Become an Impact Venture Capitalist Using Donor-Advised Funds

Become an Impact Venture Capitalist using Donor-Advised Funds

by Rick Davis of LOHAS Advisors

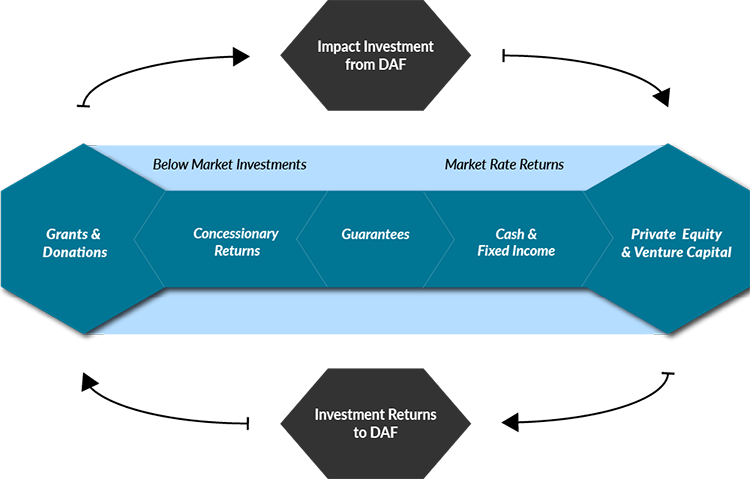

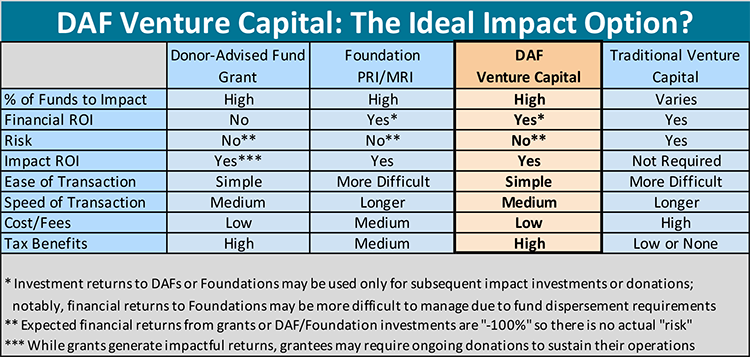

Donor-Advised Funds (“DAFs”) are quite the hot topic in the world of philanthropy and impact investing. Seems everyone has a perspective on how DAFs could be better utilized or why they’re underleveraged. Most of the news stories (correctly) center on the topic of DAFs growing in size, but funds often remaining stuck without ever reaching the parties who need this capital the most. Many of these same articles discuss various DAF-related legislative changes that, if implemented, could change the “set it and forget it” DAF dynamic. At LOHAS Advisors, while we applaud the attention being brought to this topic, we think that one path to unleashing the power of DAFs is through impact venture capital, which closes the loop on the impact investing return spectrum.

For those unaware, DAFs are philanthropic and social impact investment tools that allow donors (which could be individuals, families, corporations, etc.) to fund special accounts through DAF “sponsor” organizations. Donors receive immediate U.S. income tax deductions and maintain allocation privileges over the funds’ ultimate distribution. According to the 2019 Donor-Advised Fund Report of the National Philanthropic Trust (NPT), assets in DAFs now total over $121 billion, with over $23 billion in new DAF contributions made in 2018 alone. Notably, there are now over 728,000 individual DAFs across the U.S., and the number of DAFs grew an astonishing 55% from 2017 to 2018.

So what's the problem and how do DAFs meet our numerous societal challenges? Rick tells us here - https://greenmoney.com/become-an-impact-venture-capitalist-using-donor-advised-funds

=======