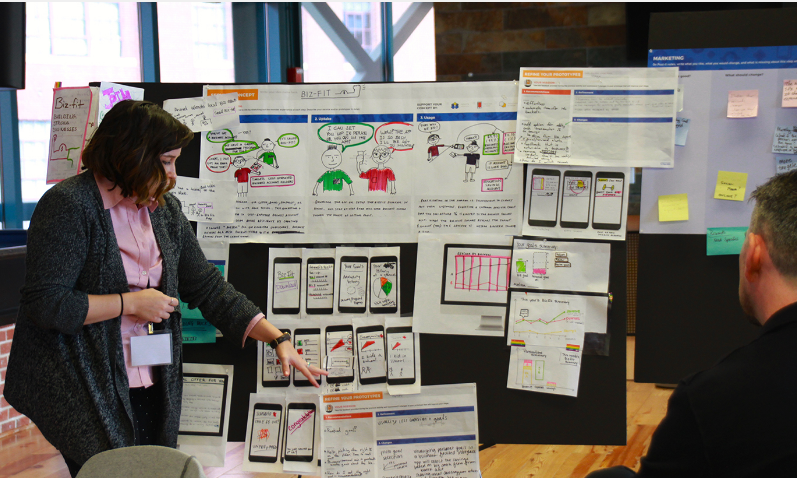

Launched in the fall of 2015 with support from MetLife Foundation, Common Cents Lab aims to change people’s relationships with money. Using behavioral science, the Lab designs interventions – products, services, prototypes and optimizations – to help low- to moderate-income people manage their finances. The Lab partners with fintechs, credit unions, banks, nonprofits and state and local governments to bring the best financial solutions to the people who need them most.

Human actions vs human intentions

Mariel Beasley, Principal at Center for Advanced Hindsight and co-founder of Common Cents Lab, explains how the Lab works: “The environment plays a huge role in our day-to-day decisions. Our co-founder, Professor Dan Ariely, regularly reminds us that whoever designs the environment has tremendous power to shape human behavior. Look at it this way – no one wakes up in the morning and thinks ‘I want to struggle to pay my bills this month.’ But our everyday decisions, influenced by our environment and our psychology, lead us down these paths. There’s a huge gap between human intentions and human actions, and what we do is try to understand that gap and try to bridge that gap.

“We’re actively working to make households more financially secure,” adds Mariel. “People across the U.S. are financially underprepared. One in three households has a bill in collections, 38 percent of adults are carrying revolving credit card debt, and 39 percent would have to sell something or borrow to cover an unexpected $400 debt. What we do is work with financial service providers to create better products, services, and processes that leverage a greater understanding of human behavior for better financial outcomes.”