Lack of Capital Isn’t the Problem in Meeting Net-Zero Bill

By Claudio Lubis, Oil, BloombergNEF

Originally published on bnef.com

Climate change won’t be a cheap problem to solve, with the race to net-zero emissions needing $4.8 trillion to be spent every year between now and 2030 on clean energy technologies.

But if you consider that this number is just a fraction of global GDP, the challenge becomes not whether the world has enough money, but whether it can be mobilized to go to the right places.

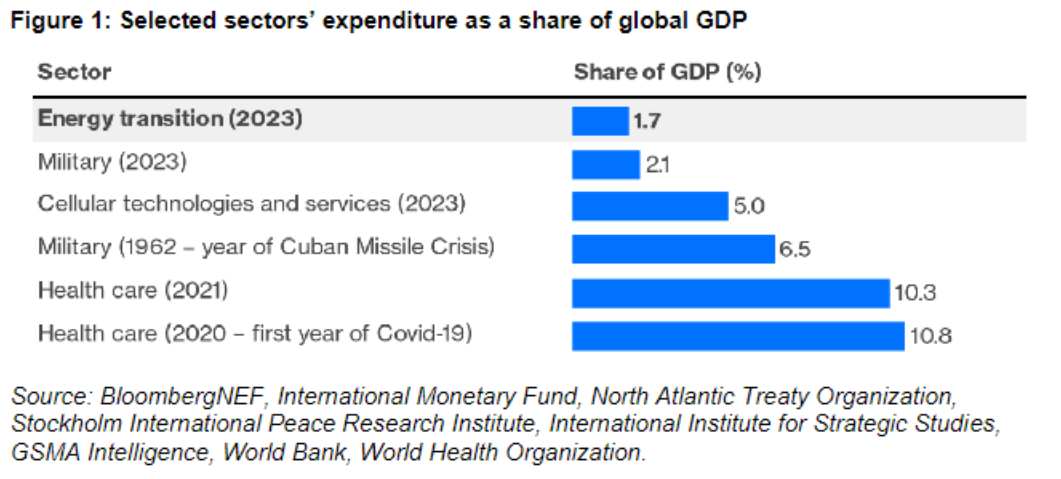

Global investment and spending on the energy transition has been gathering momentum, surging almost sixfold over the past decade, based on analysis from BloombergNEF. But the record $1.8 trillion deployed last year was still just 1.7% of the world’s GDP, trailing other key sectors of the economy (Figure 1).

Military and defense budgets commanded a 2.1% share, after hitting an all-time high of $2.2 trillion, according to the International Institute for Strategic Studies. Russia’s ongoing war in Ukraine and conflict in the Middle East were the key drivers of growth.

Defense expenditure is an obvious example of the ability to redirect capital when there’s a will. Its share of global GDP was as much as three times higher in the 1960s during the Cold War. It’s the same story for health care, where global expenditure ramped up to nearly 11% of GDP in the first year of the Covid-19 pandemic.

That’s not to say money should be diverted from hospitals to wind turbines. But these crises show that funding can be dialed up and investment encouraged when something is considered a priority.

