A $3.5 Million Commitment to Increase Financial Capability

Wells Fargo’s new Financial Capability Grant program will help two nonprofits provide financial empowerment programs to the residents in several communities.

A $3.5 million commitment to increase financial capability

Toncé Jackson was at a low point four years ago. In Chicago’s Cook County Jail for a fourth time, she was struggling with substance abuse, had no job, a limited education, terrible credit, and was burdened with debt — she didn’t even have a bank account. Caught in a painful cycle that was destroying her family, she resolved to change.

“I wanted to start my life over,” said Jackson. “I just needed a little help with my beginning.”

The Wells Fargo Financial Capability Grant program focuses on helping people, like Jackson, who are facing destabilizing economic challenges. Started in 2017, the program’s grants help people from diverse populations who are underbanked by connecting them to income supports and financial training.

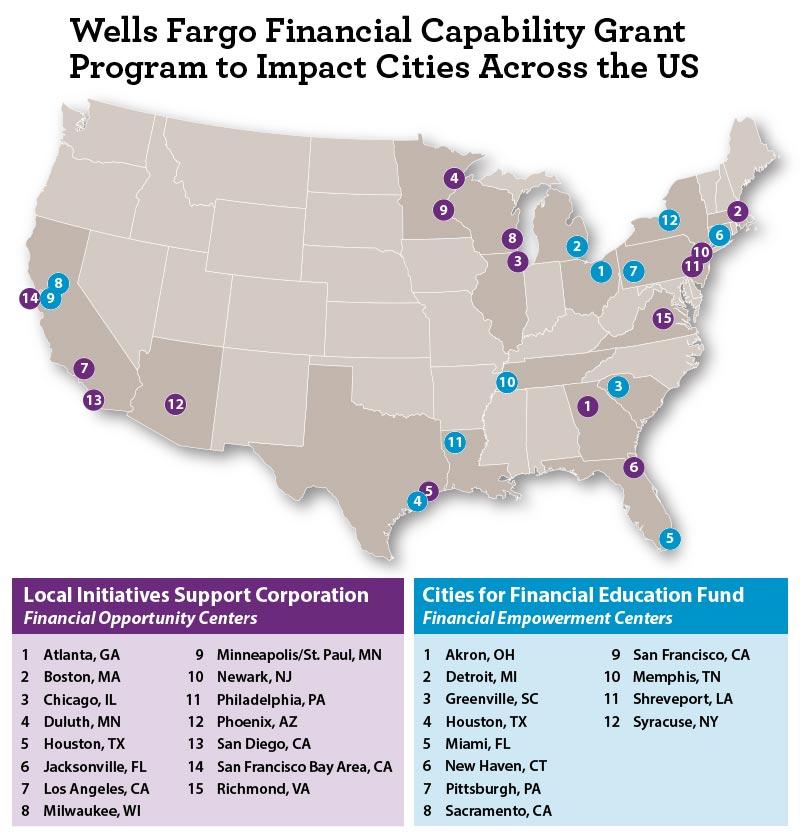

The program has just awarded $3.5 million to two nonprofits with thoughtful and focused financial capability programs — the Local Initiatives Support Corporation (LISC), and the Cities for Financial Empowerment (CFE) Fund.

Making financial empowerment front and centerThe Wells Fargo grants will provide $1 million funding for the CFE Fund and $2.5 million funding for LISC financial capability programs in a total of 25 U.S. cities and regions over three years.

“All of the cities we are working with demonstrated that they are looking to make financial empowerment front-and-center in the work they can do,” said Tamara Lindsay, a principal at the CFE Fund. “The long-term vision is to create a permanent home for this work, to help make sure it is sustainable.”

City leaders collaborate with CFE Fund partners to open Financial Empowerment Centers, or FECs, for their residents. At FECs, professionally trained counselors help consumers with low and moderate incomes manage their finances, pay down debt, increase savings, establish and build credit, and access safe and affordable mainstream banking products. The FEC model integrates counseling into other social services, including housing and foreclosure prevention, workforce development, prisoner reentry, benefits access, domestic violence services, and more. First piloted in New York City under Mayor Michael R. Bloomberg in 2008, the FECs are a proven success — about 80,000 consumers have reduced individual debt by almost $94 million and increased their families’ savings by about $12 million. A recent CFE Fund evaluation showed that this program works even for residents with very low incomes and other complex financial challenges.

“Offering financial counseling as a public service, though local governments, helps stabilize struggling households and communities. Local leaders know the importance of helping families and neighborhoods build financial stability and make better use of social services,” said Jonathan Mintz, president and CEO of the CFE Fund.

Wells Fargo’s grant to LISC will strengthen and expand the Financial Opportunity Center, or FOC, model across 15 target markets. Working through local nonprofits nationwide since 2006, FOCs offer services including employment and career counseling, one-on-one financial coaching and education, and connect individuals with low-cost financial products that help build credit, savings and assets. FOCs also have a remedial education component that provides participants with foundational reading and math skills that they need in order to get into job training programs that can lead to higher paying, living-wage careers.

“Promising talent exists in all our communities, and we have to invest to help people realize their full potential. That’s where FOCs come in,” said LISC CEO Maurice A. Jones. “By connecting people to the tools they need, they can compete for the quality jobs that employers must fill to innovate and grow. They’ll be able to earn more, save more and access life-changing opportunities for themselves and their families.”

‘I’ve started my life over’During a conversation with her parole officer, Jackson found out about a local Financial Opportunity Center housed at Chicago’s Jane Addams Resource Corporation, a nonprofit local community resource center. The FOC helped Jackson find additional education opportunities and got her into a job placement program. After she successfully landed her welding job, Jackson continued to receive guidance from a financial coach. She created a budget, reduced her medical debts, and established credit.

Mike Rizer, head of Wells Fargo Community Relations, said results like Jackson’s are the goal.

“We are very excited to be working to help build strong and resilient communities by improving the financial capability of American families,” Rizer said. “We take our responsibility to the communities we serve very seriously, and with the help of organizations like LISC and the CFE Fund, we will continue to invest in community-based programs that address critical needs at the local level.”

Now addiction- and debt-free with a solid credit score and a path to a career, Jackson said one of the keys to her transformation was getting a financial plan.

“I am very focused now that I’ve started my life over,” she said. “I want to do my very, very best. So whatever it takes — I say, ‘Put me in, coach!’”