The Effect of Legal Violations on Perceived Sustainability Performance

The Effect of Legal Violations on Perceived Sustainability Performance

Hundreds of companies violate US federal, state, and local laws each year. Do these transgressions affect how these companies are rated by ESG (Environment, Social, and Governance) experts? Using an excellent data set called Violation Tracker from Good Jobs First, we show there is a 52% correlation between the change in number of violations over a 15 month period and the change in our Leadership Ethics rating. This result suggests that corporate ESG managers need to keep an eye on their company’s legal problems. It may also indicate that those who use ESG ratings in their investment process could predict future changes in some areas of ESG ratings, based on violation patterns.

Good Jobs First has been recording US Corporate violations for a number of years. The group diligently searches and records when a US company (or a US subsidiary of a foreign company) is fined by a local, state, or Federal court or regulator. We have integrated this data into CSRHub’s consensus ratings on company sustainability performance. We have connected Good Jobs First’s information with scores on 1,544 of the more than 45,000 entities that CSRHub tracks.

We first ingested Good Jobs First data in June of 2019. Our most recent ingestion was in September of 2020. Between these dates, Good Jobs First add about 15,000 new violations cases—some of which dated back to 2000. It included violations from new agencies, including state financial regulators. Of course, it can’t and doesn’t uncover every fine or violation—but we believe its data set is the best available assessment of this issue.

1,540 of the companies present in September 2020 were also present in June 2019. However, we felt it best to narrow this list and use 1,107 of these companies (72%) who had:

- Overall ratings from CSRHub for both June 2019 and September 2020. (1)

- Ratings from CSRHub for all three of the subcategories we focused on (see below).

- At least five sources of data to support their CSRHub ratings for both June 2019 and September 2020. (2)

Our data analysis system identified that Good Jobs First violations data is correlated with the input from other sources in areas such as Community Development & Philanthropy, Board behavior, and Leadership Ethics. We hypothesized that changes in violation behavior would be tied to changes in perceived performance in these areas.

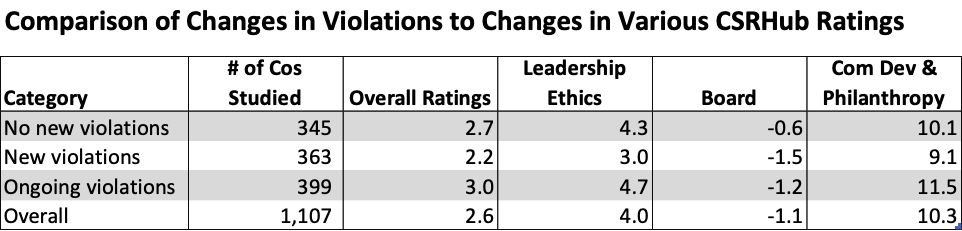

We classified the studied companies into three roughly equal violation behavior groups:

- No new violations. About 31% of the studied companies that had been tagged with violations in June 2019 did not have new violations reported for them in the September 2020 data set.

- New violations. In contrast, about 33% of the studied companies had no violations in June 2019 but did have violations in September 2020.

- Ongoing violations. The remaining 36% of companies had violations outstanding in both periods.

In general, companies that had no new violations had better changes in their ratings overall and for the three subcategories that we studied than those that had new violations. However, despite the large number of instances studied, we cannot assert that the differences in these changes were statistically significant. There was a wide variation in both the number of violations companies experienced and in the changes in their ratings.

Comparison of Changes in Violations to Changes in Various CSRHub Ratings

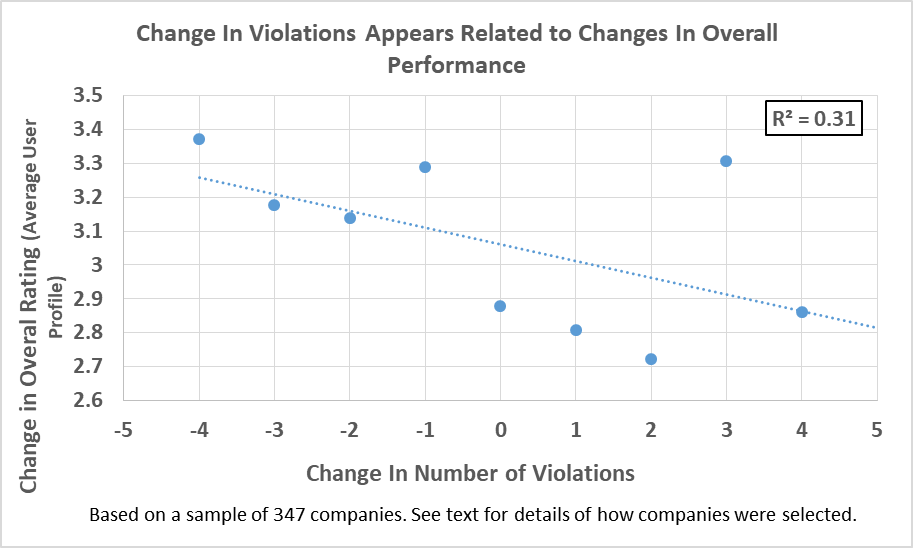

We decided to focus on the companies that had ongoing histories of violations. We excluded 52 companies that had large changes (more than four) in their violation count. The Overall Rating for the remaining 347 companies showed a good correlation (31%) with the change in the number of violations.

