Advancing Sustainability and Transparency on the ESG Journey

The 2020s are shaping up to be a transformative era of impact. Increasingly, investors, markets, employees, and customers view environmental, social, and governance (ESG) practices and priorities as being essential to a company’s long-term success and viability. Companies that overlook the growing importance of ESG may leave themselves open to serious financial, operational, and reputational risks.

“More than ever before, ESG is becoming central to corporate strategy,” said Adena Friedman, president and CEO of Nasdaq. “One of the primary factors is the realization that climate change and other social dynamics are now significant threats in a company’s overall risk management strategy.”

But ESG can be complex to navigate. Corporations, issuers, asset managers, and investors have different ESG requirements. Multiple standards and ratings organizations provide overlapping and sometimes conflicting information.

Nasdaq’s position at the nexus of all these market stakeholders gives us unique insights into the information and guidance that each group needs to be successful, no matter where they are in their ESG journey. We are uniquely positioned to help all market stakeholders with ESG in three critical ways:

1. Empower corporations and issuers to help tell their ESG story.

Our Nasdaq ESG Advisory Program helps companies at any stage of their ESG journey develop and streamline ESG strategies and disclosures.

For companies that are in the early stages of their ESG strategy, Nasdaq provides guidance on which foundational metrics to disclose, as well as how to develop and share an ESG message.

For those companies that have already made investments in ESG and developed a sustainability report, Nasdaq provides guidance on how to measure ROI / impact, how to integrate an ESG story into a broader investor narrative, and which disclosures to prioritize in order to gain recognition – and attract capital – as an ESG leader.

For example, Etsy, a global marketplace for unique and creative goods, launched its Impact Strategy in 2017 featuring specific, measurable ESG goals. In 2020, Etsy’s IR team worked with Nasdaq to benchmark the company’s Impact/ESG reporting against best practices within the financial community. In doing so, Nasdaq provided Etsy with a deeper understanding of ESG ratings, index criteria, buy-side needs, and which sustainability factors can have the greatest impact on financial performance. Nasdaq also helped Etsy align its corporate efforts to the ESG ecosystem and develop an appropriate ESG-focused investor outreach strategy.

Through its work with Nasdaq ESG Advisory Program, Etsy learned which reporting process (10-K) and framework (SASB or TCFD) investors preferred for receiving ESG information. Nasdaq offered additional ways in which Etsy could improve its ESG profile, such as making it easier for investors to find information on data privacy and security, supplier information, and labor management practices.

Even companies like Etsy that have well-established ESG programs can benefit from Nasdaq’s assistance in refining their disclosures, engagement strategies, and messaging so that investors are more likely to recognize and reward their ESG best practices.

“The key is transparency,” said Tomas Thyblad, vice president and head of European ESG Solutions at Nasdaq. “When companies openly show they have a sustainable business strategy and have integrated sustainable ways of thinking throughout their business strategy, they have a greater likelihood of attracting capital from investors and being included in different ESG indexes.”

Watch the clip here

ESG data is valuable not only for investors seeking performance indicators, but also for public companies aiming to improve their operational efficiency, reduce their resource dependency, and attract both customers and employees.

“ESG is about more than sustainability or social responsibility — it’s really about measuring performance in a new way, using data to drive decision-making, and achieving a higher level of management excellence,” said Evan Harvey, Global Head of Sustainability for Nasdaq.

Nasdaq OneReport provides companies with an ESG reporting and workflow solution that streamlines the process of capturing and sharing ESG data. Nasdaq OneReport connects to more ESG raters and frameworks than any other system, making it easier for companies to capture ESG information, harmonize the data, and produce customized reports for a wide variety of ESG stakeholders.

2. Improve transparency to help investors find new ESG investments and assess their existing portfolios

Investment firms and asset managers are eager to invest in sustainable bonds and equities to fulfill mandates, attract ESG-minded investors, and achieve financial outperformance. Nasdaq can help by providing price discovery and intelligence on ESG bonds and other investable products, as well as portfolio optimization and ESG performance metrics.

The Nasdaq Sustainable Debt Market helps these investors to obtain price discovery for green, social, and sustainability bonds, as well as sustainability-linked bonds. This Europe-based market gives issuers a venue in which to highlight and finance projects that will creative positives changes for communities, the climate, or the environment.