China at the forefront

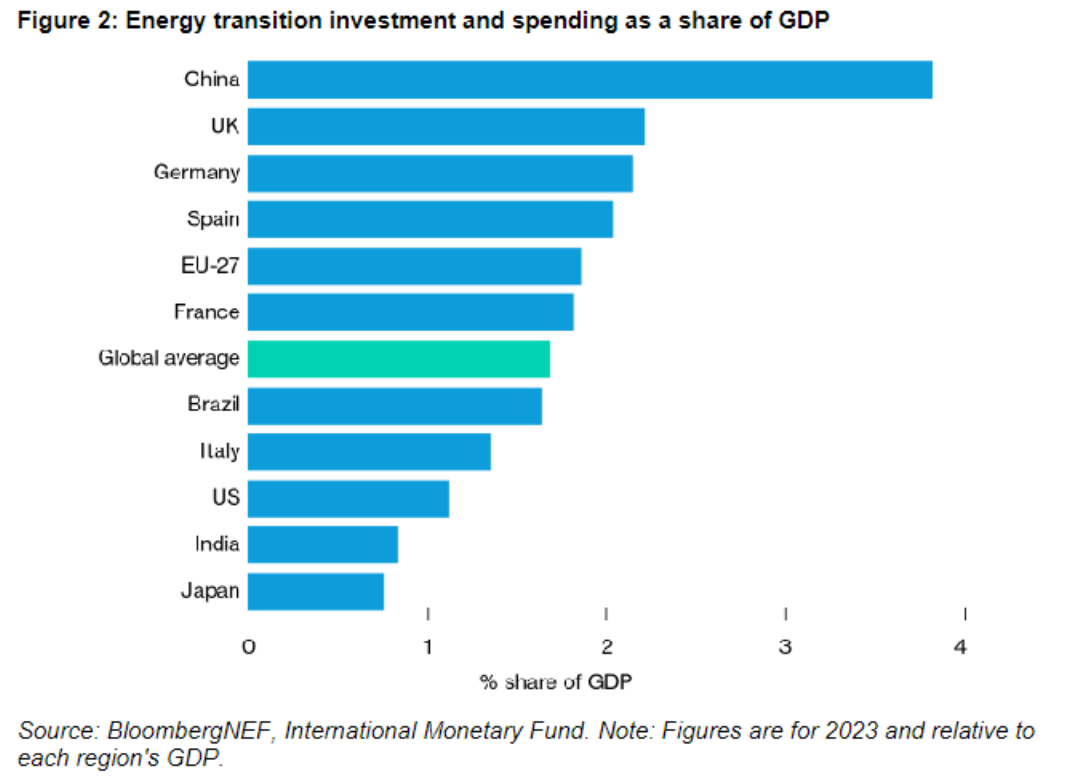

China is the leader when it comes to the absolute volume of energy transition spending, making up more than a third of the global total last year. Most of that $676 billion went to renewables and electrified transport.

That’s not to say money should be diverted from hospitals to wind turbines. But these crises show that funding can be dialed up and investment encouraged when something is considered a priority.

But the Asian powerhouse is also top of the pile when it comes to this investment as a share of GDP – way out in front at 3.8%. That’s more than double the global average of 1.7% (Figure 2).

The European Union is above the middle of the pack too as policies like the REPowerEU plan and Fit for 55 push the bloc to slash emissions and scale up the deployment of green technologies.

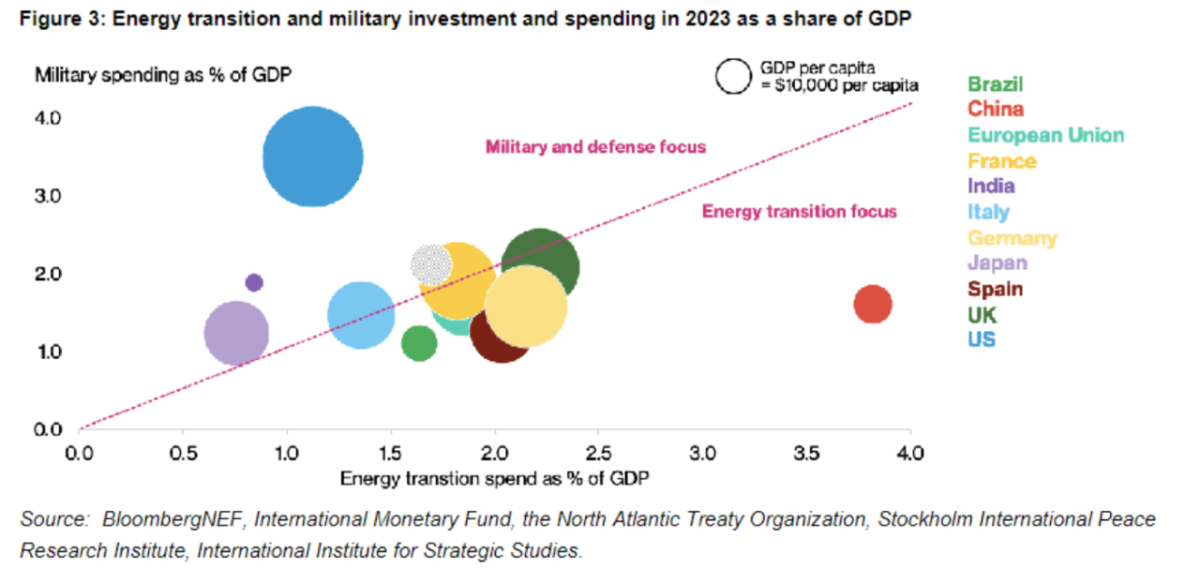

But other key economies such as the US, Brazil and Japan are lagging. For the US and Japan, and India as well, a greater emphasis has been placed on budgeting for military capabilities, outstripping energy transition expenditure as a share of GDP (Figure 3). It’s the opposite for Germany and, perhaps somewhat surprisingly, China too.

Looking ahead, investment and spending on clean energy will need to ramp up to avert climate disaster. Under BNEF’s Net Zero Scenario, the capital required would equate to a modest 3.5-4% of GDP per year across the rest of this decade.

With theoretically enough funding to hand to align with a net-zero trajectory, the question is whether the public and private sectors can co-ordinate to get financing to the right areas, especially in emerging economies.

About BloombergNEF

BloombergNEF (BNEF) is a strategic research provider covering global commodity markets and the disruptive technologies driving the transition to a low-carbon economy. Our expert coverage assesses pathways for the power, transport, industry, buildings and agriculture sectors to adapt to the energy transition. We help commodity trading, corporate strategy, finance and policy professionals navigate change and generate opportunities.