Change in Violations Appears Related to Changes in Overall Performance

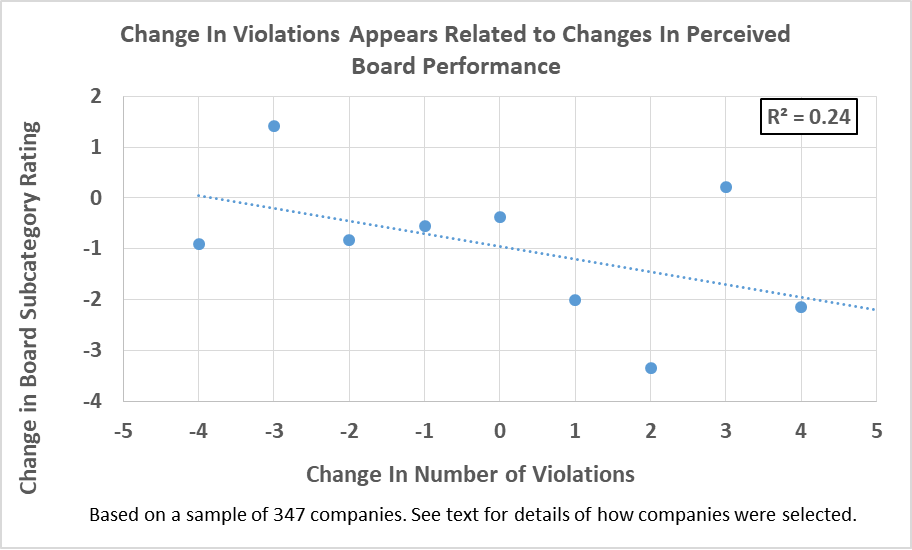

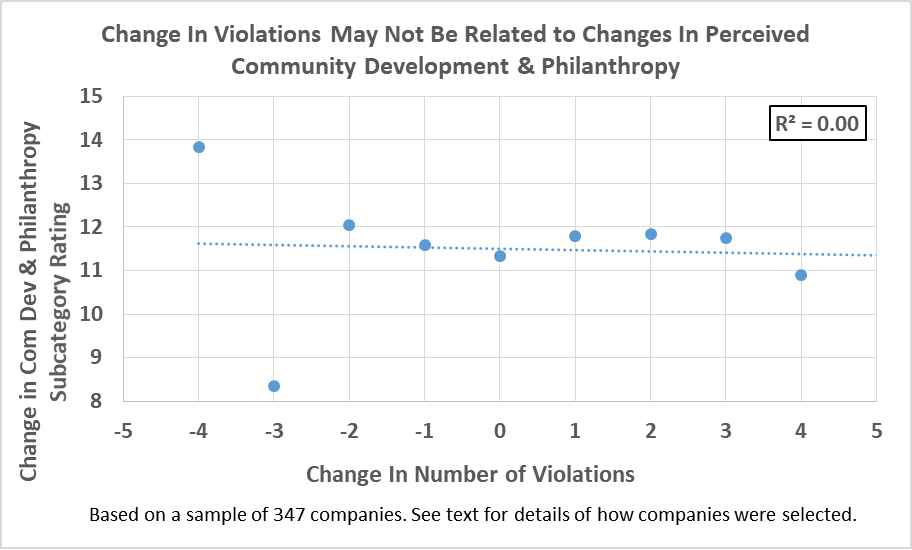

We performed the same analysis on three of CSRHub’s twelve subcategories. We found an even stronger 52% correlation between the change in number of violations and the change in our Leadership Ethics rating. There was a solid 24% correlation with the change in CSRHub’s Board rating but no clear correlation with the change in our Community Development & Philanthropy subcategory scores.

Change in Violations Appears Related to Changes in Perceived Leadership & Ethics Performance

Change in Violations Appears Related to Changes in Perceived Board Performance

Change in Violations May Not be Related to Changes in Perceived Community Development & Philanthropy

Our results suggest that the ESG experts who drive CSRHub’s ratings are sensitive to changes in corporate violations. Bad behavior that leads to legal proceedings and fines seems to also affect its ESG rating. We found a strong connection to the perceived ethics of a company’s leaders. Boards are also held responsible—but to a lesser degree. Interestingly, there is not a strong connection with a company’s community development activity. It seems that a company may misbehave and get fined, but may still be accepted as a positive contributor to its community’s welfare.

We did not use the data Good Jobs First gathers on the amount of money that companies pay in fines. There was too much variation in these numbers to use them in this type of analysis, but other approaches could extract value also from this data. Good Jobs First also studies corporate subsidies. We believe these other data elements contain other useful insights into how company behavior affects how they are perceived.

(1) There was a general improvement in the ratings of the companies in this study set, during the study period. On average, the Overall Ratings for these companies improved 2.6 points. This change was probably driven by the increase in attention on sustainability issues for US companies during 2019 and 2020.

(2) This last constraint should have avoided significant covariance in our analysis from the fact that Good Jobs First data contributed to our ratings assessment. The average number of sources available for the studies companies was 18.7 in June 2019 and 25.4 in September 2020. We estimate that Good Jobs First contributed less than 1% of the data elements used to generate the ratings used in this analysis.

Bahar Gidwani is CEO and Co-founder of CSRHub. He has built and run large technology-based businesses for many years. Bahar holds a CFA, worked on Wall Street with Kidder, Peabody, and with McKinsey & Co. Bahar has consulted to a number of major companies and currently serves on the board of several software and Web companies. He has an MBA from Harvard Business School and an undergraduate degree in physics and astronomy. He plays bridge, races sailboats, and is based in New York City.

CSRHub offers one of the world’s broadest and most consistent set of Environment, Social, and Governance (ESG) ratings, covering 20,000 companies. Its Big Data algorithm combines millions of data points on ESG performance from hundreds of sources, including leading ESG analyst raters, to produce consensus scores on all aspects of corporate social responsibility and sustainability. CSRHub ratings can be used to drive corporate, investor and consumer decisions. For more information, visit www.CSRHub.com. CSRHub is a B Corporation.