53% year-over-year growth in listed volumes on the Nasdaq Sustainable Debt Market in 2020

Looking beyond price discovery, the Nasdaq Sustainable Bond Network provides detailed information on sustainable bonds that helps investors perform due diligence, selection, and monitoring. In 2020, over 300 issuers joined the platform, including the Nordic Investment Bank, African Development Bank, IFC (a member of the World Bank Group), a number of major European banks, plus state and government agency issuers from Italy, Holland, and Mexico.

Nasdaq has also announced a partnership with SGX (Singapore Exchange) to expand the platform into the Asian-Pacific region in 2021.

“With the Nasdaq Sustainable Bond Network, we are trying to create a level playing field regardless of whether a bond issuer is based in the U.S., China, or Norway,” said Ann-Charlotte Eliasson, Head of the Nasdaq Sustainable Bond Network. “All the bond issues are presented in a similar way so that it’s very easy for investors to get the information they need and make an informed decision instead of having to read innumerable reports.”

Nasdaq offers two other solutions that help investors and asset managers with their ESG-related decision making. ESG Footprint combines data from 60 global sources with more than 40 filtering criteria (negative screens such as child labor or high GHG emissions, plus positive screens such as business ethics and green energy production) to produce an intuitive dashboard report that investors and asset managers can use to determine the real-world impacts of their overall investment holdings. ESG Footprint even makes recommendations on equities or bonds that investors and managers can add to their portfolio to better meet the sustainability goals of their stakeholders.

Meanwhile, the Nasdaq ESG Data Portal provides a central database for objective and quantifiable ESG data from Nasdaq-listed companies. These firms release their data directly into the Portal, where Nasdaq then compiles and standardizes the ESG metrics so that firms can use the data for their own portfolios and processes.

The Nasdaq ESG Data Portal is growing rapidly. The number of companies that provide data to the Portal has tripled from approximately 200 to 600 firms over the past 18 months.

3. Provide dedicated ESG indexes and marketplace

Nasdaq is accelerating the shift toward ESG investments by providing ESG indexes and a sustainable debt market that make it easier for buy-side players to fulfill their ESG strategies.

Nasdaq creates and publishes ESG themed indexes such as the OMX Stockholm 30 ESG Responsible Index that buy-side players can use for benchmarking purposes and/or license for portfolio management.In 2018,Nasdaq also launched futures based on the OMXS30 ESG index – the first exchange-listed ESG index future in the world. Within a year of its launch, trading on the OMXS30 ESG future reached 1 million contracts and has more recently reached 2 million contracts. In the future, Friedman has said that Nasdaq expects to launch additional ESG-oriented indexes.

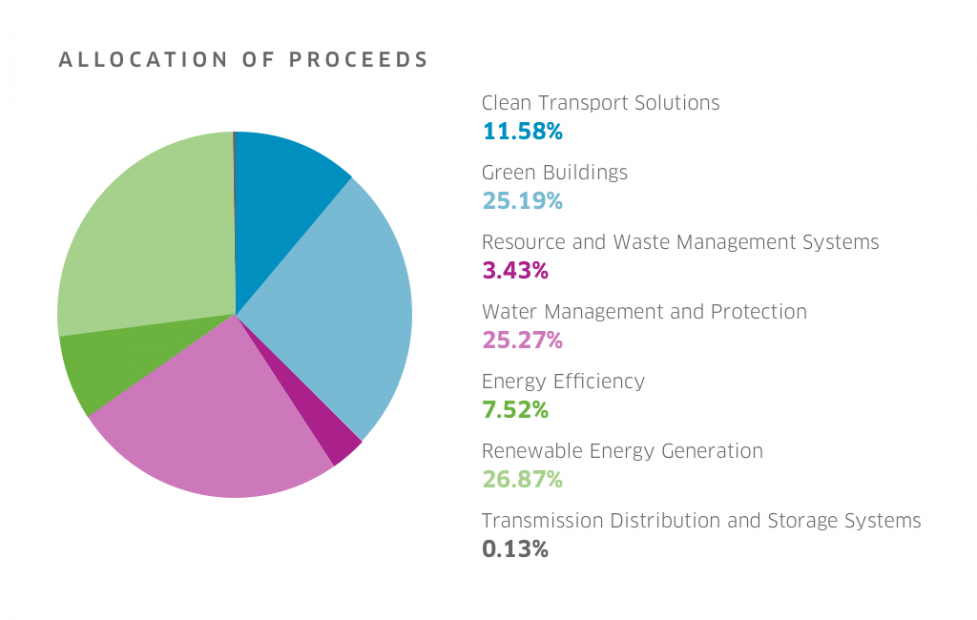

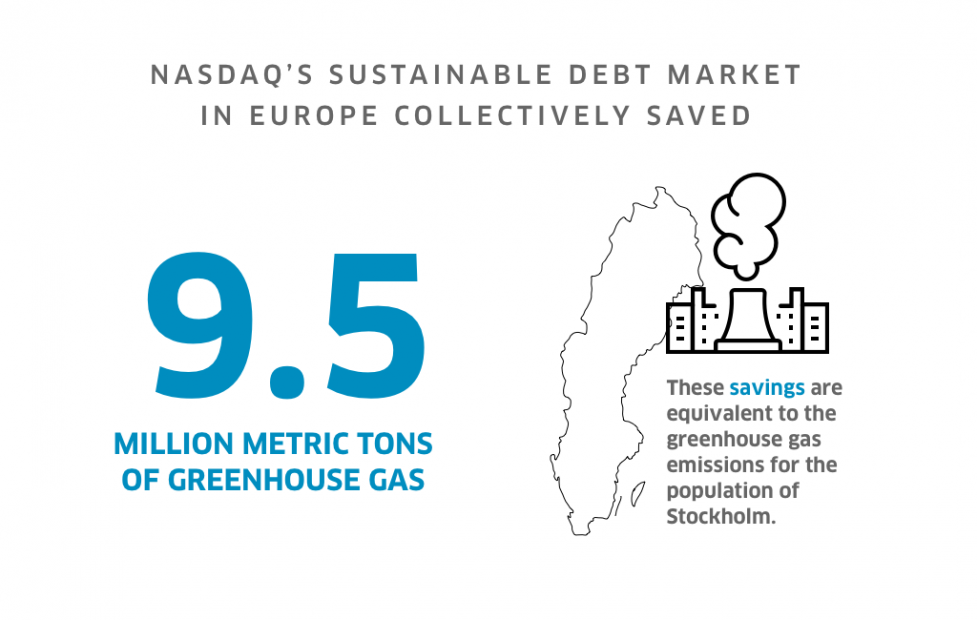

Right now, buyers looking for sustainable debt issuances will find plenty of opportunities to make a positive impact in the Nasdaq Sustainable Debt Market. The issuers listing bonds at Nasdaq’s Sustainable Debt Market in Europe collectively saved 9.5 million metric tons of greenhouse gas equivalents through the investments financed by their sustainable bonds, as reported by the issuers in their latest annual reports. These savings are equivalent to the greenhouse gas emissions for the population of Stockholm.

The Nasdaq Sustainable Debt Market accepts issues of four types of bonds:

- Sustainability Bonds are used to finance projects that bring clear environmental and socioeconomic benefits.

- Green Bonds are used to finance projects and activities that benefit the environment. Blue bonds that fund marine-related activities such as sustainable fisheries, marine conservation, and coastal protection are considered to be a sub-category of green bonds.

- Social Bonds are used to finance projects that achieve positive socioeconomic outcomes (with a neutral or positive impact on the environment).

- Sustainability-Linked Bonds are used to finance general corporate purposes, but with characteristics such as coupon rates that depend on the issuers’ ability to meet certain sustainability targets.

For example, in 2019, the Nordic Investment Bank (NIB) turned to Nasdaq’s Nordic Sustainable Debt Market to issue an inaugural five-year Nordic-Baltic Blue Bond for SEK 2 billion. The next year, NIB followed that up with another five-year Nordic-Baltic Blue Bond for SEK 1.5 billion to finance water management and protection projects. Those blue bonds helped fund wastewater treatment in the Helsinki, Finland region to prevent pollution and protect fisheries in the Baltic Sea. See more about the project in this Nasdaq video.

“If you invest in a green bond or a blue bond from the Nordic Investment Bank, you can steer your money into something that is environmentally friendly,” said Angela Brusas, Director, Funding & Investor Relations, Nordic Investment Bank. “You can be sure that we will report in detail on the allocation, the projects financed, and the impact.”

The massive capital inflows into ESG investments shows that markets and capital are working together to solve fundamental environmental and social problems.

“At Nasdaq, our goal with all our ESG-related offerings is to bring corporations and investors together, help them make sense of a complex data landscape, and give them the clarity they need to make decisions that can help us all reach a more sustainable future,” said Thyblad.

Watch the clip here